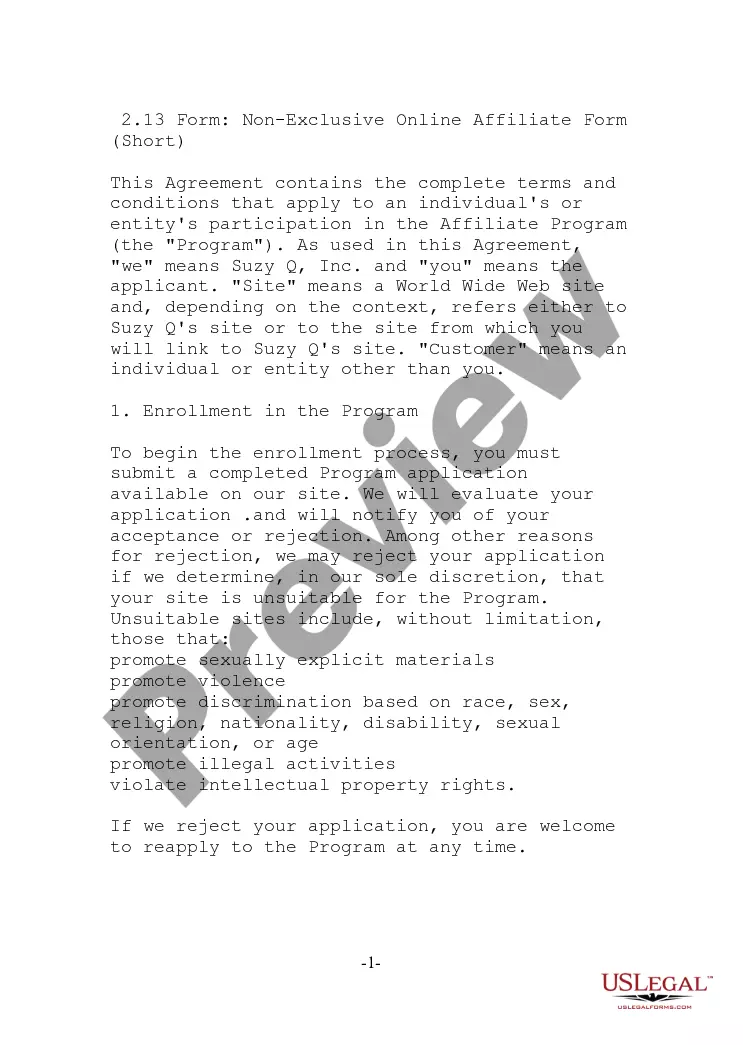

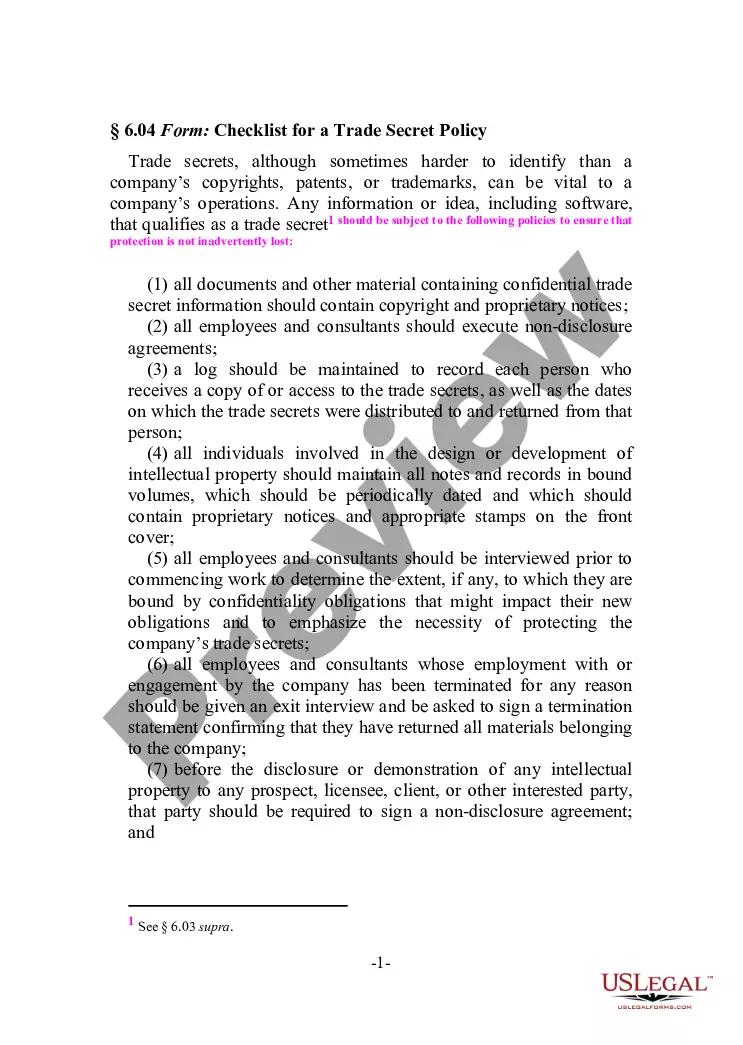

A South Dakota Separation Notice for 1099 Employees is an important document that outlines the formal termination of the employment relationship between an employer and independent contractor in the state of South Dakota. This legal notice serves as an official record of the separation and ensures compliance with state labor laws. The South Dakota Separation Notice for 1099 Employees typically includes the following information: 1. Employer Information: The notice begins by stating the name, address, and contact details of the employer or the company terminating the contract with the independent contractor. 2. Employee Information: The notice includes the name, address, and contact details of the independent contractor (referred to as the employee for documentation purposes). 3. Separation Details: This section provides the date on which the employment relationship is terminated, highlighting that the independent contractor is no longer affiliated with the employer. It may specify whether the separation is voluntary or involuntary, depending on the circumstances. 4. Compensation and Benefits: The notice outlines any outstanding payments, including wages, bonuses, or commissions, that the employer owes the independent contractor. It might also address the continuation or termination of benefits like health insurance or retirement plans, if applicable. 5. Non-Disclosure Agreement: In some cases, the separation notice may remind the parties of any non-disclosure or confidentiality agreements that should remain in effect even after the termination of the employment relationship. 6. Unemployment Benefits: If the independent contractor is eligible for unemployment benefits, the notice might provide information on how to apply for those benefits and any specific requirements or deadlines to be met. It's worth noting that there may not be different types of South Dakota Separation Notices for 1099 Employees specifically, as this notice mainly serves to document the separation and the associated details. However, variations may arise depending on the specific terms and conditions mentioned in the independent contractor's agreement or state regulations. Keywords: South Dakota, Separation Notice, 1099 Employees, termination, employment relationship, independent contractor, compliance, state labor laws, employer, employee, separation details, compensation, benefits, non-disclosure agreement, unemployment benefits.

