South Dakota Expense Reimbursement Form for an Employee

Description

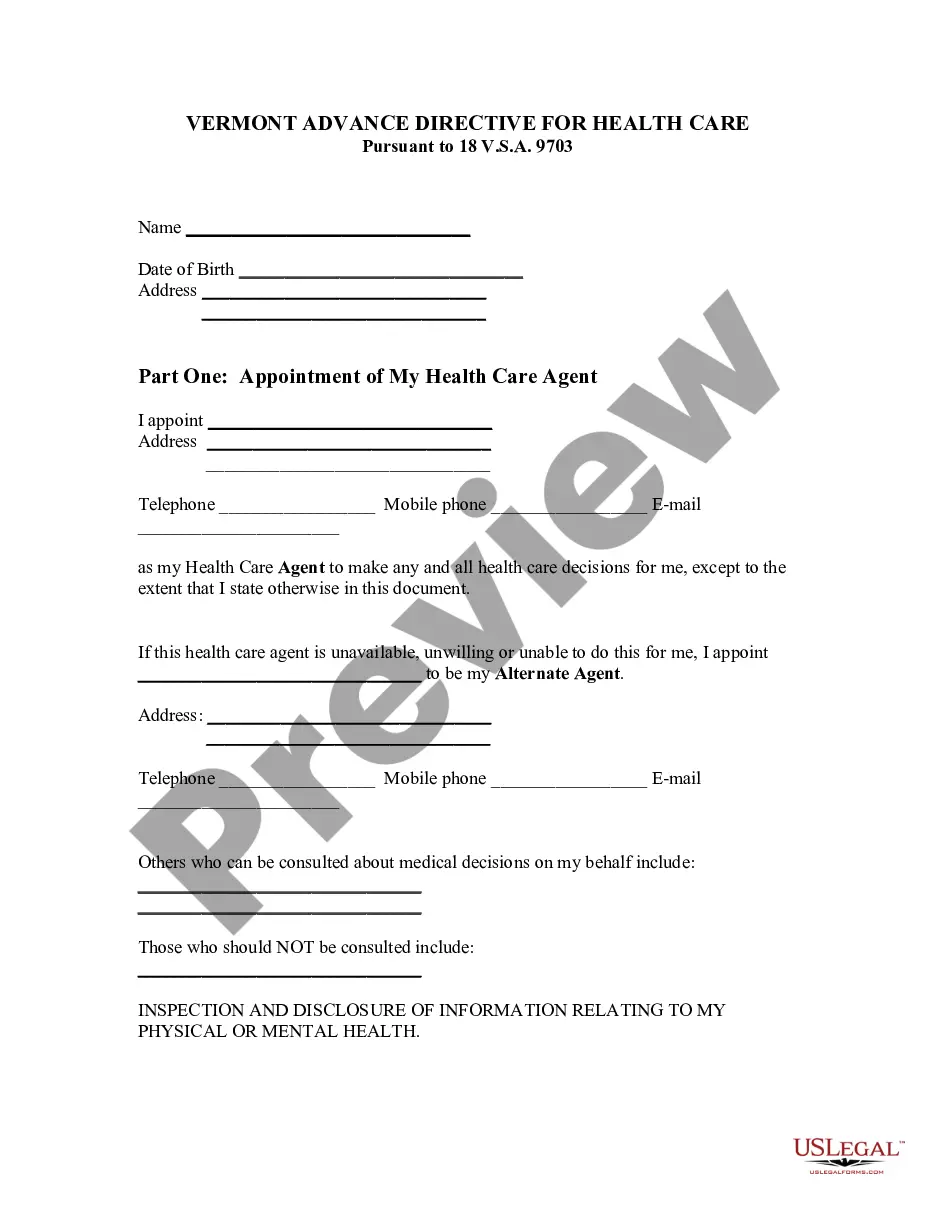

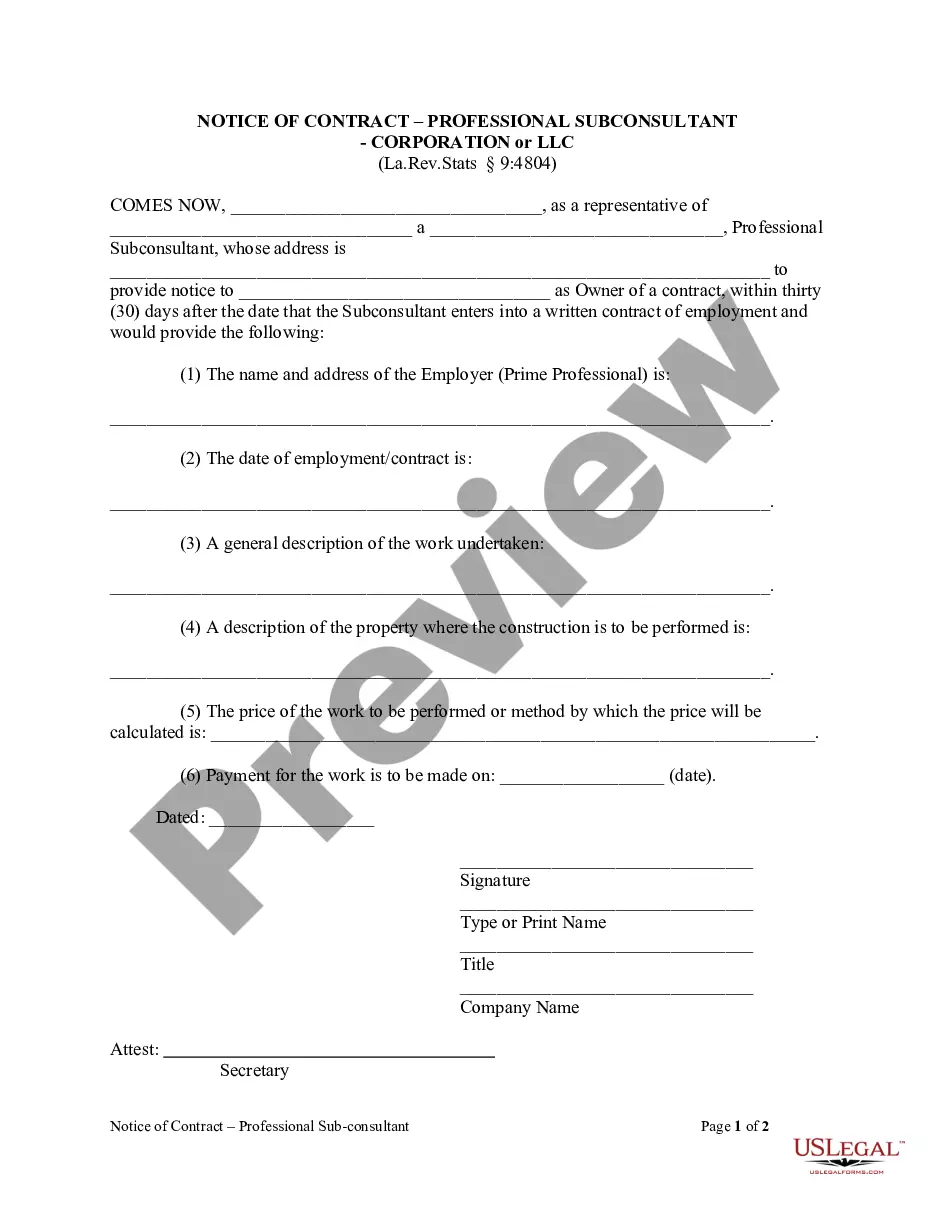

How to fill out Expense Reimbursement Form For An Employee?

You can spend hours on the web looking for the legal documents template that complies with the state and federal standards you will require.

US Legal Forms offers thousands of legal documents that are examined by experts.

You can indeed download or print the South Dakota Expense Reimbursement Form for an Employee from the service.

If you wish to locate another version of the form, use the Search section to find the template that suits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, print, or sign the South Dakota Expense Reimbursement Form for an Employee.

- Each legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, head to the My documents section and click on the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- Firstly, ensure you have selected the correct document template for your preferred area/city.

- Review the form description to confirm that you have chosen the right form.

- If available, use the Preview button to browse through the document template as well.

Form popularity

FAQ

Generally Non-Taxable Employee ReimbursementsEducational reimbursements up to a maximum $5,250 per year. Specific insurance premiums including: up to $50,000 in group life insurance coverage, accident and health benefits, and the employer's share of COBRA contributions.

Is my employer required to cover my expenses if I work from home? The federal Fair Labor Standards Act (FLSA) generally does not require that an employee be reimbursed for expenses incurred while working from home.

