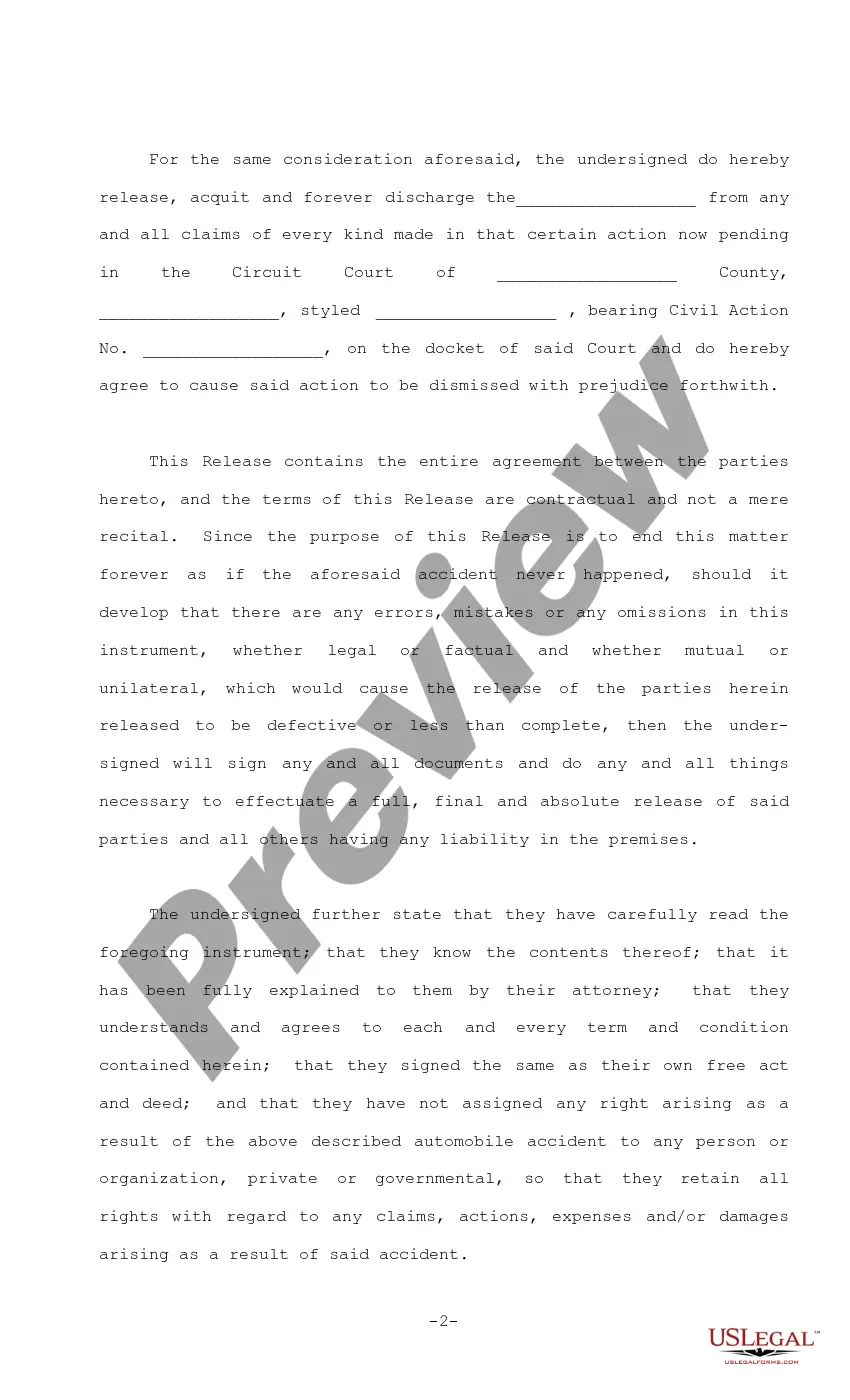

South Dakota Full, Final and Absolute Release

Description

How to fill out Full, Final And Absolute Release?

You can devote several hours online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms provides a vast array of valid forms that are reviewed by experts.

You can easily download or print the South Dakota Full, Final and Absolute Release from their services.

If available, use the Review button to browse through the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the South Dakota Full, Final and Absolute Release.

- Each valid document template you obtain is yours for years.

- To get another copy of any purchased form, go to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Check the form description to confirm you have chosen the right form.

Form popularity

FAQ

A release must typically include the names of the parties involved, a clear description of the claims being released, and the effective date. Furthermore, it should contain explicit language that states the release is full, final, and absolute in nature. By using a well-structured South Dakota Full, Final and Absolute Release, you can enhance clarity and prevent disputes.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

To write a South Dakota quit claim deed form, you will need to provide the following information:Preparer's name and address.Full name and mailing address of the person to whom the recorded deed should be sent.County where the real property is located.The consideration paid for the property.More items...

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

On July 1, 2014, South Dakota enacted the Real Property Transfer on Death Act, which provides for the transfer of real property in the event of death. TOD (transfer on death) and POD (pay on death) account designations have been offered by banks and investment firms for decades.

In South Dakota, the statute of limitations is six years. If a debt collector attempts to collect a debt that is older than what is permitted under state law, you may be able to sue them.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

How long does a judgment lien last in South Dakota? A judgment lien in South Dakota will remain attached to the debtor's property (even if the property changes hands) for ten years.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score.

South Dakota judgments are also easily transcribed to additional counties where the judgment debtor may own real or personal property. A judgment is enforceable for a period of ten (10) years and may be renewed for an addition period of ten Page 2 2 (10) years.