South Dakota Employee Evaluation Form for Labourer

Description

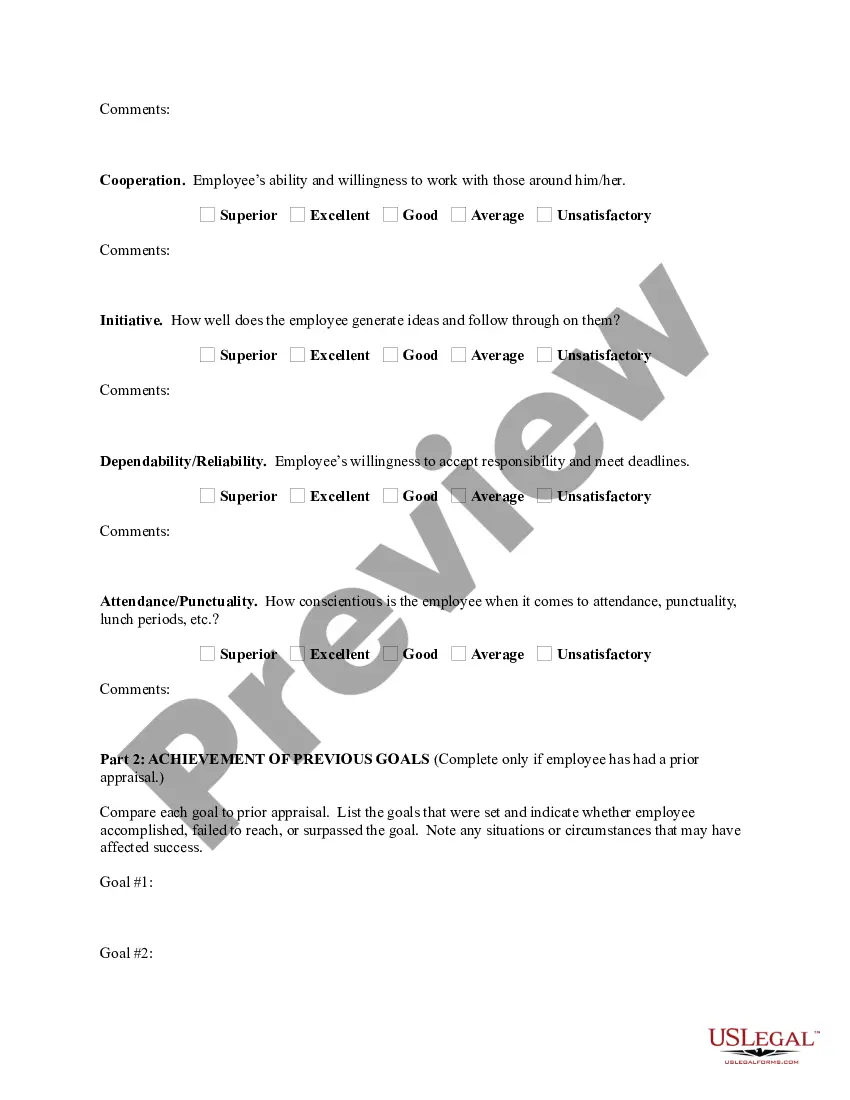

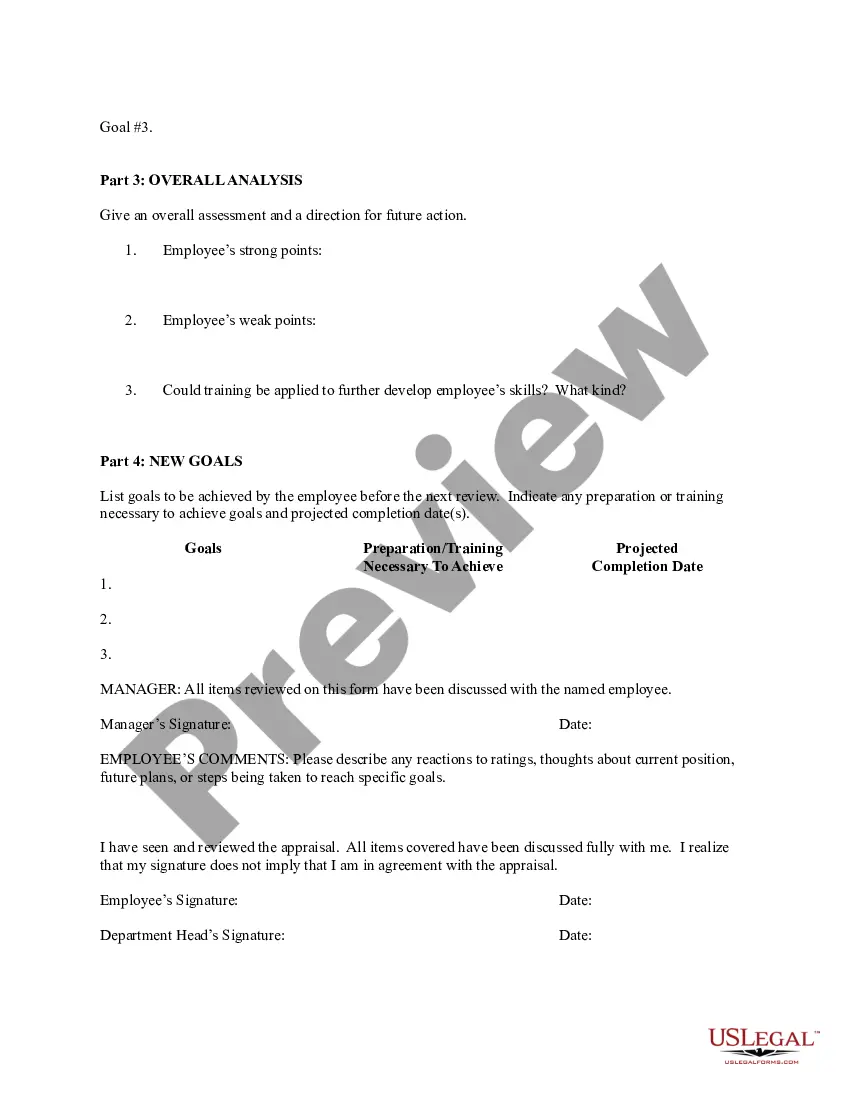

How to fill out South Dakota Employee Evaluation Form For Labourer?

If you need to full, download, or print out legal document layouts, use US Legal Forms, the biggest selection of legal kinds, that can be found on-line. Utilize the site`s simple and easy hassle-free lookup to discover the files you will need. Different layouts for organization and specific reasons are categorized by classes and states, or key phrases. Use US Legal Forms to discover the South Dakota Employee Evaluation Form for Labourer in a number of click throughs.

Should you be currently a US Legal Forms client, log in to the accounts and click the Down load switch to obtain the South Dakota Employee Evaluation Form for Labourer. You can even gain access to kinds you earlier delivered electronically within the My Forms tab of your accounts.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for that right city/land.

- Step 2. Make use of the Review method to look through the form`s content material. Never neglect to read the description.

- Step 3. Should you be unhappy with all the kind, make use of the Research area near the top of the monitor to find other variations from the legal kind design.

- Step 4. When you have discovered the shape you will need, click on the Acquire now switch. Opt for the rates prepare you choose and add your references to sign up for an accounts.

- Step 5. Approach the deal. You should use your charge card or PayPal accounts to finish the deal.

- Step 6. Choose the format from the legal kind and download it on your product.

- Step 7. Complete, change and print out or indicator the South Dakota Employee Evaluation Form for Labourer.

Every single legal document design you acquire is your own for a long time. You might have acces to every single kind you delivered electronically inside your acccount. Select the My Forms section and choose a kind to print out or download yet again.

