South Dakota Sample Self-Employed Independent Contractor Contract - for specific job

Description

How to fill out Sample Self-Employed Independent Contractor Contract - For Specific Job?

Are you currently in the location where you frequently require documents for either business or personal reasons almost every day.

There is an array of legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of form templates, including the South Dakota Sample Self-Employed Independent Contractor Agreement - for specific work, which are designed to comply with federal and state requirements.

Once you find the right form, simply click Acquire now.

Select a convenient file format and download your copy. You can view all the document templates you have purchased in the My documents section. You may obtain an additional copy of the South Dakota Sample Self-Employed Independent Contractor Agreement - for specific work anytime, if desired. Click on the necessary form to download or print the document template. Utilize US Legal Forms, the most comprehensive selection of legal templates, to save time and prevent errors. This service provides expertly crafted legal document templates that you can employ for various purposes. Create an account on US Legal Forms and start making your life simpler.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the South Dakota Sample Self-Employed Independent Contractor Agreement - for specific work template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/area.

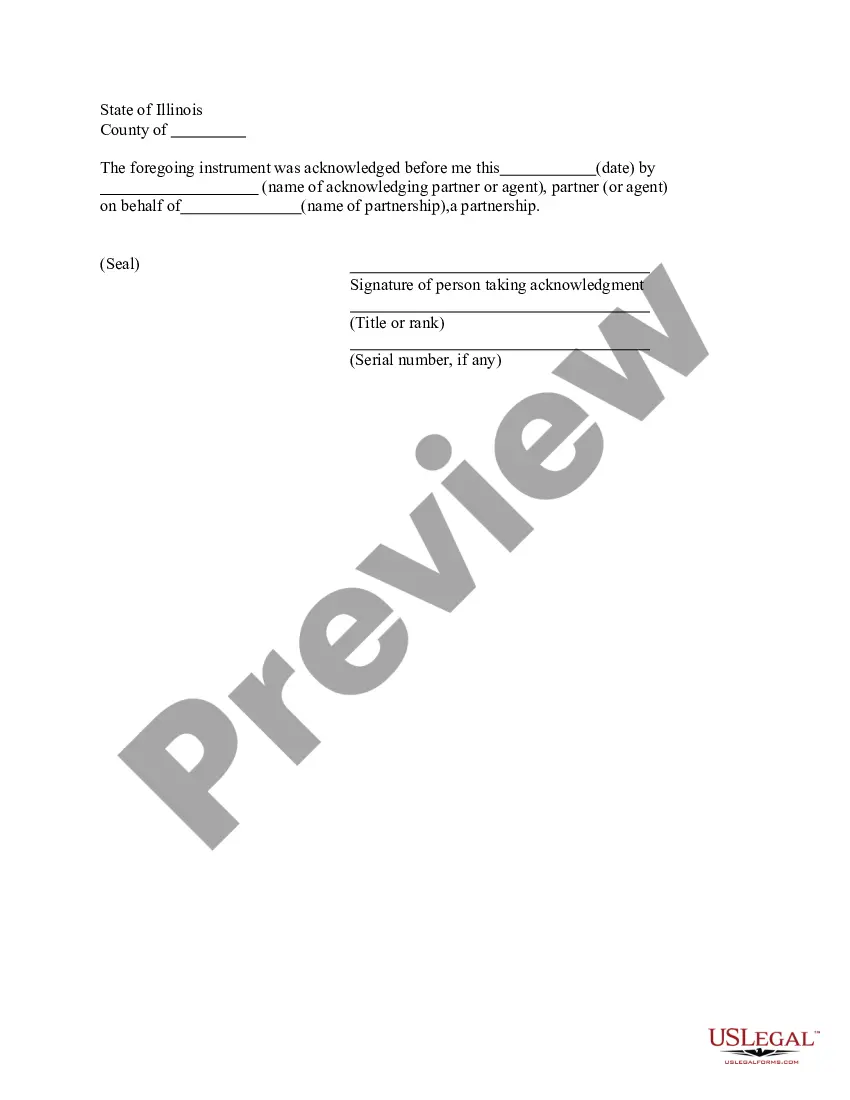

- Utilize the Review feature to examine the form.

- Read the description to confirm that you have selected the correct form.

- If the form does not match your needs, use the Lookup field to find the template that suits your requirements.

Form popularity

FAQ

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

Temporary employees A temporary employee refers to an employee who is appointed: for a period not exceeding three months; as a substitute for an employee who is temporarily absent; or. in a category of work or for a period that is determined as temporary in terms of any collective agreement or sectorial determination.

What Should an Independent Contractor Agreement Contain?Terms. This is the first section of any agreement or contract and states the names and locations of the parties involved.Responsibilities & Deliverables.Payment-Related Details.Confidentiality Clause.Contract Termination.Choice of Law.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...

A temporary contract should include parts, such as:Information About the Parties. In the first part of the document, the parties involved should designate their names and addresses.Subject.Salary.Compensation.Employment Time Period.Rights and Responsibilities of the Parties.Contact Information.Signatures.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

The definition of a temporary contract is an agreement to work for an employer for a specific time, such as over the summer or for another busy season.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.