South Dakota Acceptance of Election in a Limited Liability Company (LLC) is a crucial legal process that allows an LLC to establish its existence and secure its status as a recognized entity within the state. By submitting an acceptance of election, an LLC acknowledges the responsibilities, liabilities, and benefits associated with operating within South Dakota. Keywords: South Dakota, acceptance of election, limited liability company, LLC, legal process, entity, responsibilities, liabilities, benefits. There are several types of South Dakota Acceptance of Election in a Limited Liability Company (LLC). Let's explore the different categories: 1. Articles of Organization: This is the primary document required to form an LLC in South Dakota. It includes important information such as the LLC's name, registered agent, registered office address, business purpose, and duration of the LLC. 2. Operating Agreement: Although not required by law, an LLC can create an operating agreement to define the internal operations, management structure, decision-making processes, profit distribution, and membership rights and responsibilities. This agreement further solidifies the acceptance of election and outlines the procedures guiding the company's operations. 3. Certificate of Conversion: If an existing business entity, such as a corporation or partnership, wants to convert to an LLC, a Certificate of Conversion is filed. This document formalizes the acceptance of election and verifies the successful transition from the previous entity to an LLC. 4. Annual Report: South Dakota LCS must file an annual report with the Secretary of State's office to maintain their good standing status. This report provides an update on the company's vital information, including changes in membership, registered agent, and financial particulars. 5. Statement of Change: If any alterations occur within the LLC, such as changes to the registered agent, registered office address, or members, a Statement of Change is filed to notify the state authorities. This document ensures that accurate and up-to-date information is reflected in the public records. 6. Articles of Dissolution: When an LLC decides to terminate its operations in South Dakota, it must file Articles of Dissolution to formally dissolve the company. This document serves as official acceptance of the LLC's election to cease its activities and helps clarify any lingering legal responsibilities. In conclusion, South Dakota Acceptance of Election in a Limited Liability Company (LLC) encompasses a variety of documents and filings that establish and maintain the legal standing of an LLC within the state. By adhering to the regulatory requirements and submitting the necessary paperwork, an LLC can operate with clarity, transparency, and legal recognition in South Dakota.

