South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets is a process undertaken when a partnership is dissolved and its assets need to be sold off and distributed among the partners. This can happen due to various reasons such as retirement, death, or a mutual agreement between the partners to wind up the business. The liquidation process ensures that all partnership assets are properly monetized, debts are paid off, and remaining proceeds are distributed proportionally among the partners. It involves several steps and legal procedures to ensure a fair and equitable distribution. One type of South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets is the voluntary dissolution of a partnership. This occurs when partners decide to end their business relationship by choice, usually after carefully considering the financial and personal circumstances of each partner. In cases where a partnership is dissolved due to the retirement or death of a partner, another type of liquidation is initiated. This type often involves additional legal processes to ensure the smooth transfer of assets and to address any estate-related matters. During the liquidation process, all partnership assets, including real estate, equipment, inventory, and investments, are identified, appraised, and sold. The proceeds from the sale are then used to clear any outstanding debts and obligations of the partnership, such as loans, taxes, and other liabilities. Once the partnership's debts are settled, the remaining funds are distributed among the partners proportionally based on their ownership interests or as agreed upon in the partnership agreement. It is crucial to ensure a fair distribution that reflects each partner's contributions and entitlements. To initiate the South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets, partners must follow specific legal procedures and requirements outlined in South Dakota partnership laws. This may involve filing dissolution documents, notifying creditors, and properly documenting the entire liquidation process. The liquidation process can be complex and time-consuming, requiring the involvement of legal and financial professionals with expertise in partnership dissolution and asset distribution. Consulting with a knowledgeable attorney who specializes in South Dakota partnership law is highly recommended ensuring compliance with all legal requirements and smooth execution of the liquidation process. In conclusion, South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets is a legally mandated process that ensures the proper dissolution and distribution of assets among partners. It involves selling off partnership assets, paying off debts, and distributing remaining funds among partners proportionally. By following the necessary legal procedures, partners can ensure a fair and equitable liquidation process.

South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets

Description

How to fill out South Dakota Liquidation Of Partnership With Sale And Proportional Distribution Of Assets?

If you want to total, down load, or produce legitimate document web templates, use US Legal Forms, the biggest collection of legitimate kinds, which can be found on the web. Take advantage of the site`s simple and easy hassle-free research to find the papers you want. A variety of web templates for enterprise and personal functions are categorized by categories and claims, or key phrases. Use US Legal Forms to find the South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets within a couple of mouse clicks.

Should you be previously a US Legal Forms customer, log in in your bank account and click the Download key to have the South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets. You can even gain access to kinds you earlier acquired in the My Forms tab of the bank account.

