South Dakota Shipping Order for Warehoused Goods

Description

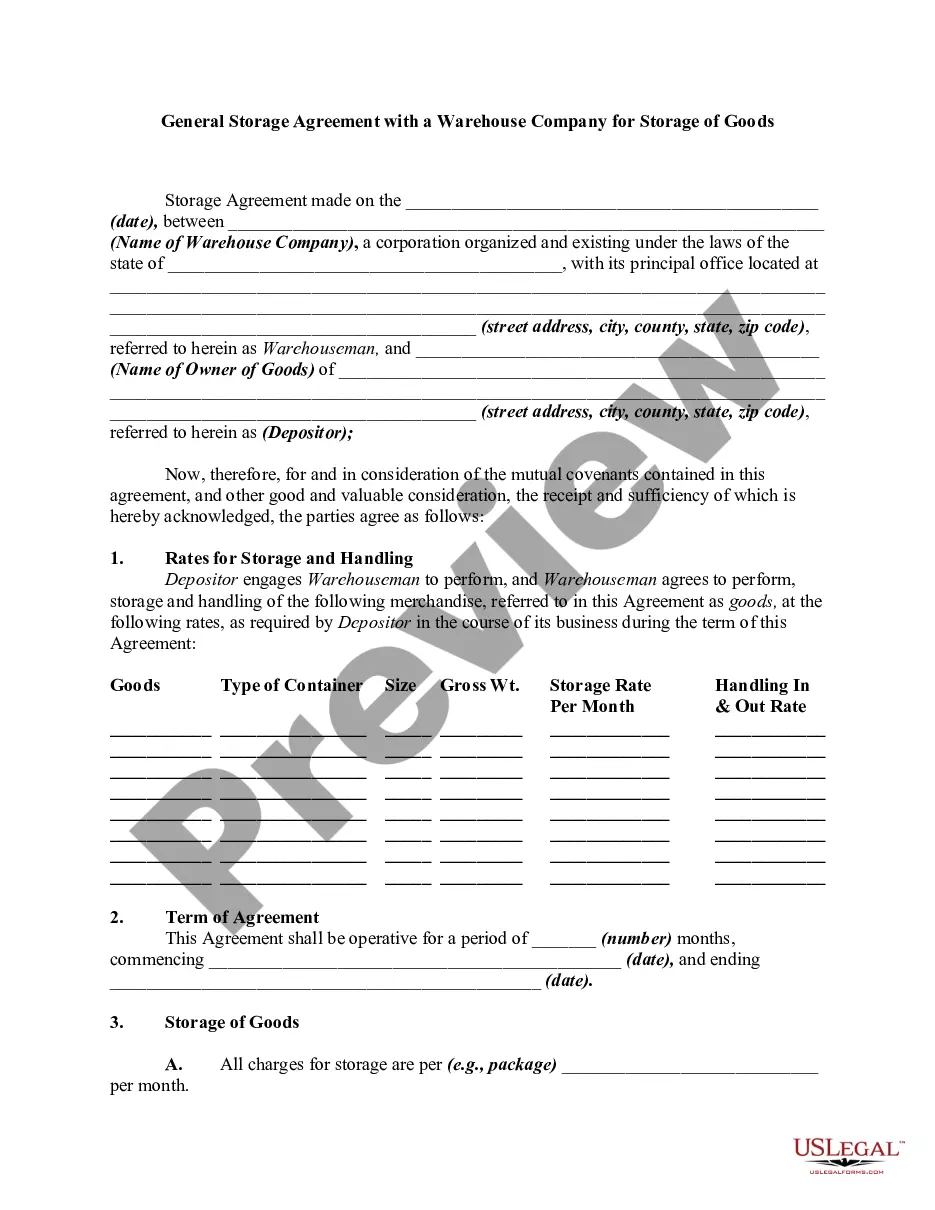

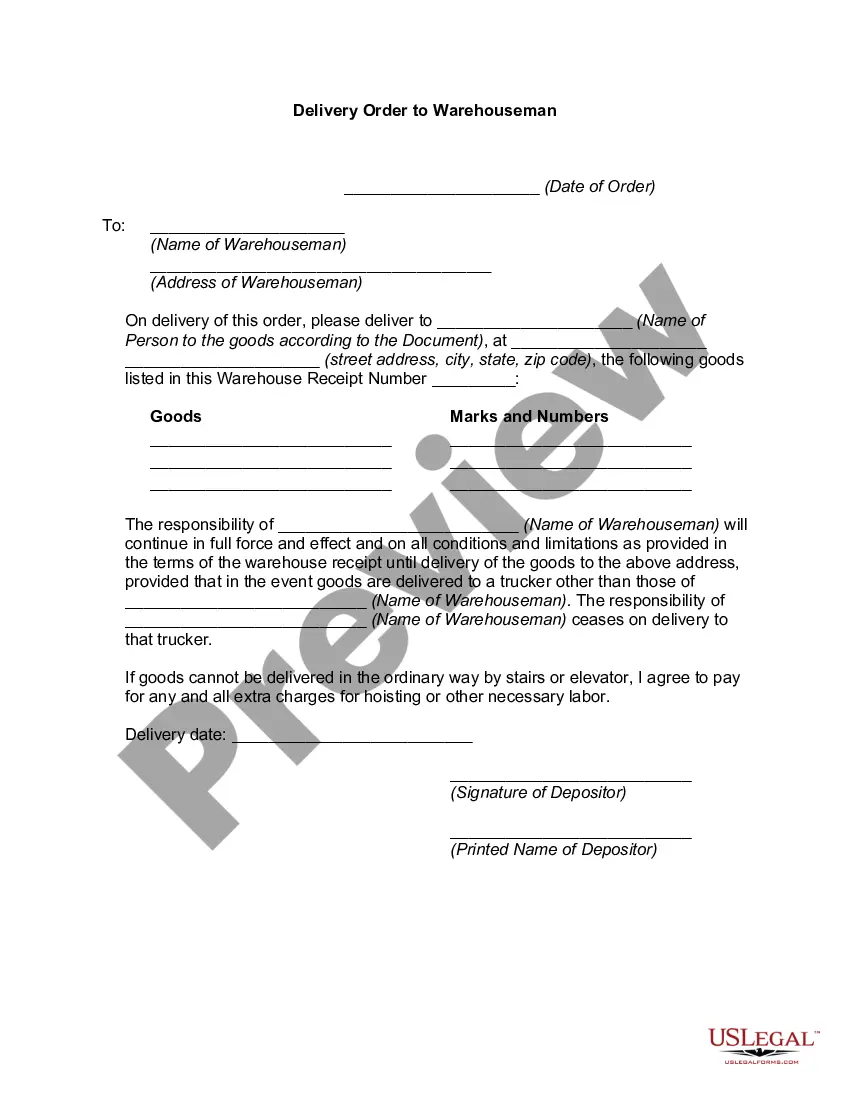

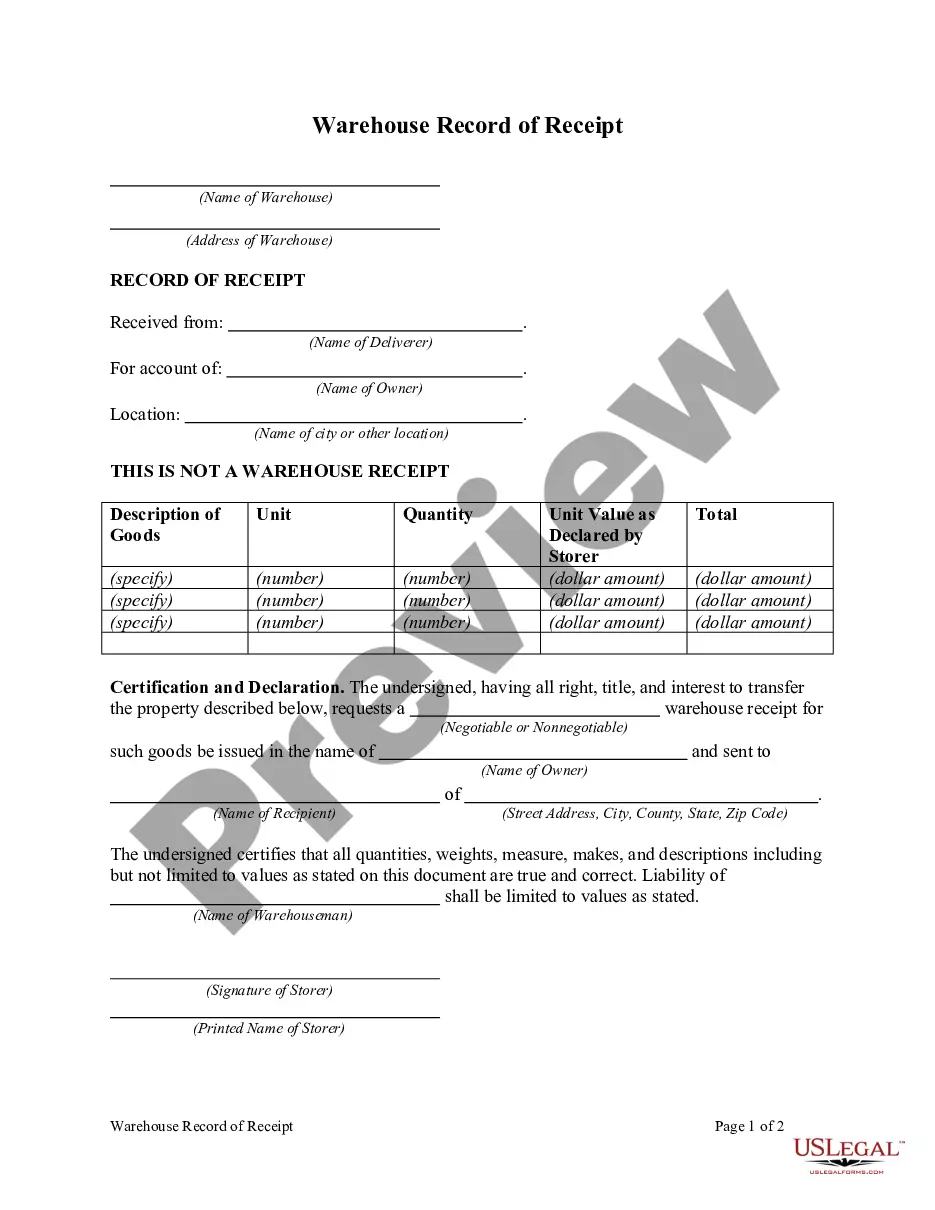

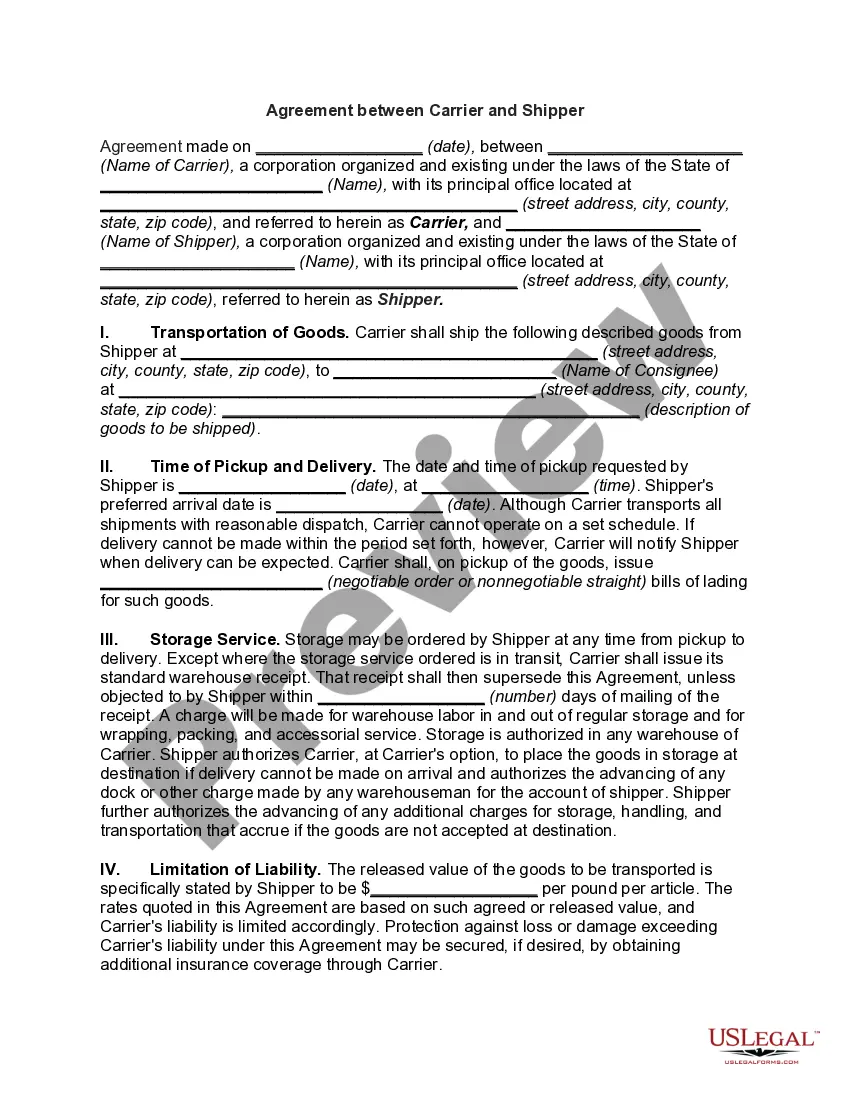

How to fill out Shipping Order For Warehoused Goods?

Selecting the optimal lawful document format can be challenging. Clearly, there are numerous templates accessible online, but how do you obtain the official form you require.

Utilize the US Legal Forms website. This service offers countless templates, including the South Dakota Shipping Order for Warehoused Goods, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with both state and federal regulations.

If you are already registered, Log Into your account and hit the Download button to locate the South Dakota Shipping Order for Warehoused Goods. Use your account to view the official forms you have acquired in the past. Visit the My documents section of your account and obtain another copy of the document you need.

