South Dakota Specific Guaranty is a legal binding agreement that aims to secure a financial obligation or debt repayment for a specific individual or entity in the state of South Dakota. This guarantee serves as a promise made by the guarantor to assume responsibility for the outstanding debt or obligation in case the primary debtor defaults or fails to fulfill the terms of the agreement. The South Dakota Specific Guaranty is a crucial tool used in a variety of financial transactions, including loans, leases, mortgages, or any other form of credit arrangements. Lenders and creditors often seek guarantors to provide an additional layer of security, ensuring that the loan or financial obligation will be satisfied even if the borrower encounters difficulties. There are different types of South Dakota Specific Guaranty that can be employed based on the specific needs and requirements of the agreement. Some commonly used types of guaranties include: 1. Unlimited Guaranty: In this type of guaranty, the guarantor assumes full responsibility for the entire outstanding debt or obligation, leaving no specified limit to their liability. This guaranty provides the highest level of assurance to the lender or creditor. 2. Limited Guaranty: A limited guaranty sets a predetermined cap or limit on the guarantor's liability. In case of default by the borrower, the guarantor is only responsible for a specified portion or amount of the outstanding debt, typically up to a certain percentage. 3. Continuing Guaranty: This type of guaranty extends its coverage to future or successive obligations that may arise between the borrower and the lender. It provides assurance to the lender that the guarantor will continue to be responsible for new debts or obligations incurred over time. 4. Demand Guaranty: A demand guaranty allows the lender or creditor to seek repayment from the guarantor immediately upon default by the borrower. This type of guaranty does not require the lender to wait for a specific notice period or event before enforcing the guarantor's responsibility. South Dakota Specific Guaranty is a contractual arrangement that requires careful consideration and understanding of the legal implications involved. It is advisable for all parties, including the borrower, lender, and guarantor, to seek professional legal counsel to ensure compliance with the state laws and regulations governing such agreements.

South Dakota Specific Guaranty

Description

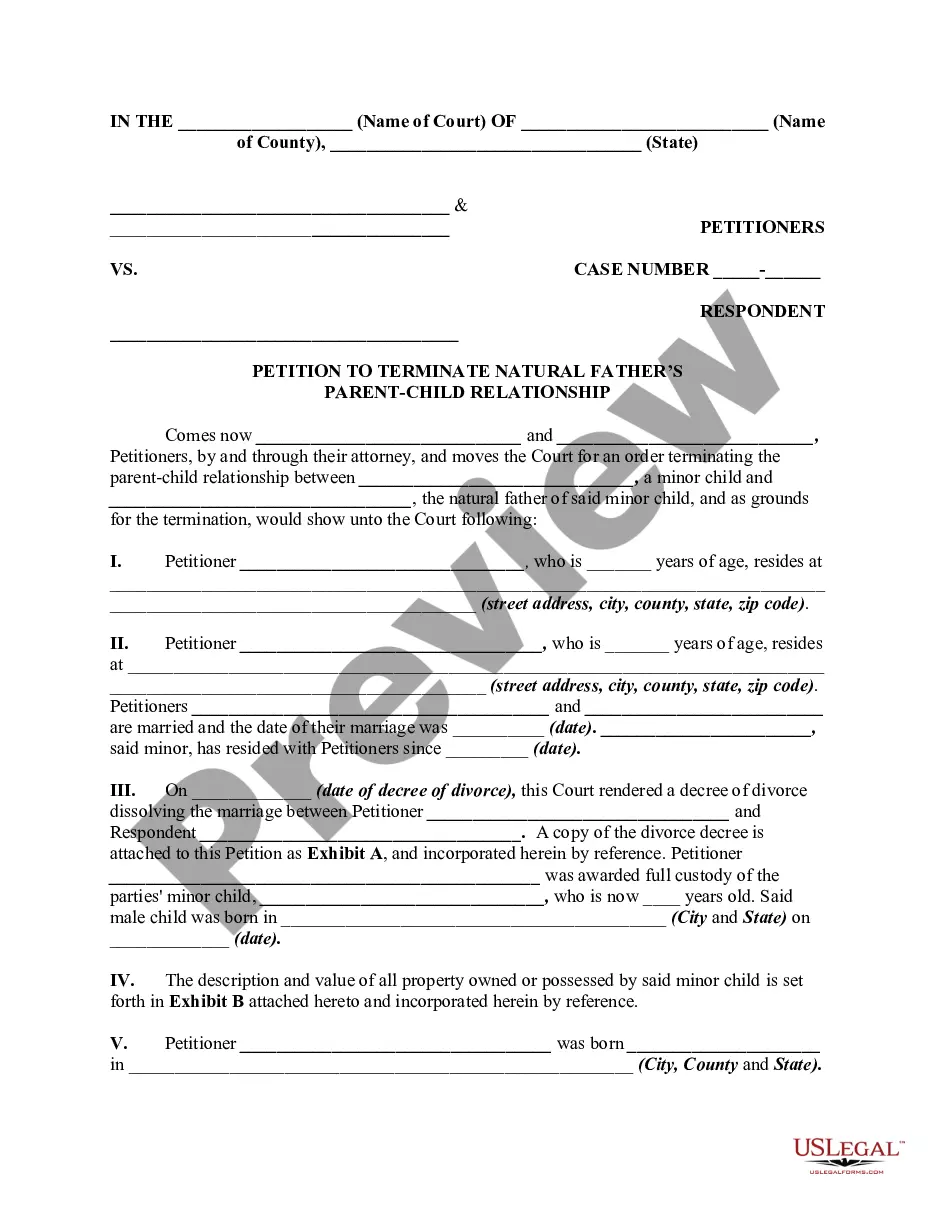

How to fill out South Dakota Specific Guaranty?

If you wish to comprehensive, down load, or print legal document web templates, use US Legal Forms, the biggest selection of legal types, which can be found on the web. Take advantage of the site`s simple and hassle-free research to discover the paperwork you want. Numerous web templates for organization and personal reasons are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the South Dakota Specific Guaranty with a few click throughs.

If you are previously a US Legal Forms client, log in to your accounts and click the Download option to get the South Dakota Specific Guaranty. You can also gain access to types you in the past saved within the My Forms tab of your accounts.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the form for your appropriate town/land.

- Step 2. Take advantage of the Preview option to look through the form`s information. Do not forget about to learn the description.

- Step 3. If you are unsatisfied with the develop, make use of the Search industry near the top of the monitor to discover other variations of your legal develop design.

- Step 4. Once you have discovered the form you want, click on the Buy now option. Opt for the prices plan you favor and include your accreditations to register to have an accounts.

- Step 5. Procedure the deal. You should use your bank card or PayPal accounts to complete the deal.

- Step 6. Select the structure of your legal develop and down load it in your system.

- Step 7. Total, change and print or signal the South Dakota Specific Guaranty.

Each and every legal document design you buy is your own property eternally. You possess acces to every single develop you saved inside your acccount. Click on the My Forms segment and select a develop to print or down load again.

Contend and down load, and print the South Dakota Specific Guaranty with US Legal Forms. There are thousands of expert and state-distinct types you may use for your personal organization or personal requires.