South Dakota Agreement between Co-lessees as to Payment of Rent and Taxes

Description

How to fill out Agreement Between Co-lessees As To Payment Of Rent And Taxes?

Are you presently in a situation where you require paperwork for possibly organization or individual uses virtually every day time? There are a lot of lawful papers web templates available on the Internet, but getting types you can trust isn`t effortless. US Legal Forms provides a huge number of develop web templates, like the South Dakota Agreement between Co-lessees as to Payment of Rent and Taxes, that are published to satisfy state and federal requirements.

When you are previously acquainted with US Legal Forms internet site and have your account, simply log in. Following that, it is possible to obtain the South Dakota Agreement between Co-lessees as to Payment of Rent and Taxes format.

Should you not provide an bank account and need to start using US Legal Forms, follow these steps:

- Get the develop you need and ensure it is for that right metropolis/state.

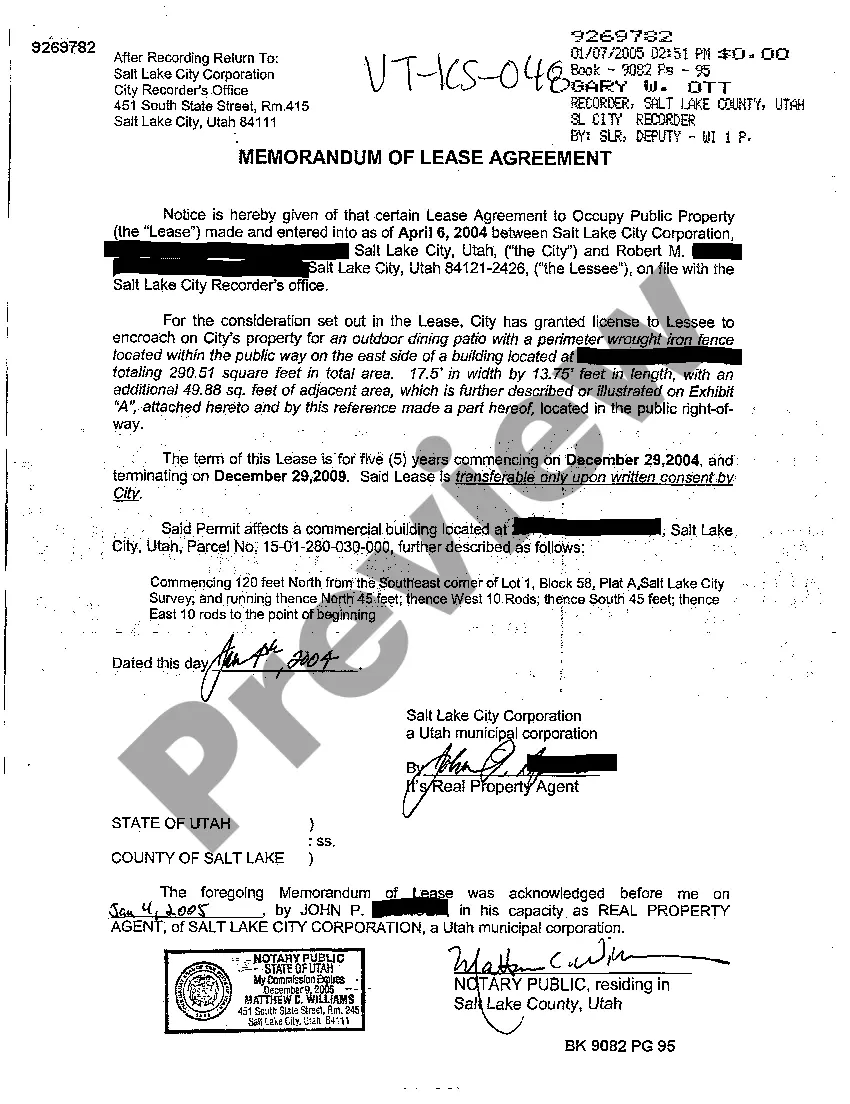

- Make use of the Review switch to examine the shape.

- Browse the outline to ensure that you have chosen the right develop.

- When the develop isn`t what you`re looking for, utilize the Look for area to discover the develop that meets your requirements and requirements.

- Once you obtain the right develop, click on Purchase now.

- Select the pricing prepare you would like, complete the specified details to generate your account, and buy an order utilizing your PayPal or bank card.

- Pick a convenient file format and obtain your copy.

Get each of the papers web templates you may have purchased in the My Forms food selection. You may get a further copy of South Dakota Agreement between Co-lessees as to Payment of Rent and Taxes whenever, if required. Just click on the required develop to obtain or produce the papers format.

Use US Legal Forms, probably the most comprehensive assortment of lawful forms, to save lots of some time and avoid blunders. The support provides skillfully created lawful papers web templates that can be used for a selection of uses. Make your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

South Dakota does not have a gift tax exemption limit since there's no estate tax for this state. To clarify this, estate and gift taxes are usually viewed identically because they are subject to the same rate and share the lifetime exemption amount.

Washington, Hawaii, Vermont, and Minnesota also have high tax rates for death taxes. Just as with the federal estate tax exemption, states also have thresholds, and if your estate is less than the amount, you may not have to pay estate taxes. New Jersey and Kentucky have the highest inheritance tax rates in the U.S.

Unlike federal capital gains taxes, there is no capital gains tax in South Dakota. In other words, there is not a state-level tax imposed on capital gains earned by individuals, businesses, or other legal entities.

Lease and Rental Services Gross receipts from the lease or rental of tangible personal property are subject to the state sales tax, plus applicable municipal sales tax. Sales tax also applies to any buy-out payments at the end of a lease.

Intestate Succession: Extended Family Inheritance SituationWho Inherits Your PropertyChildren, but unmarriedEntire estate to childrenParents, but no spouse, children, or siblingsEntire estate to parentsParents are deceased, and no spouse or childrenEntire estate goes to siblings.

There are different kinds of lease arrangements. It makes sense to consider them all to see which is best suited to your business, your particular circumstances and the asset that you are acquiring. The three main types of leasing are finance leasing, operating leasing and contract hire.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

South Dakota does not have an inheritance tax. Another state's inheritance tax may apply, however, if you receive an inheritance from someone residing in a state that does have an inheritance tax.