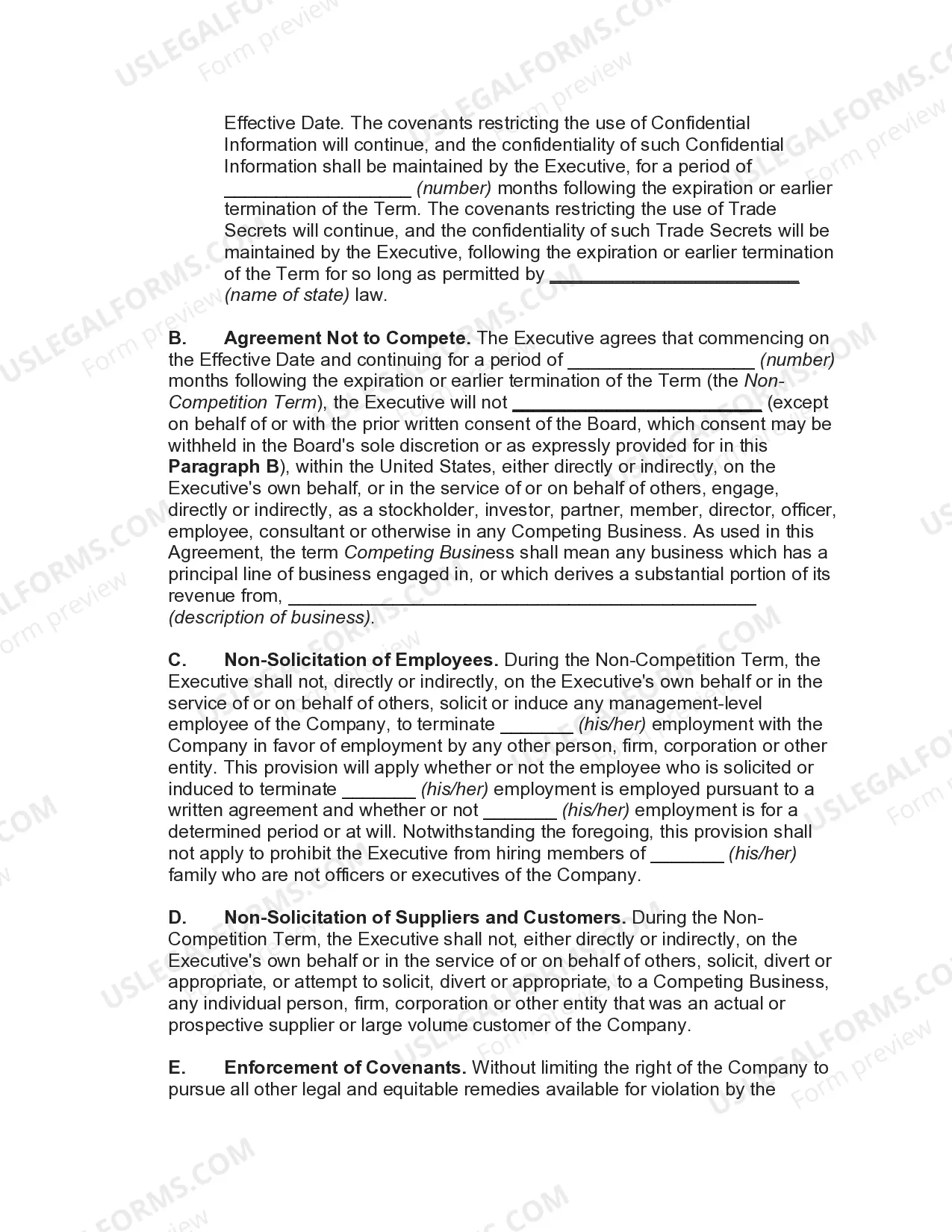

South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer: A Comprehensive Overview Introduction: The South Dakota Employment Agreement with the Executive Vice President (MVP) and Chief Financial Officer (CFO) is an essential legal document that outlines the terms and conditions of employment for these executive positions within a company. This agreement serves as a legally binding contract between the employer and the MVP/CFO, ensuring clarity on rights, responsibilities, compensation, benefits, and other relevant terms. Key Elements: 1. Position and Title: The agreement clearly establishes the MVP/CFO's position, title, and their reporting hierarchy within the company. This section may also outline the MVP/CFO's role and responsibilities. 2. Duration: The agreement specifies the term of employment, whether it is a fixed term or an indefinite period. It may include provisions for renewal or termination of the agreement. 3. Compensation and Benefits: This section highlights the MVP/CFO's salary, bonus potential, incentive plans, stock options, and other forms of compensation such as allowances, retirement benefits, health insurance, and vacation entitlement. It may also outline reimbursement policies for business-related expenses. 4. Duties and Obligations: The MVP/CFO's specific job duties, obligations, and performance expectations are detailed here. The agreement may specify confidential information and trade secrets the MVP/CFO must protect, as well as any non-compete or non-disclosure clauses. 5. Termination and Severance: This section outlines conditions under which the agreement may be terminated, such as for cause (e.g., gross misconduct) or without cause (e.g., restructuring). It also covers severance packages, notice periods, and any financial or other benefits payable upon termination. 6. Dispute Resolution: The agreement may include provisions for alternative dispute resolution methods, such as mediation or arbitration, in case of conflicts between the MVP/CFO and the employer. Types of South Dakota Employment Agreements with MVP/CFO: 1. Fixed-Term Employment Agreement: This type of agreement establishes employment for a specific duration, typically with a predefined end date. It is commonly used when the MVP/CFO is hired for a specific project, assignment, or contract. 