US Legal Forms is the largest collection of legal forms where you can find various document templates. Utilize this service to download expertly crafted paperwork that adheres to state regulations.

- First, ensure that you have chosen the correct form for your region/county. You can examine the form using the Review button and read the form description to confirm this is the appropriate one for you.

- If the form does not satisfy your requirements, use the Search field to find the correct form.

- Once you are confident the form is suitable, click the Get now button to acquire the form.

- Select the preferred payment plan and enter the necessary information. Create your account and finalize the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the received South Dakota Shipping Order for Warehoused Goods.

Form popularity

FAQ

Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

Sellers must keep exemption certificates in their records for three years. If the purchaser doesn02bct provide the seller with a properly completed exemption certificate, the seller must collect sales tax. An exemption certificate may be issued for a single purchase or as a blanket certificate.

In general, delivery-related charges for taxable products are not taxable when you ship directly to the purchaser via common carrier, contract carrier, or USPS; delivery, shipping, freight, or postage charges are separately stated; and the charge isn't greater than the actual cost of delivery.

Charges for shipping, handling, delivery, freight, and postage are generally taxable in South Dakota. If the sale is tax exempt, the shipping charges are generally exempt as well.

Most businesses operating in or selling in the state of South Dakota are required to purchase a resale certificate annually. Even online based businesses shipping products to South Dakota residents must collect sales tax. Obtaining your sales tax certificate allows you to do so.

Most businesses starting in South Dakota selling a product or offering services will need to register for a sales tax license. This is commonly referred to as a seller's permit, sales tax permit, sales & use tax number, or sales tax registration.

You can register your business for a sales tax permit with the South Dakota Department of Revenue's e-services center. Once your application is approved, you will receive a license card. You must have a separate license for each business location you operate, but you may be eligible to apply for consolidated filing.

Goods that are subject to sales tax in South Dakota include physical property, like furniture, home appliances, and motor vehicles. The purchase of prescription medication and gasoline are tax-exempt. South Dakota is unique in the fact that almost all services are taxable.

You can register your business for a sales tax permit with the South Dakota Department of Revenue's e-services center. Once your application is approved, you will receive a license card.