South Dakota Separation Notice for 1099 Employee

Description

How to fill out South Dakota Separation Notice For 1099 Employee?

US Legal Forms - one of the greatest libraries of authorized kinds in the States - offers a variety of authorized papers web templates you may obtain or printing. While using internet site, you can get 1000s of kinds for organization and specific uses, categorized by types, suggests, or keywords and phrases.You can find the newest versions of kinds such as the South Dakota Separation Notice for 1099 Employee within minutes.

If you already possess a monthly subscription, log in and obtain South Dakota Separation Notice for 1099 Employee through the US Legal Forms library. The Acquire button will appear on every single develop you see. You gain access to all formerly downloaded kinds inside the My Forms tab of your own accounts.

In order to use US Legal Forms for the first time, allow me to share simple instructions to help you started out:

- Be sure to have picked the right develop for your town/county. Click on the Preview button to check the form`s content. Read the develop explanation to actually have chosen the right develop.

- In the event the develop does not match your demands, take advantage of the Research discipline at the top of the display screen to get the one who does.

- When you are happy with the shape, validate your option by clicking on the Buy now button. Then, pick the costs prepare you favor and provide your references to register for an accounts.

- Approach the deal. Use your credit card or PayPal accounts to finish the deal.

- Pick the structure and obtain the shape on the product.

- Make changes. Fill out, edit and printing and signal the downloaded South Dakota Separation Notice for 1099 Employee.

Every single template you included in your money lacks an expiration time and is your own eternally. So, if you wish to obtain or printing yet another backup, just visit the My Forms segment and click on the develop you want.

Gain access to the South Dakota Separation Notice for 1099 Employee with US Legal Forms, the most substantial library of authorized papers web templates. Use 1000s of expert and express-specific web templates that meet up with your business or specific needs and demands.