According to research that covered 1,900 remote workers from 90 countries, 78% of remote workers pay for their own internet connection. In truth, there is no wide-reaching federal law that requires the employer to reimburse Internet expenses for their remote employers only some states require employees to do so.

Here's when internet reimbursement is taxable income for your team: If you're giving the additional money to cover their home internet usage as cash or in their paycheck. You don't require receipts from your employees to receive the reimbursement.

sizefitsall WFH stipend for all employees even if intended to reimburse for business expenses is likely taxable. That is unless the business adds the complication of collecting receipts from all employees or otherwise substantiating the reimbursement.

Home Office Reimbursement Employer ResponsibilitiesThe federal Fair Labor Standards Act (FLSA) generally does not require employers to reimburse home-office expenses accrued by employees. The exception is that the FLSA does apply to employer reimbursements when the worker's earnings fall beneath the minimum wage.

However, ten states (and Washington D.C.) currently have laws requiring employers to reimburse employees for certain remote work expenses: California, Washington D.C., Illinois, Iowa, Massachusetts, Minnesota, Montana, Hampshire, New York, North Dakota, Pennsylvania, and South Dakota.

It also requires employers to reimburse their remote employees for all their work-related expenses. This includes the remote workstations they create in their homes, as well as the Internet fees, and tax deductions.

A necessary expense is anything required for the performance of an employees' job. This depends on the work performed, but reasonable reimbursable expenses will likely include: internet services, mobile data usage, laptop computers or tablets, and equipment such as copiers and printers.