South Dakota Private Trust Company

Description

How to fill out Private Trust Company?

Are you presently in a situation where you require documents for both business or personal purposes each time.

There are numerous legal document templates accessible online, yet finding ones you can rely on is not simple.

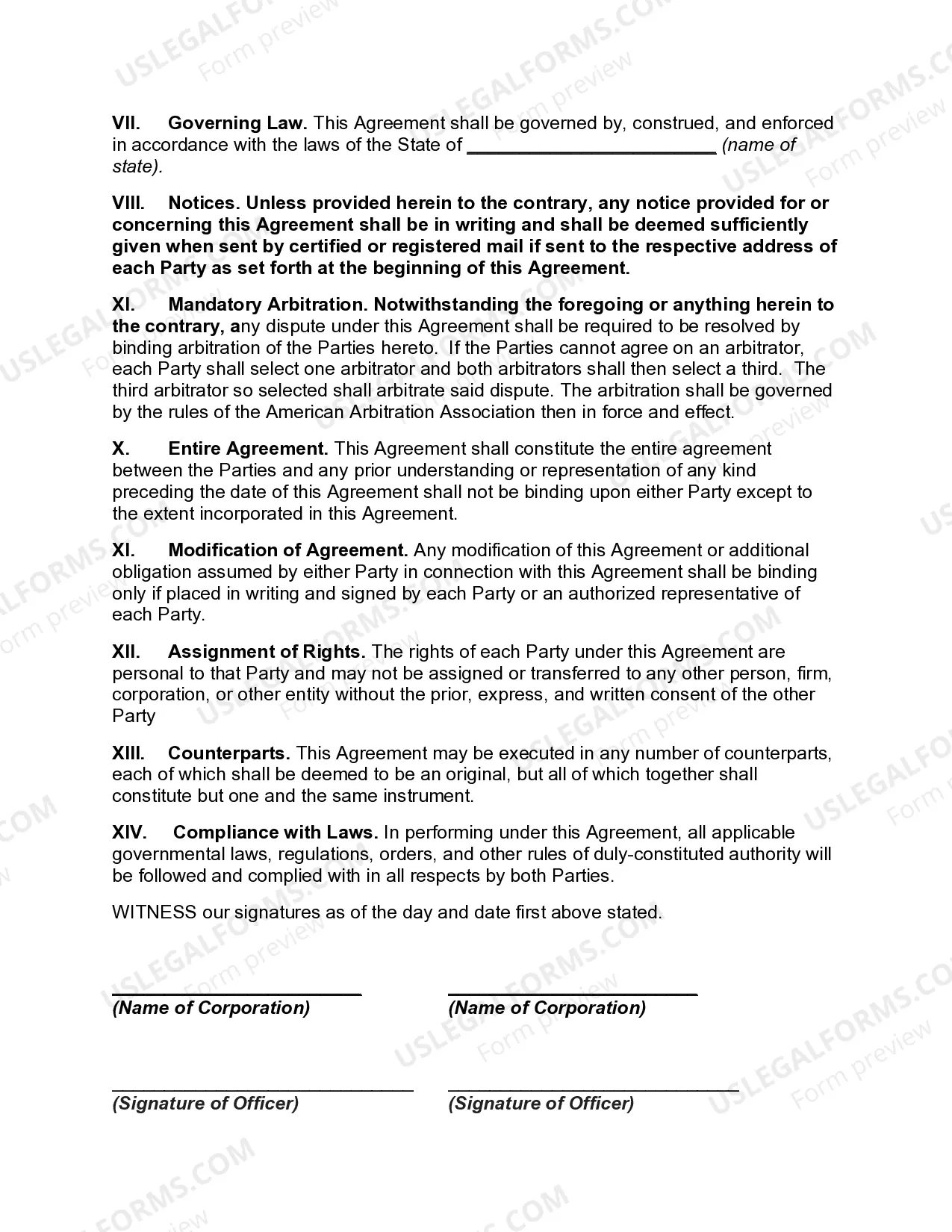

US Legal Forms offers a vast collection of form templates, including the South Dakota Private Trust Company, which are designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Dakota Private Trust Company template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to check the form.

- Review the details to confirm that you have chosen the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that meets your needs and requirements.

- Once you find the correct form, click on Acquire now.

- Select the pricing plan you want, fill in the necessary information to create your account, and purchase the order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the South Dakota Private Trust Company whenever needed. Just follow the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally created legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Yes, South Dakota Private Trust Companies are regulated by the state’s Division of Banking. This oversight ensures that these companies adhere to stringent guidelines for managing trusts. Therefore, working with a regulated South Dakota Private Trust Company can provide peace of mind regarding compliance and fiduciary responsibility.