Form popularity

FAQ

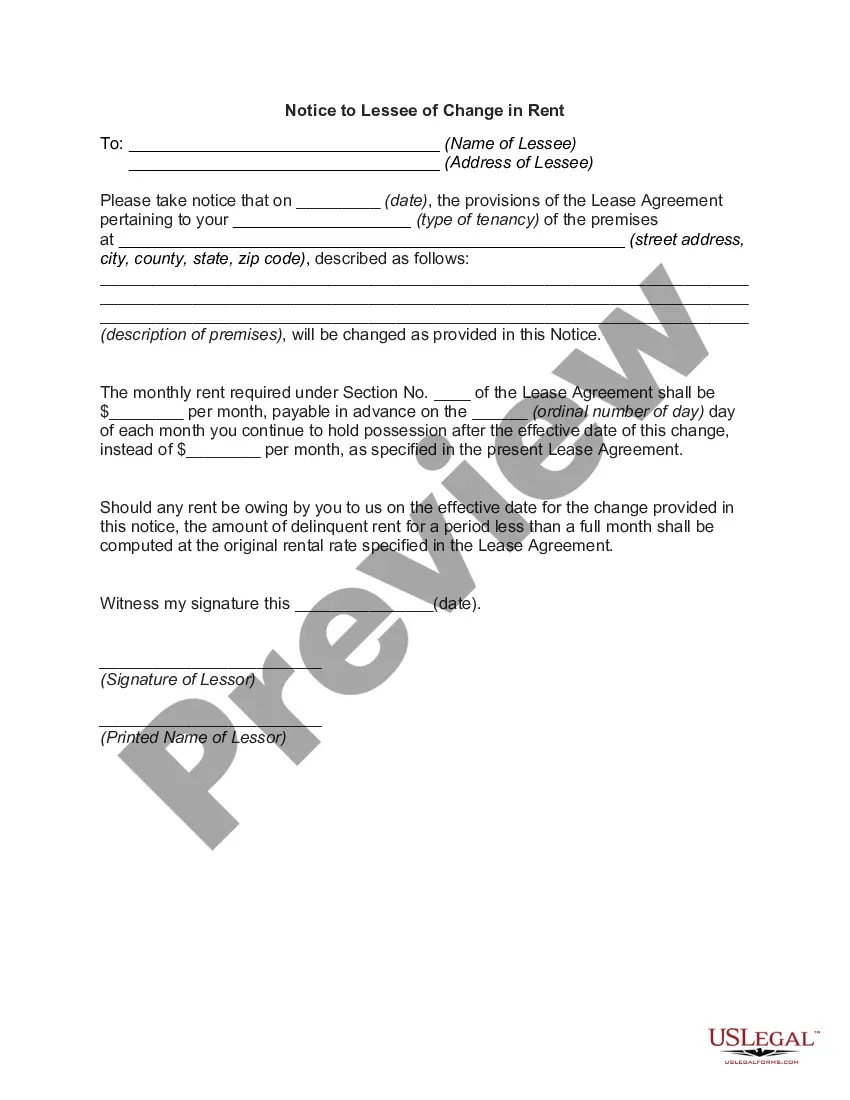

The following states require that employers provide written notice of separation (discharge, layoff, voluntary resignation) to a departing employee: Arizona, California, Connecticut, Georgia, Illinois, Louisiana, Massachusetts, Michigan, New Jersey, New York, and Tennessee.

South Carolina's Department of Employment and Workforce (DEW) issued a notice effective April 16, 2020, requiring all employers to provide employees with a Notification of the Availability of Unemployment Insurance Benefits upon separation of employment.

When a company ends an employee's job, they typically provide a termination letter, also called a letter of separation, stating the reason for termination and next steps. A termination letter is an official and professional way to document and describe the separation between the employee and employer.

Notice of Separation means the completion of a written election by an Eligible Team Member, on a form that has been approved by the Plan Administrator, that he or she wishes to terminate his or her employment in accordance with the Officer Separation Program, as described in Article III of this document.

A general separation notice is a written communication from an employer or an employee saying that the employment relationship is ending.

Excessive EarningsYou reported earnings that were more than your weekly benefit amount and will not receive a payment.

Under South Dakota law, employment is considered at-will, meaning that employment may be terminated at the will of either party. Consequently, an employee may quit and an employer may terminate a worker for any reason or for no reason at all.

Normally, except in the event of a mass layoff, no notice to the state of Texas is required for any kind of work separation, but if the employee was subject to a wage garnishment order for child support or alimony, the employer must notify the New Hire division of the Attorney General's office within seven days of the

NOTICE TO EMPLOYEE OCGA SECTION 34-8-190(c) OF THE EMPLOYMENT SECURITY LAW REQUIRES THAT YOU TAKE THIS NOTICE TO THE GEORGIA DEPARTMENT OF LABOR FIELD SERVICE OFFICE IF YOU FILE A CLAIM FOR UNEMPLOYMENT INSURANCE BENEFITS.