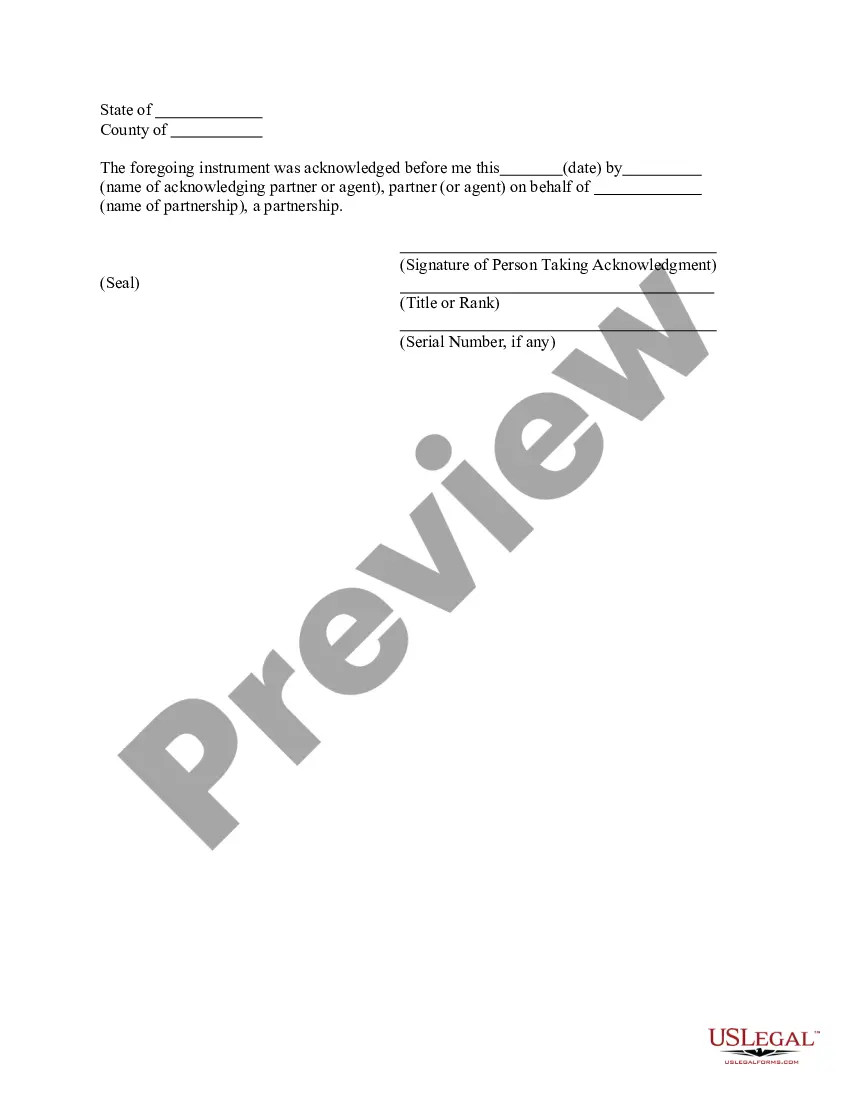

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for the proper town/nation.

- Step 2. Make use of the Review solution to look over the form`s information. Never neglect to see the description.

- Step 3. Should you be not happy together with the form, make use of the Research area towards the top of the monitor to find other types in the legitimate form design.

- Step 4. When you have located the form you want, go through the Buy now key. Select the prices strategy you prefer and include your accreditations to register to have an bank account.

- Step 5. Process the transaction. You should use your charge card or PayPal bank account to perform the transaction.

- Step 6. Find the format in the legitimate form and down load it on your own product.

- Step 7. Complete, revise and produce or indication the South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets.

Each and every legitimate document design you buy is yours eternally. You have acces to every form you acquired in your acccount. Click the My Forms segment and decide on a form to produce or down load once again.

Be competitive and down load, and produce the South Dakota Liquidation of Partnership with Sale and Proportional Distribution of Assets with US Legal Forms. There are thousands of expert and condition-particular kinds you can utilize for the enterprise or personal demands.

Form popularity

FAQ

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

When a partnership business is terminated, partners are expected to pay taxes on the taxable gain distributed to them upon liquidation of current and fixed assets.

Property Distributions. When property is distributed to a partner, then the partnership must treat it as a sale at fair market value ( FMV ). The partner's capital account is decreased by the FMV of the property distributed. The book gain or loss on the constructive sale is apportioned to each of the partners' accounts

Only partners who receive a liquidating distribution of cash may have an immediate taxable gain or loss to report. The value of marketable securities, such as stock investments that are traded on a public stock exchange, and decreases to your share of the partnership's debt are both treated as cash distributions.

In order to dissolve a partnership, the following four accounting steps must be executed: sell noncash assets; allocate any gains or losses arising from the sale based on the partnership agreement; pay off liabilities; distribute the remaining funds based on capital account balances of the partners.

Liquidating distributions (cash or noncash) are a form of a return of capital. Any liquidating distribution you receive is not taxable to you until you recover the basis of your stock. After the basis of your stock is reduced to zero, you must report the liquidating distribution as a capital gain.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

Partnership reports distributions of all other property on Schedule K, line 19b and on Form 1065, Schedule M-2. Liquidating partner determines if he must recognize gain or loss from the transaction on his Form 1040.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.