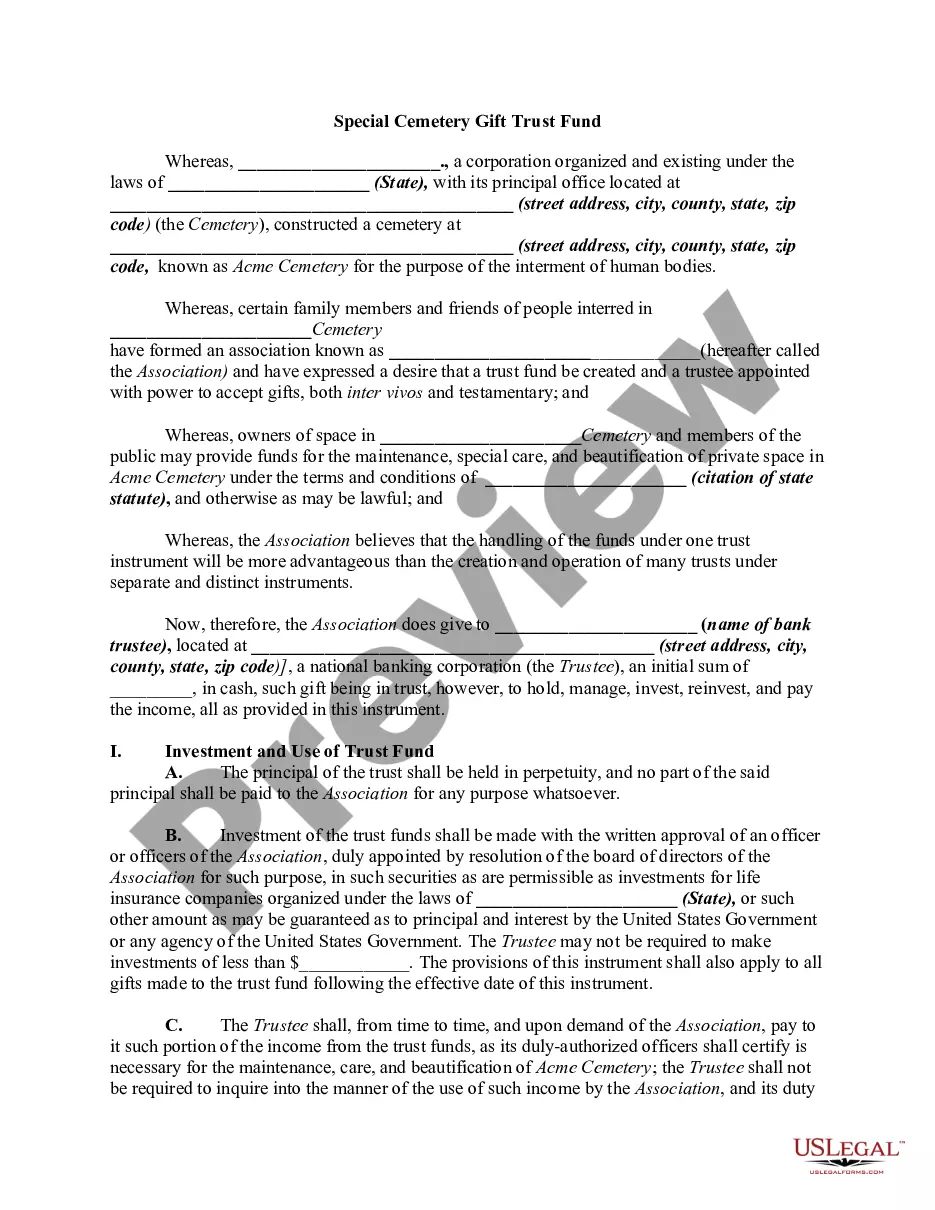

South Dakota has one of the top dynasty purpose trust statutes in the U.S. In fact, South Dakota is one of the few states that allow for purpose trusts to be established for any lawful purpose, not just for the pets or honoraries. The purpose trust does not have beneficiaries; its sole purpose is to care for an asset.

South Dakota is home to 63 public trust companies and 43 private trust companies. A private trust company limits activities to management of private assets, typically for the benefit of a single-family lineage.

For now, note that the top states for perpetual trusts are Alaska, Delaware, Nevada, and South Dakota. These states all allow perpetual trusts and don't assess state income taxes on these trusts....Which States Allow Perpetual Trusts?Alaska.Delaware.District of Columbia.Hawaii.Idaho.Illinois.Kentucky.Maine.More items...

According to independent rankings, the top states with the best trust laws are South Dakota trust law and Nevada in the US.

South Dakota Trust Company (SDTC) can assist a family or a family office with the setup, operation and administration of a cost-effective South Dakota regulated trust company by serving as Corporate Agent.

Private trust companies are designed to preserve ownership of family wealth, which may include business assets, real estate, alternative assets such as hedge funds or private equity. These assets are managed by the trustee in accordance with the wishes of the family.

Because trust companies are subject to regulation substantially similar to that applicable to banks, they enjoy many of the same exemptions from securities and other laws.

South Dakota offers everything a wealthy person setting up a trust could want. There is no state income tax or capital gains tax, so investment gains on assets placed in the trust are tax-free if it's structured correctly. Robust protections provide anonymity and shield assets from creditors.

States that recognize regulated private trust companies include:Alabama.Colorado.Delaware.Massachusetts.Nevada.New Hampshire.Pennsylvania.South Dakota.More items...