Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

South Dakota Insurers Rehabilitation and Liquidation Model Act

Description

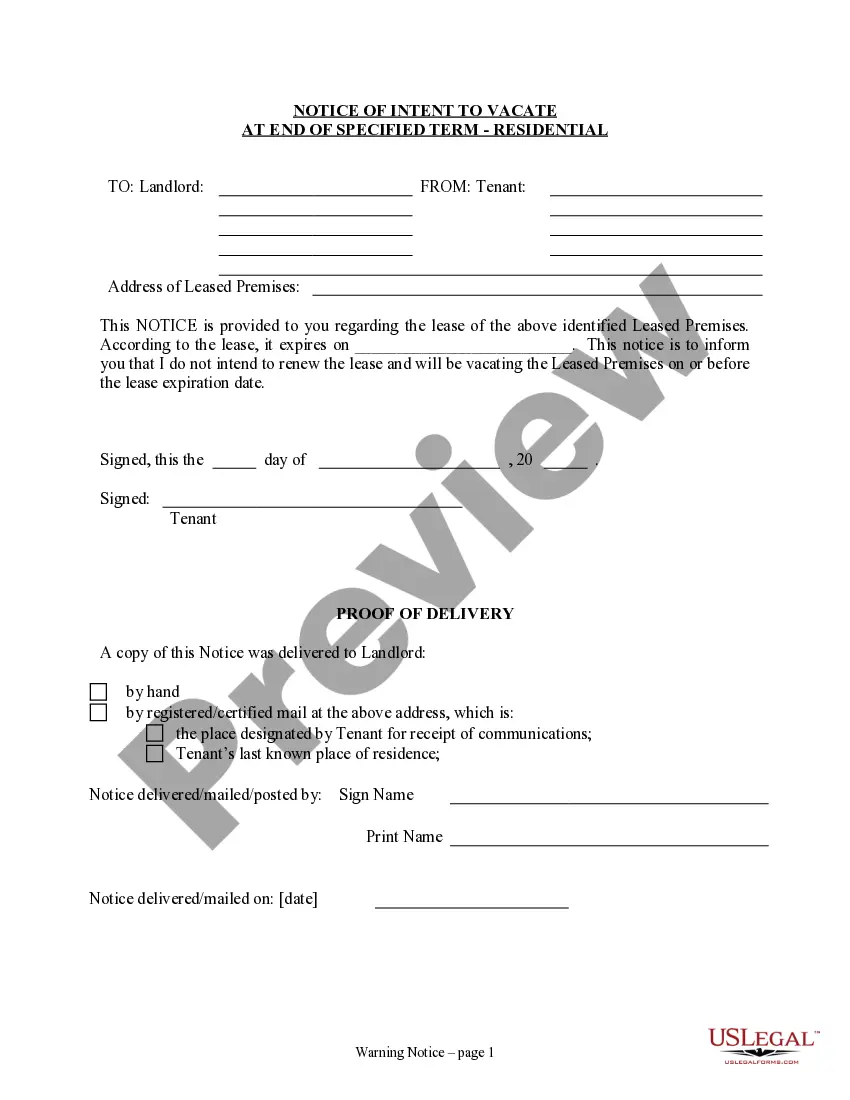

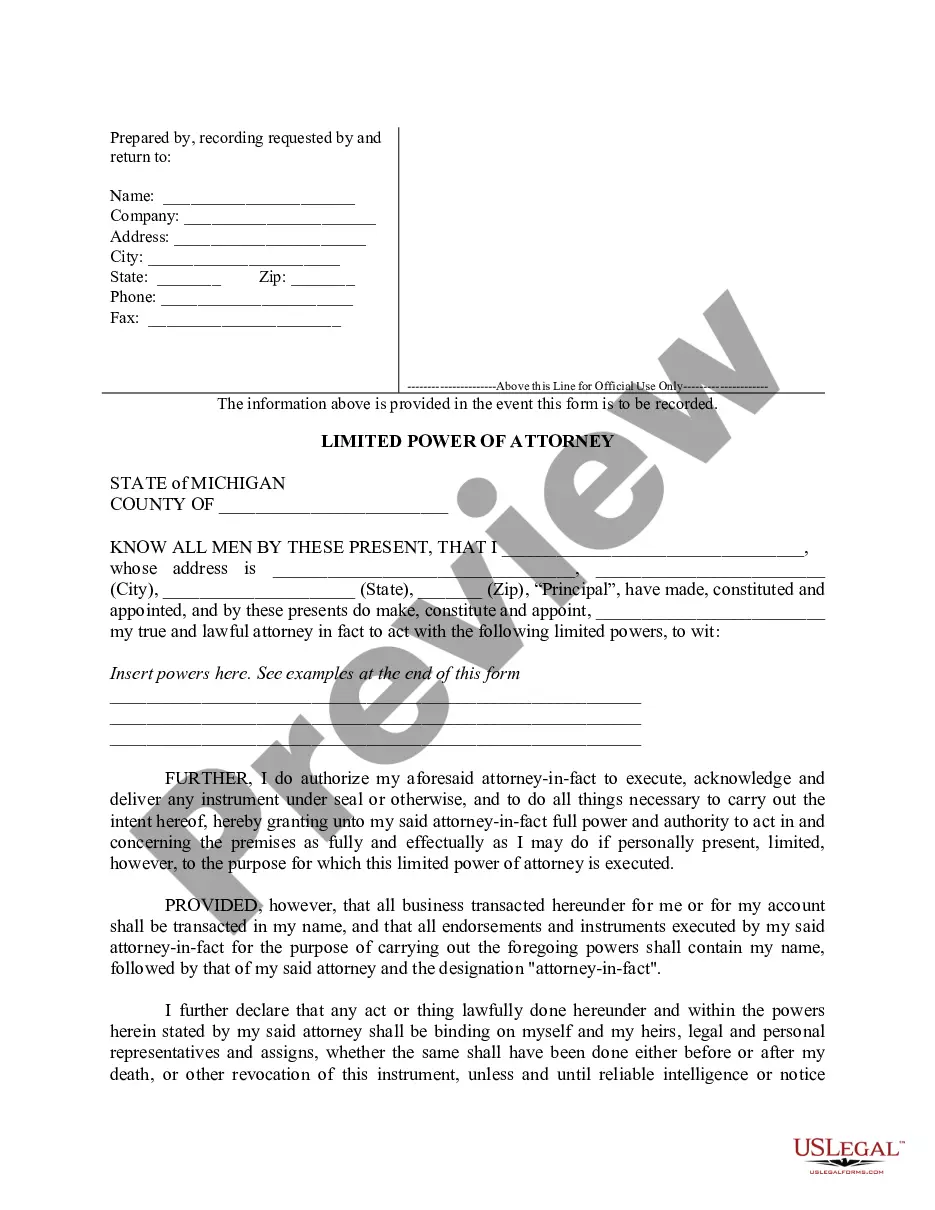

How to fill out Insurers Rehabilitation And Liquidation Model Act?

Finding the right legitimate papers format could be a struggle. Obviously, there are a lot of themes accessible on the Internet, but how can you find the legitimate type you want? Utilize the US Legal Forms website. The assistance delivers a large number of themes, like the South Dakota Insurers Rehabilitation and Liquidation Model Act, that you can use for company and personal needs. Each of the varieties are examined by specialists and meet up with federal and state demands.

Should you be currently authorized, log in to your accounts and click the Obtain key to get the South Dakota Insurers Rehabilitation and Liquidation Model Act. Utilize your accounts to appear with the legitimate varieties you have purchased in the past. Go to the My Forms tab of the accounts and obtain another copy of the papers you want.

Should you be a fresh customer of US Legal Forms, here are basic instructions that you should adhere to:

- Initially, make sure you have chosen the right type for the town/county. You are able to examine the shape making use of the Preview key and study the shape explanation to ensure it is the best for you.

- In the event the type is not going to meet up with your expectations, use the Seach area to obtain the correct type.

- Once you are sure that the shape is suitable, click the Purchase now key to get the type.

- Opt for the costs strategy you want and enter the required information. Create your accounts and purchase an order using your PayPal accounts or bank card.

- Select the submit structure and down load the legitimate papers format to your product.

- Complete, change and print and indicator the obtained South Dakota Insurers Rehabilitation and Liquidation Model Act.

US Legal Forms will be the biggest catalogue of legitimate varieties where you can see numerous papers themes. Utilize the service to down load expertly-created documents that adhere to state demands.

Form popularity

FAQ

"Liquidation" is the process whereby the Commissioner, upon a Superior Court's order, terminates an insurance company's insurance business by canceling all insurance policies and by not issuing any new or renewal policies.

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).

When a company becomes insolvent, meaning that it can no longer meet its financial obligations, it undergoes liquidation. Liquidation is the process of closing a business and distributing its assets to claimants. The sale of assets is used to pay creditors and shareholders in the order of priority.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.