South Dakota Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

Are you presently in a situation where you find yourself needing files for both business and personal activities almost every day.

There are plenty of legitimate document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers a multitude of form templates, including the South Dakota Employee Payroll Records Checklist, designed to meet state and federal requirements.

Once you have the right form, click Get now.

Choose the pricing plan you want, fill in the necessary details to create your account, and pay for the order using PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Next, you can download the South Dakota Employee Payroll Records Checklist template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- 1. Search for the form you require and ensure it is for your specific city/region.

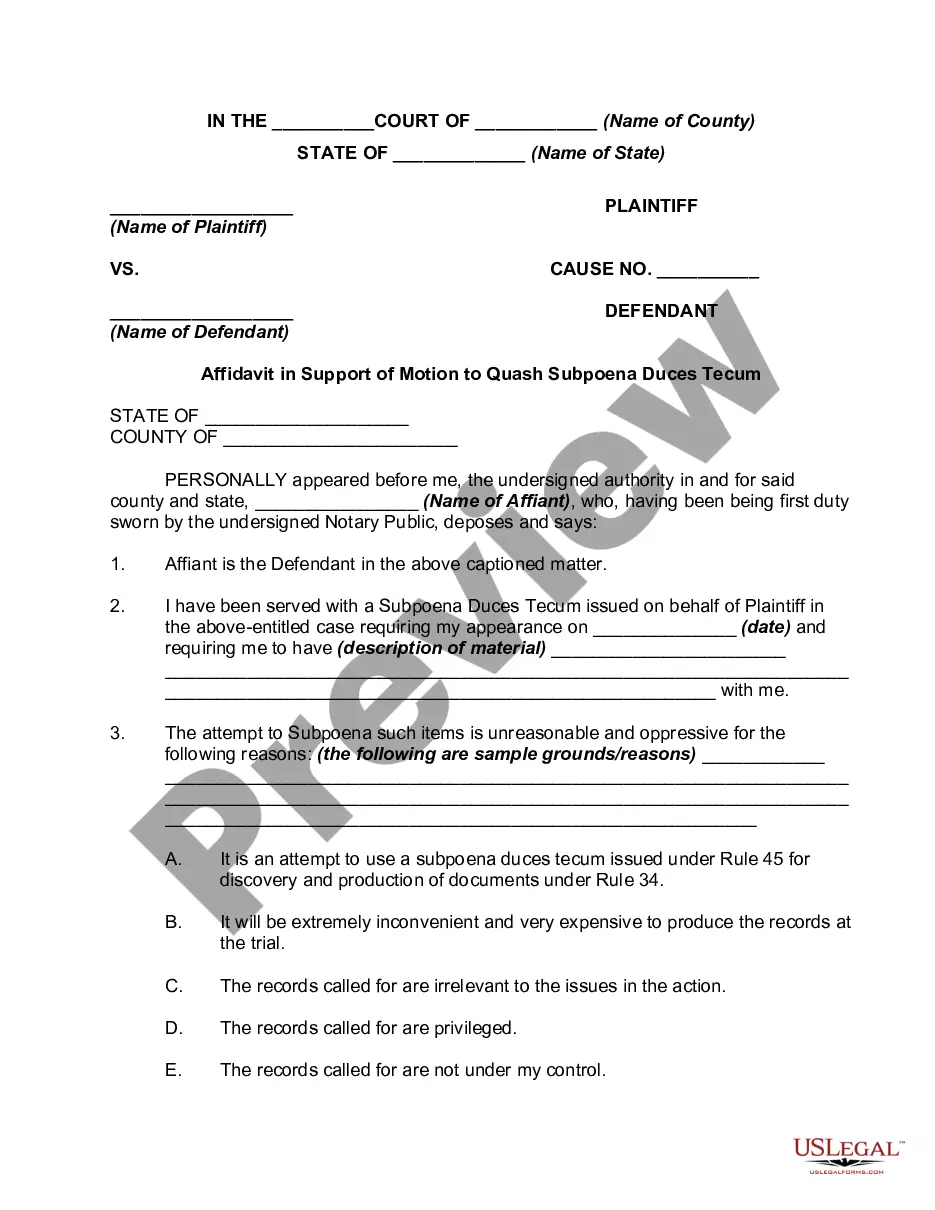

- 2. Utilize the Preview button to view the form.

- 3. Review the description to confirm you have selected the correct form.

- 4. If the form is not what you’re looking for, use the Lookup field to find the form that satisfies your needs.

Form popularity

FAQ

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

To get started:Step 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.

Form W-2, Wage and Tax Statements. Form W-4, Employee's Withholding Certificate. State and local jurisdiction tax withholding certificates. Payroll deductions.

How to manually calculate payroll for your small businessStep 1: Prepare your business to process payroll.Step 2: Calculate gross wages.Step 3: Subtract pre-tax deductions.Step 4: Calculate employee payroll taxes.Step 5: Subtract post-tax deductions and calculate net pay.Step 6: Calculate employer payroll taxes.More items...?

Salary information The number of hours paid at the normal rate. The amount of overtime paid. The amount of overtime replaced by time off with the applicable rate. The type and amount of any bonuses, allowance, benefits or commissions paid.

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

What payroll reports do employers need to file?Wages paid to employees.Federal income tax withheld from employee wages.Medicare and Social Security taxes deducted from employee wages.Employer contributions to Medicare and Social Security taxes.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

To complete your payroll setup checklist, you just need to enter these pieces of key info: Withholding account number. Unemployment Insurance Account Number (and rate) Worker's Compensation Insurance Account Number (and rate)

10 Steps to Setting Up a Payroll SystemObtain an Employer Identification Number (EIN)Check whether you need state/local IDs.Independent contractor or employee.Take care of employee paperwork.Decide on a pay period.Carefully document your employee compensation terms.Choosing a payroll system.Running payroll.More items...