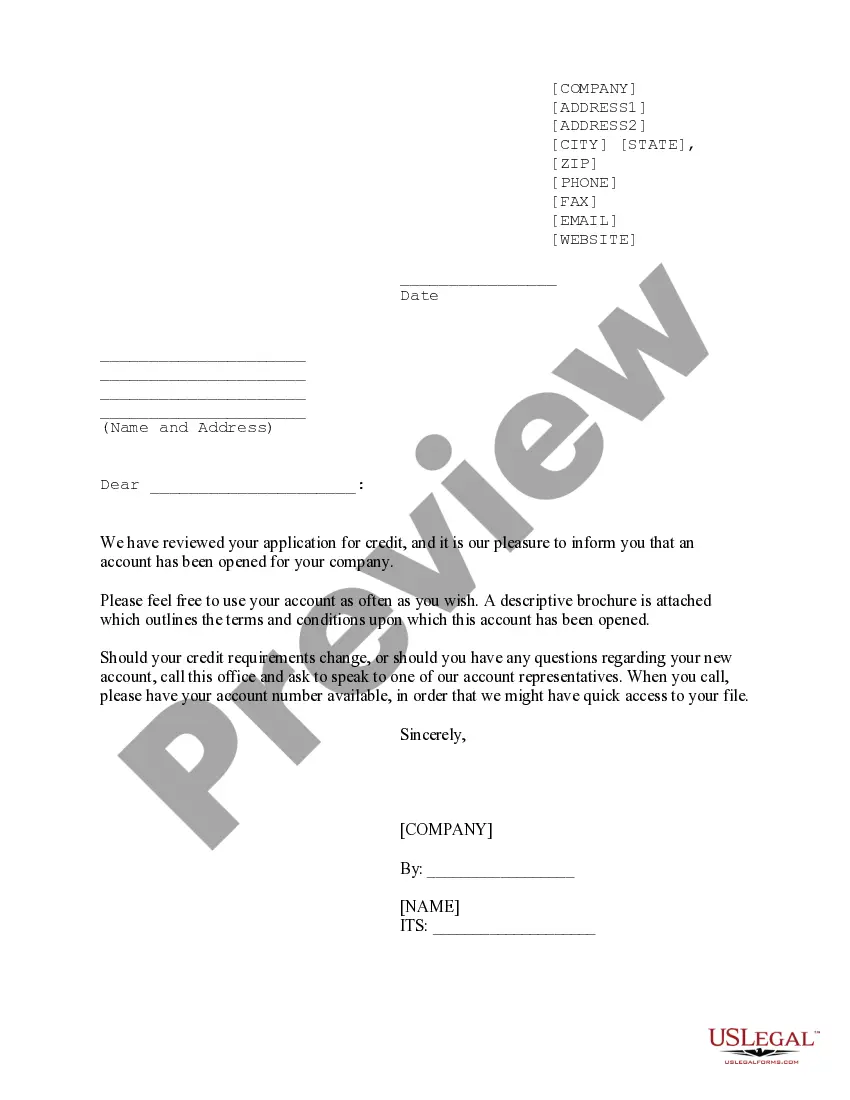

South Dakota Credit Approval Form

Description

How to fill out Credit Approval Form?

Selecting the appropriate legal document template can be a significant challenge.

It goes without saying that there are numerous styles available online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. This service offers a vast selection of templates, including the South Dakota Credit Approval Form, which can be utilized for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is accurate, click the Buy now button to acquire the form. Choose the pricing plan you want and enter the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received South Dakota Credit Approval Form. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally crafted paperwork that meets state requirements.

- All of the forms are reviewed by professionals and adhere to state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the South Dakota Credit Approval Form.

- Use your account to browse through the legal forms you may have previously ordered.

- Visit the My documents tab in your account to download an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and examine the form description to confirm it is suitable for you.

Form popularity

FAQ

To obtain a transcript from South Dakota State University, go to their official website and navigate to the registrar's office. You will find a request form that you can fill out online or print and mail. Make sure to include all requested information to avoid delays. If you plan to secure financial approval through a South Dakota Credit Approval Form, your transcripts may be needed to support your application.

To request a transcript from the University of South Dakota, visit their official website and go to the registrar's office section. You can usually submit a request online, or you can mail a written request with your details. Ensure you include your student ID and specify the type of transcripts you need. If you are considering applying for a South Dakota Credit Approval Form, having your transcripts ready can support your application.