2. Indefinite Employment Agreement: In this agreement, there is no fixed term, and employment is continuous until either party decides to terminate the agreement. The terms and conditions remain in effect until modified or terminated. Conclusion: The South Dakota Employment Agreement with the MVP and CFO is a crucial legal document that sets forth the terms and conditions of employment for these executive roles. It ensures clarity, protects the rights of both parties, and establishes a framework for a mutually beneficial employment relationship. As with any legal agreement, it is advisable for both parties to seek legal counsel to ensure compliance with relevant state laws and tailor the agreement to their unique circumstances.

South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer

Description

How to fill out South Dakota Employment Agreement With Executive Vice President And Chief Financial Officer?

If you want to comprehensive, acquire, or print lawful record themes, use US Legal Forms, the biggest selection of lawful varieties, which can be found online. Utilize the site`s basic and practical search to obtain the paperwork you will need. Numerous themes for enterprise and specific uses are categorized by types and states, or keywords. Use US Legal Forms to obtain the South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer in a handful of click throughs.

When you are already a US Legal Forms consumer, log in in your account and then click the Acquire option to get the South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer. You can even accessibility varieties you formerly saved within the My Forms tab of your account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for your appropriate area/nation.

- Step 2. Take advantage of the Preview method to look over the form`s content material. Never forget about to read the information.

- Step 3. When you are not happy with the develop, use the Search discipline near the top of the screen to find other models in the lawful develop web template.

- Step 4. Upon having identified the shape you will need, select the Acquire now option. Select the prices prepare you like and add your references to register for an account.

- Step 5. Process the purchase. You may use your credit card or PayPal account to accomplish the purchase.

- Step 6. Pick the format in the lawful develop and acquire it in your system.

- Step 7. Full, change and print or sign the South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer.

Each lawful record web template you purchase is yours eternally. You might have acces to each develop you saved inside your acccount. Click the My Forms section and decide on a develop to print or acquire again.

Remain competitive and acquire, and print the South Dakota Employment Agreement with Executive Vice President and Chief Financial Officer with US Legal Forms. There are millions of specialist and state-specific varieties you can use for your enterprise or specific requirements.