The South Dakota Agreement to Form Limited Partnership is a legal document that outlines the terms and conditions for creating a limited partnership in the state of South Dakota. This agreement serves as the foundation for forming a business partnership with one or more general partners and one or more limited partners. The agreement starts by identifying the parties involved, including their names, addresses, and roles within the partnership. It is important to clearly distinguish between general partners, who have unlimited liability and management responsibilities, and limited partners, who have limited liability and a more passive role. Key provisions in the agreement include the purpose of the partnership, the duration of the partnership, and the initial capital contribution of each partner. The agreement will also outline the profit and loss sharing arrangements among the partners, as well as the procedures for admitting new partners or transferring partnership interests. Another crucial aspect covered in the South Dakota Agreement to Form Limited Partnership is the governance and decision-making process. This includes specifying the powers and responsibilities of the general partners, as well as any limitations or restrictions on their authority. The agreement may also establish the procedures for holding partner meetings, voting on partnership matters, and resolving disputes. Additionally, the agreement will address the distribution of profits and losses, as well as the process for allocating assets and liabilities upon the dissolution or termination of the partnership. It will define the procedure for winding up the partnership's affairs and distributing its assets to the partners. South Dakota recognizes different types of limited partnership agreements, including general and limited partnerships and limited liability partnerships (Laps). General partnerships have multiple general partners who share equal management authority and unlimited liability. Limited partnerships have one or more general partners who bear the unlimited liability, while limited partners have limited liability and a more passive role. Laps are a special category that protects partners from personal liability for the negligence, malpractice, or wrongdoing of other partners. This type of partnership is typically used by professionals such as lawyers, accountants, architects, and engineers. In conclusion, the South Dakota Agreement to Form Limited Partnership is a comprehensive legal document that governs the formation and operation of limited partnerships in South Dakota. It encompasses various crucial aspects such as partner roles, capital contributions, profit-sharing, decision-making procedures, dissolution, and asset distribution. It is essential for partners to carefully draft and review this agreement to ensure clarity and protect their rights and obligations.