Remain competitive and download, and print out the South Dakota Employee Evaluation Form for Labourer with US Legal Forms. There are millions of skilled and status-distinct kinds you can utilize for the organization or specific demands.

Form popularity

FAQ

North Dakota law requires businesses (with limited exceptions) to have workers' compensation insurance prior to hiring their first employee. Workers' compensation insurance is meant to protect both your company and your employees. To receive the latest employer newsletter, subscribe to our Employer InSite .

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Montana requires every employer to provide their employees with workers' compensation insurance. This policy covers the cost of an injured worker's medical treatment.

There is no law in South Dakota requiring any employer to carry workers' compensation insurance. However, it is highly recommended. An uninsured employer may be sued in civil court by an injured worker.

South Dakota does not have any required number of hours to be full-time. So, it is up to each company to set how many hours an employee must work to be part-time or full-time. Employees should contact their supervisor to find out if they are considered full-time or part-time at their job.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

An injured worker's wage paid is 66 2/3%. The weekly payment minimum is $299, 50% of the state average weekly wage or the injured workers average wage if it is less. The weekly maximum is $597, 100% of the South Dakota state average weekly wage. Maximum period of payments is the length of the disability.

Steps to Hiring your First Employee in South DakotaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Employers who opt for coverage in the South Dakota Workers' Compensation program gain legal protection against claims that their negligence caused an employee injury. The program covers the cost of medical expenses and partial lost wages for workplace injuries and occupational diseases.

5 Best Places To Find Employees OnlineZipRecruiter.Indeed.Monster.Glassdoor.CareerBuilder.SimplyHired.Ladders.Handshake.