South Dakota Agreement for Auditing Services between Accounting Firm and Municipality

Description

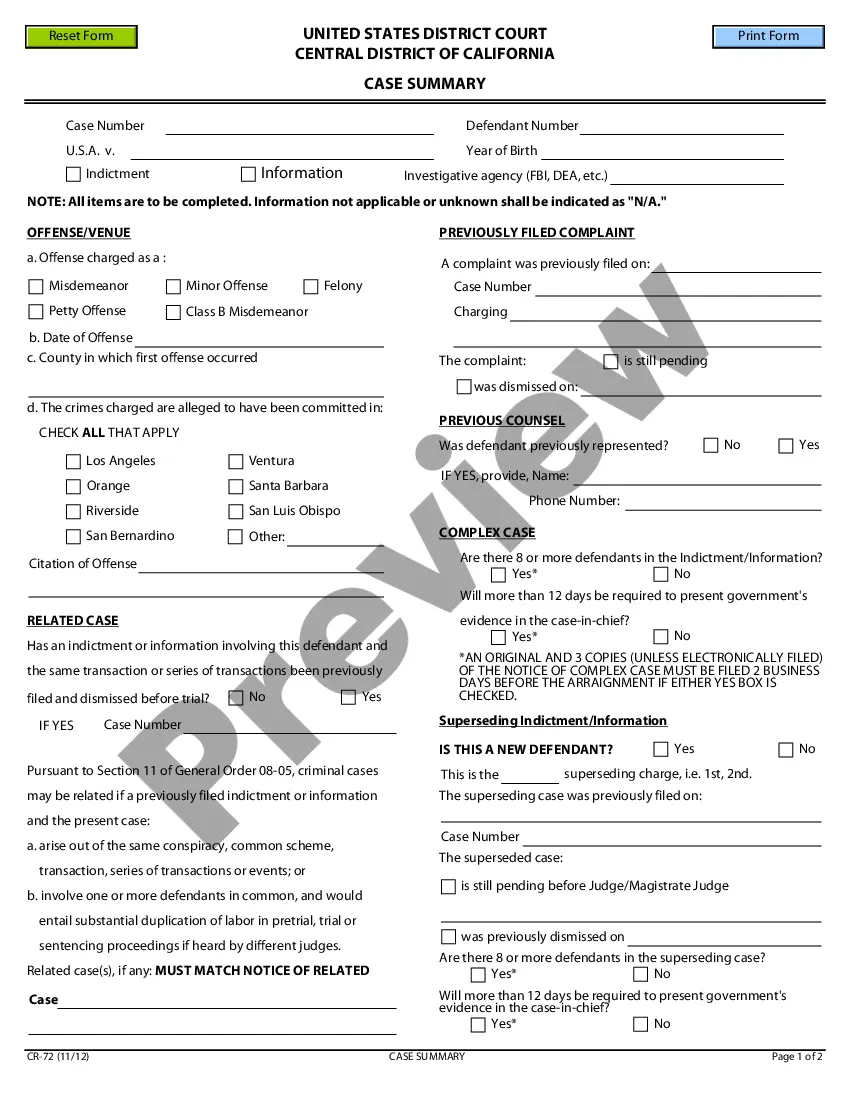

How to fill out Agreement For Auditing Services Between Accounting Firm And Municipality?

If you wish to total, download, or produce legal papers layouts, use US Legal Forms, the biggest assortment of legal varieties, which can be found on-line. Use the site`s simple and handy lookup to find the paperwork you want. Numerous layouts for company and individual functions are sorted by types and suggests, or search phrases. Use US Legal Forms to find the South Dakota Agreement for Auditing Services between Accounting Firm and Municipality in a couple of click throughs.

Should you be already a US Legal Forms buyer, log in to the account and click on the Acquire button to get the South Dakota Agreement for Auditing Services between Accounting Firm and Municipality. You can even entry varieties you formerly saved within the My Forms tab of your own account.

If you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the shape for your correct metropolis/country.

- Step 2. Make use of the Review option to check out the form`s information. Don`t forget about to learn the description.

- Step 3. Should you be unsatisfied with all the kind, use the Search discipline at the top of the screen to get other versions in the legal kind web template.

- Step 4. Once you have located the shape you want, click on the Acquire now button. Pick the pricing program you favor and put your references to sign up for an account.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal account to finish the purchase.

- Step 6. Find the structure in the legal kind and download it on your system.

- Step 7. Full, modify and produce or sign the South Dakota Agreement for Auditing Services between Accounting Firm and Municipality.

Every legal papers web template you purchase is the one you have eternally. You might have acces to every single kind you saved inside your acccount. Click on the My Forms segment and select a kind to produce or download once again.

Compete and download, and produce the South Dakota Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms. There are many professional and express-specific varieties you may use for your company or individual requires.

Form popularity

FAQ

Any person who, with intent to defraud, falsely makes, completes, or alters a written instrument of any kind, or passes any forged instrument of any kind is guilty of forgery.

South Dakota State law requires players to be at least 18 years old for online or scratch ticket purchases. You must be 21 years old to play video lottery.

Accounting services are subject to state sales tax, plus applicable municipal sales tax. The following sourcing rules determine where sales tax applies to accounting services (ARSD :): If the client receives the service at the accountant?s office, charge the sales tax rate at the accountant?s office location.

42-7A-26. Appointment of assistant attorney general to assist in enforcement. The attorney general shall appoint an assistant attorney general to assist the South Dakota Lottery in the enforcement of the criminal and civil provisions of this chapter. Source: SL 1987, ch 313, § 30.