South Dakota Agreement to Form Limited Partnership

Description

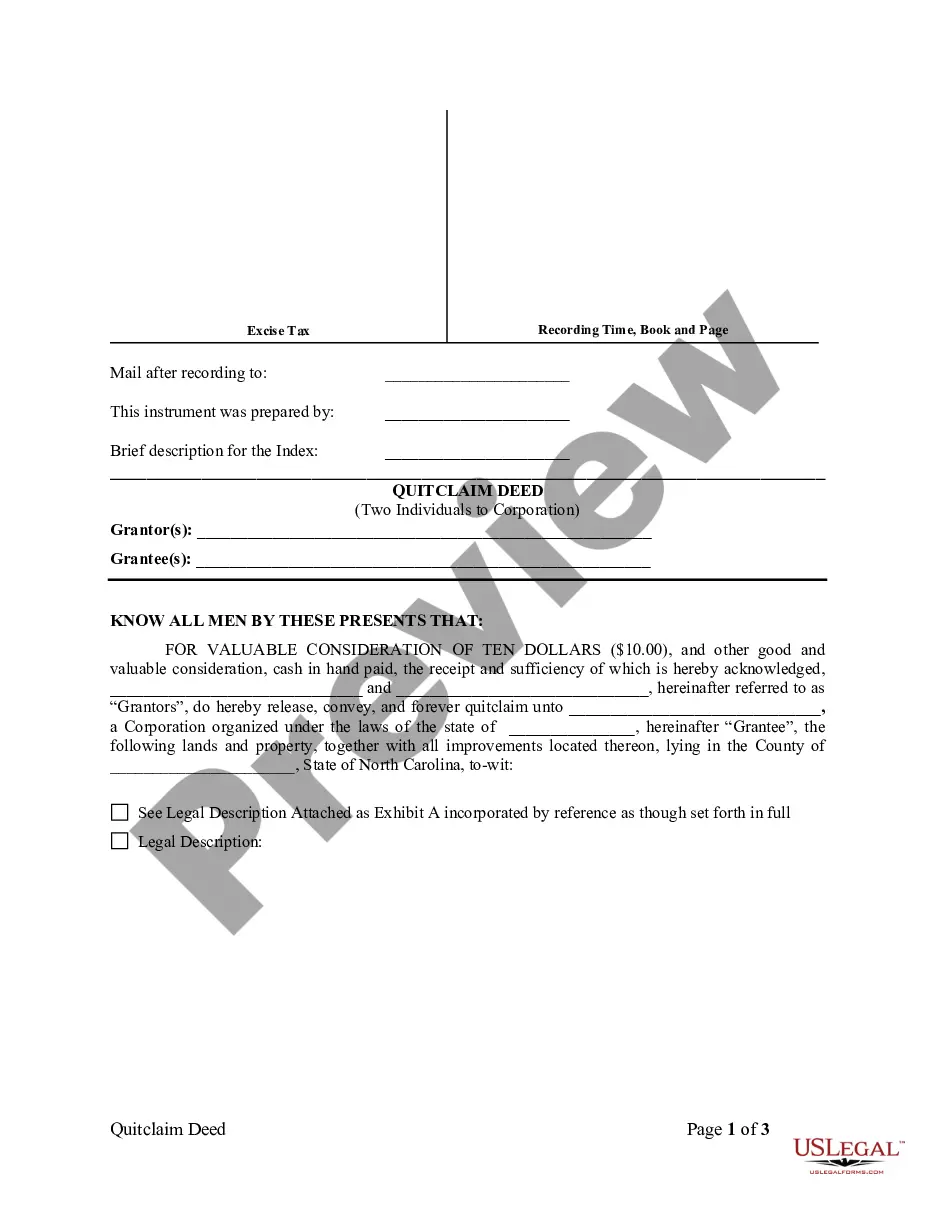

How to fill out Agreement To Form Limited Partnership?

It is feasible to spend hours online searching for the valid document format that fulfills the federal and state requirements you need.

US Legal Forms offers a wide array of valid templates that are reviewed by professionals.

It is easy to obtain or print the South Dakota Agreement to Form Limited Partnership from their services.

If available, utilize the Preview button to examine the document format as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, alter, print, or sign the South Dakota Agreement to Form Limited Partnership.

- Every valid document format you receive is yours indefinitely.

- To obtain an additional copy of any purchased form, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure that you have selected the correct document format for the area/city of your choice.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

While you can technically have a partnership without a written agreement, it is not recommended. A partnership without an agreement can lead to confusion and disagreement over roles and contributions. Creating a South Dakota Agreement to Form Limited Partnership can prevent these issues by establishing clear guidelines and expectations for all partners involved.

Yes, a limited partnership inherently includes a partnership agreement. This document encompasses the terms and conditions governing the partnership’s operations, offering essential protection for all partners. By utilizing the South Dakota Agreement to Form Limited Partnership, partners can ensure their arrangement is legally sound and well-structured.

Yes, a limited partnership does require a partnership agreement to function effectively. This agreement lays out the rights and responsibilities of each partner, which is crucial for navigating potential disputes. For those considering the South Dakota Agreement to Form Limited Partnership, such an agreement serves as a foundational document that clarifies partner relationships.

To establish a limited partnership, you must have at least one general partner and one limited partner. Additionally, both parties must file a certificate of limited partnership with the South Dakota Secretary of State. Finally, a formal South Dakota Agreement to Form Limited Partnership must be in place to define the terms, ensuring all partners understand their roles and liabilities.

While it is technically possible to establish a partnership without a written agreement, having one is highly advisable. A written agreement provides clarity in roles and financial arrangements, reducing the risk of disputes. In the context of a South Dakota Agreement to Form Limited Partnership, a formal document ensures that all partners understand their obligations and expectations.

An operating agreement for a limited partnership (LP) outlines the management structure and operational guidelines for the partnership. It clearly defines the roles of general and limited partners while detailing their rights and responsibilities. This document is essential for establishing transparency and preventing disputes among partners, making it a crucial component of the South Dakota Agreement to Form Limited Partnership.

A limited partnership is a partnership that has at least two classes of partners, a general or managing partner who operates the company and limited partners who invest but do not partake in day to day decisions.

Top states for limited partnerships If you do this, you must file for foreign qualification to legally operate in your state. Delaware and Nevada are generally considered the most advantageous states in which to incorporate due to their business-friendly laws and tax codes.

A Limited Partnership Agreement is an agreement between the general partner, the limited partners and the Limited Partnership itself in which the partners can set forth in writing the particular agreements that they have among themselves.

A limited partnership is similar to a general partnership, but offers limited liability protection to some partners. At least one partner must be a general partner with unlimited liability, and at least one partner must be a limited partner whose liability is typically limited to the amount of his or her investment.