Title: South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts: A Comprehensive Guide Introduction: Opening a bank account for your South Dakota Limited Liability Company (LLC) is an essential step in managing your business finances. To ensure proper documentation and decision-making, a formal resolution of meeting of LLC members is required. This article aims to provide a detailed description of what the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts entails, outlining its importance and highlighting various types of resolutions that can be adopted. 1. Understanding the South Dakota Resolution of Meeting of LLC Members: The South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts acts as an official document that authorizes designated LLC members to initiate and maintain business bank accounts. This resolution clearly outlines the authorized members who possess the authority to handle the company's finances and make financial decisions on behalf of the LLC. 2. Importance of the Resolution: By adopting the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts, your LLC benefits in several ways. It provides legal protection, clarifies roles and responsibilities, strengthens financial accountability, and ensures compliance with state regulations. It also promotes transparency within the LLC and streamlines banking processes. 3. Types of South Dakota Resolution of Meeting of LLC Members: a) Standard Resolution: The standard resolution is the most common type of resolution used in South Dakota LCS. It authorizes specific members to open a bank account in the name of the LLC, defines their roles, responsibilities, and authority in managing the account, and establishes the signing requirements for financial transactions. b) Multiple Signatory Resolution: In some cases, an LLC may require multiple members to sign off on financial transactions. The multiple signatory resolution specifies that more than one designated member must approve transactions and withdrawals from the LLC's bank account. This type of resolution ensures a higher level of financial oversight and reduces the risk of unauthorized transactions. c) Restricted Resolution: A restricted resolution sets limitations on the designated members' financial authority in managing the LLC's bank account. This type of resolution may restrict the maximum transaction amount, specify the purposes for which funds may be allocated, or impose limits on specific types of transactions. It is generally used when members want to ensure tighter control over financial decisions. d) Amending Resolution: An amending resolution is used when there is a need to modify an existing resolution related to the opening of bank accounts. It may be necessary to update authorized signatories, revise the account signing requirements, or alter any other aspect of the resolution. This type of resolution ensures that changes to the bank account management are properly documented and authorized. Conclusion: The South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts is a crucial document that identifies authorized members responsible for managing the LLC's finances, clarifies their roles, and ensures compliance with legal requirements. Understanding the different types of resolutions available allows LLC members to tailor the document to their specific needs and preferences. It is advised to consult with legal professionals or experienced advisors while drafting and adopting the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts.

