A South Dakota Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse is a type of trust that provides various benefits and protections for married couples in estate planning. This specific trust structure offers specific advantages to the trust or (individual creating the trust) and the beneficiary spouse (the married partner who receives the trust assets). The trust operates in such a way that the trust or funds the trust with their assets while they are alive or upon their death. The assets then become a part of the trust and are managed by a designated trustee, who is responsible for administering the trust in accordance with its terms and the applicable laws. One of the key features of this type of trust is the marital deduction. The trust or's assets are passed to the trust estate, and the beneficiary spouse is entitled to receive income generated by the trust assets during their lifetime. This ensures that the beneficiary spouse has a source of income to sustain their needs after the trust or's demise. Furthermore, a Power of Appointment is provided to the beneficiary spouse in this trust structure. This means that the beneficiary spouse has the authority to decide how the trust assets will be distributed after their death. They can appoint these assets to specific individuals or entities, including themselves, their children, or others. This power allows the beneficiary spouse to retain control and flexibility over the trust assets even after the trust or's passing. South Dakota is recognized as an attractive jurisdiction for establishing this type of trust due to its favorable trust laws. The state offers various advantages, such as no state income tax on trusts and no rule against perpetuates, making it an appealing option for estate planning. Different variations of the South Dakota Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse may exist based on specific modifications or additions to the trust's terms or unique requirements of the trust or and beneficiary spouse. It is crucial to consult with an experienced estate planning attorney or financial advisor to tailor the trust provisions to meet individual circumstances and goals. In summary, the South Dakota Marital-deduction Residuary Trust with a Single Trust or and Lifetime Income and Power of Appointment in Beneficiary Spouse offers married couples several advantages in estate planning. It allows for the seamless transfer of assets, provides income for the surviving spouse, and grants the beneficiary spouse the flexibility to distribute the trust assets as they see fit.

South Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

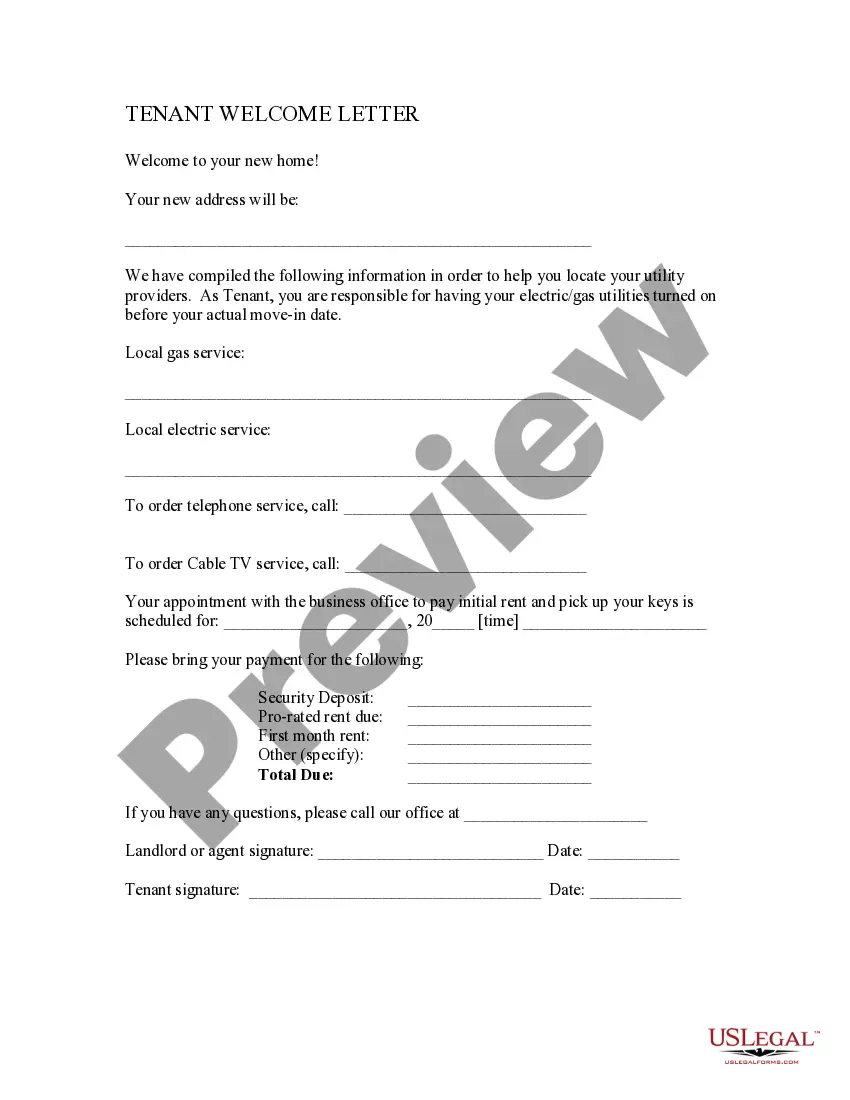

How to fill out South Dakota Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Finding the right authorized papers format might be a have difficulties. Of course, there are a variety of themes available on the net, but how do you obtain the authorized kind you will need? Use the US Legal Forms web site. The service gives 1000s of themes, for example the South Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, which can be used for enterprise and private demands. All the types are checked out by experts and meet up with federal and state needs.

Should you be previously registered, log in for your accounts and then click the Download option to get the South Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse. Make use of accounts to look throughout the authorized types you possess bought formerly. Proceed to the My Forms tab of your accounts and acquire an additional copy of the papers you will need.

Should you be a whole new user of US Legal Forms, listed below are basic instructions so that you can adhere to:

- Initially, be sure you have selected the right kind for the metropolis/area. You may look through the form making use of the Review option and look at the form outline to make certain this is basically the right one for you.

- When the kind is not going to meet up with your requirements, utilize the Seach area to find the proper kind.

- Once you are positive that the form is acceptable, click the Purchase now option to get the kind.

- Pick the pricing program you need and enter in the needed information. Create your accounts and purchase the transaction using your PayPal accounts or Visa or Mastercard.

- Select the document formatting and down load the authorized papers format for your device.

- Total, revise and print and sign the attained South Dakota Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

US Legal Forms may be the largest catalogue of authorized types in which you can find various papers themes. Use the service to down load professionally-manufactured files that adhere to status needs.

Form popularity

FAQ

A Discretionary Trust is an arrangement that gives trustees flexibility and control over how best to use the trust assets for the benefit of the beneficiaries. What is a Discretionary Trust? - The Private Office theprivateoffice.com ? specialist-services ? d... theprivateoffice.com ? specialist-services ? d...

Placing a power of appointment in your will or trust allows you to name a holder, or person with the authority to redirect your inheritance and decide where the money or property will go when you die.

Outright Trust Distributions They consist of the trustee releasing each beneficiary's inheritance without any restrictions. Outright distributions can either be made as a single lump sum, or periodically. Prior to making outright trust distributions, the trustee will need to pay the trust's debts and taxes. Trust Fund Distributions to Beneficiaries: Can a Trustee ... keystone-law.com ? trust-fund-distributions-when... keystone-law.com ? trust-fund-distributions-when...

For example, if the donee had the power to select only amongst the decedent's children, that is a special power of appointment.

Discretionary trust distributions are unique because they are the only type of trust distribution in which the trustee has the authority to decide which beneficiaries among a group of predetermined beneficiaries will inherit, how much they will inherit, when they will inherit, and whether they will inherit from the ...

Understanding the 3 Primary Classes of Trusts Revocable Trusts. A revocable trust can be altered?or even terminated?at any time during the trustor's (person establishing the trust) lifetime. ... Irrevocable Trusts. ... Testamentary Trusts. Understanding the 3 Primary Classes of Trusts wealthenhancement.com ? blog ? understan... wealthenhancement.com ? blog ? understan...

Discretionary distributions allow the trustee to decide how much income or principal a beneficiary or beneficiaries will receive under the trust and when they will receive it. Discretionary distributions require the trustee to rely on his or her own judgment relating to such distributions. Discretionary Distributions - The Grossman Law Firm APC grossmanlaw.net ? discretionary-distributions grossmanlaw.net ? discretionary-distributions

SAMPLE LANGUAGE: Notwithstanding any other provision in this will, all trusts created hereunder pursuant to the exercise of a power of appointment and all trusts created by the exercise of a further power of appointment granted over such appointed trusts shall terminate upon the expiration of the period of the rule ...