South Dakota Acceptance of Election in a Limited Liability Company LLC

Description

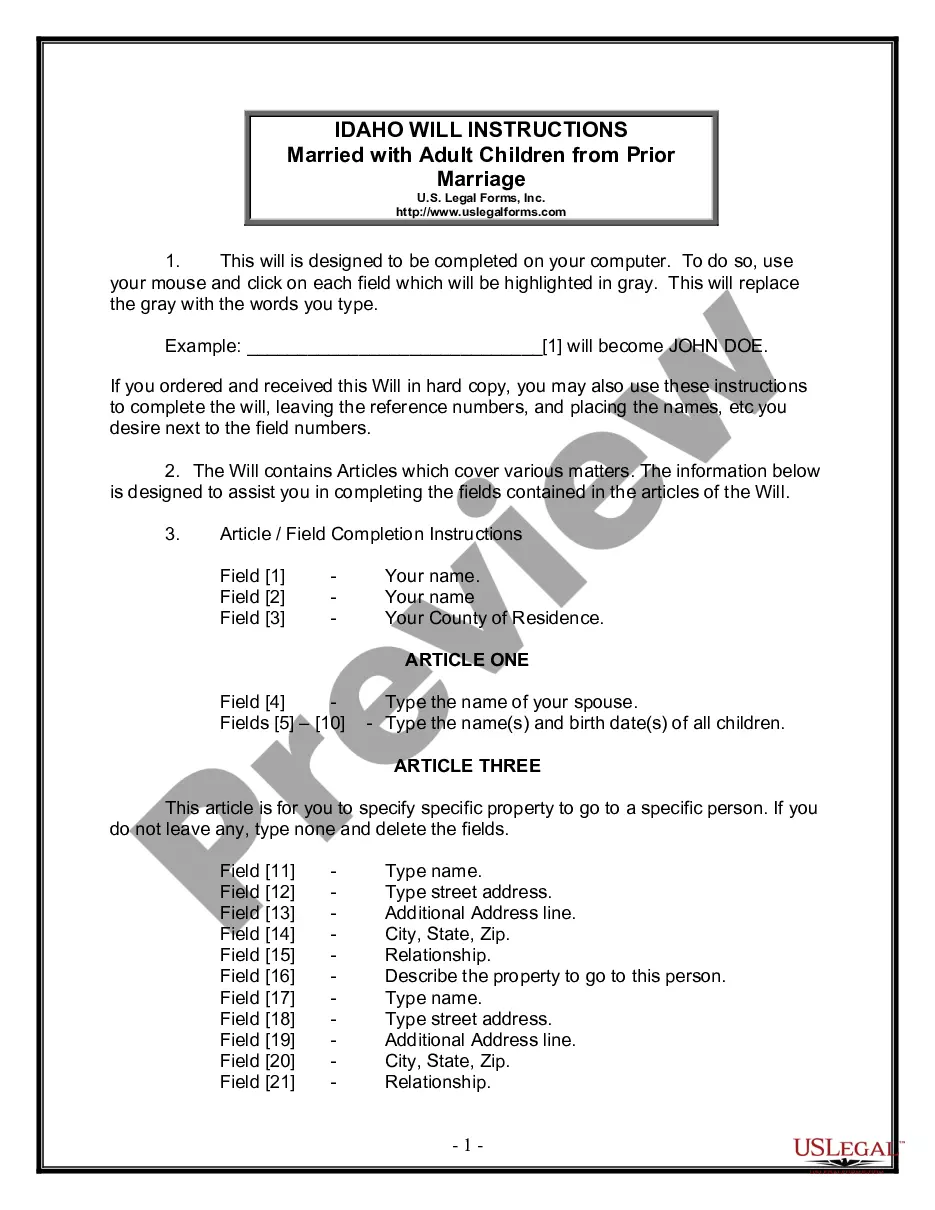

How to fill out South Dakota Acceptance Of Election In A Limited Liability Company LLC?

You are able to commit time on-line looking for the legitimate document web template which fits the state and federal needs you will need. US Legal Forms provides a large number of legitimate varieties that are reviewed by pros. You can actually download or print the South Dakota Acceptance of Election in a Limited Liability Company LLC from the assistance.

If you already possess a US Legal Forms profile, you are able to log in and click the Acquire button. Following that, you are able to complete, change, print, or sign the South Dakota Acceptance of Election in a Limited Liability Company LLC. Every legitimate document web template you get is your own property forever. To acquire an additional backup for any obtained type, go to the My Forms tab and click the related button.

If you use the US Legal Forms internet site initially, keep to the easy directions under:

- Very first, make certain you have selected the best document web template to the state/area of your choice. Browse the type description to ensure you have picked the correct type. If offered, take advantage of the Preview button to search from the document web template also.

- If you would like discover an additional edition in the type, take advantage of the Lookup field to discover the web template that fits your needs and needs.

- When you have found the web template you need, click on Get now to move forward.

- Choose the pricing prepare you need, enter your references, and register for a merchant account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal profile to fund the legitimate type.

- Choose the structure in the document and download it to your gadget.

- Make alterations to your document if necessary. You are able to complete, change and sign and print South Dakota Acceptance of Election in a Limited Liability Company LLC.

Acquire and print a large number of document templates using the US Legal Forms Internet site, which provides the most important variety of legitimate varieties. Use expert and condition-specific templates to tackle your small business or personal needs.

Form popularity

FAQ

Although most states do not require the creation of an operating agreement, it is nonetheless regarded as a critical document that should be included when forming a limited liability company. Once each member (owner) signs the document, it becomes a legally binding set of regulations that must be followed.

The first step is to file a form called the Amended Articles of Organization with the Secretary of State and wait for it to be approved. This is how you officially change your LLC name in South Dakota. The filing fee for the Amended Articles of Organization in South Dakota is $60.

Is an operating agreement required in South Carolina? South Carolina state law doesn't require LLCs to adopt an operating agreement. SC Code § 33-44-112 (2019) states that LLCs may adopt an operating agreement, not that they must.

Use the online portal to register your business with the South Dakota Secretary of State. Alternatively, you can mail the forms or fill them out in person. Review your local city or county website for more information about location or industry-specific requirements.

Dakota's LLCs will protect your personal assets from the creditors of your business. These creditors could be employees, individuals the business has contracted with, or individuals bringing personal liability claims against the business.

Yes, Delaware's LLC law requires all Delaware LLCs to have an Operating Agreement in some form. The law states that an LLC Operating Agreement can be ?written, oral, or implied? between the members. However, having a written LLC Operating Agreement is the only way to make the agreement enforceable.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Your operating agreement should be kept on file at your business location. An operating agreement is not required in South Dakota state but can still be important when starting an LLC. An operating agreement can include provisions on: Rights and responsibilities of members.