South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts

Description

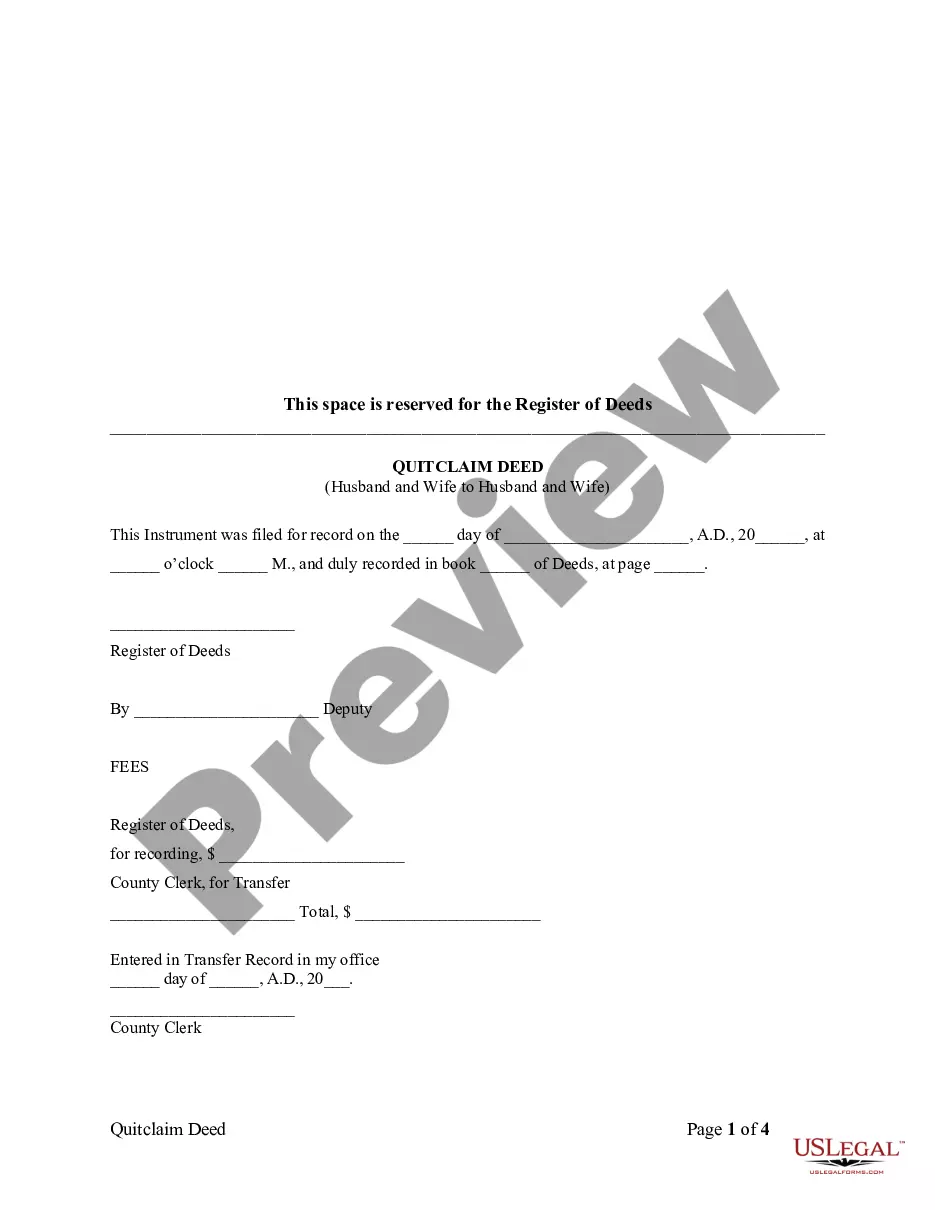

How to fill out South Dakota Resolution Of Meeting Of LLC Members To Open Bank Accounts?

If you wish to complete, down load, or printing lawful record web templates, use US Legal Forms, the most important assortment of lawful forms, which can be found online. Take advantage of the site`s easy and handy lookup to obtain the paperwork you require. A variety of web templates for organization and individual reasons are sorted by types and claims, or key phrases. Use US Legal Forms to obtain the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts with a couple of mouse clicks.

When you are presently a US Legal Forms client, log in to your accounts and click the Acquire switch to find the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts. Also you can entry forms you in the past downloaded inside the My Forms tab of your respective accounts.

If you are using US Legal Forms the first time, follow the instructions under:

- Step 1. Make sure you have selected the form for that right area/country.

- Step 2. Make use of the Preview method to look over the form`s articles. Do not neglect to read the outline.

- Step 3. When you are unhappy using the develop, make use of the Lookup area towards the top of the screen to get other versions from the lawful develop design.

- Step 4. Once you have identified the form you require, click on the Get now switch. Select the rates plan you like and include your references to sign up for an accounts.

- Step 5. Procedure the deal. You should use your credit card or PayPal accounts to complete the deal.

- Step 6. Find the formatting from the lawful develop and down load it on your gadget.

- Step 7. Full, modify and printing or indication the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts.

Each and every lawful record design you buy is your own for a long time. You possess acces to every single develop you downloaded inside your acccount. Click on the My Forms area and pick a develop to printing or down load again.

Compete and down load, and printing the South Dakota Resolution of Meeting of LLC Members to Open Bank Accounts with US Legal Forms. There are thousands of skilled and condition-particular forms you can utilize for the organization or individual needs.