South Dakota Employee Evaluation Form for Sole Trader

Description

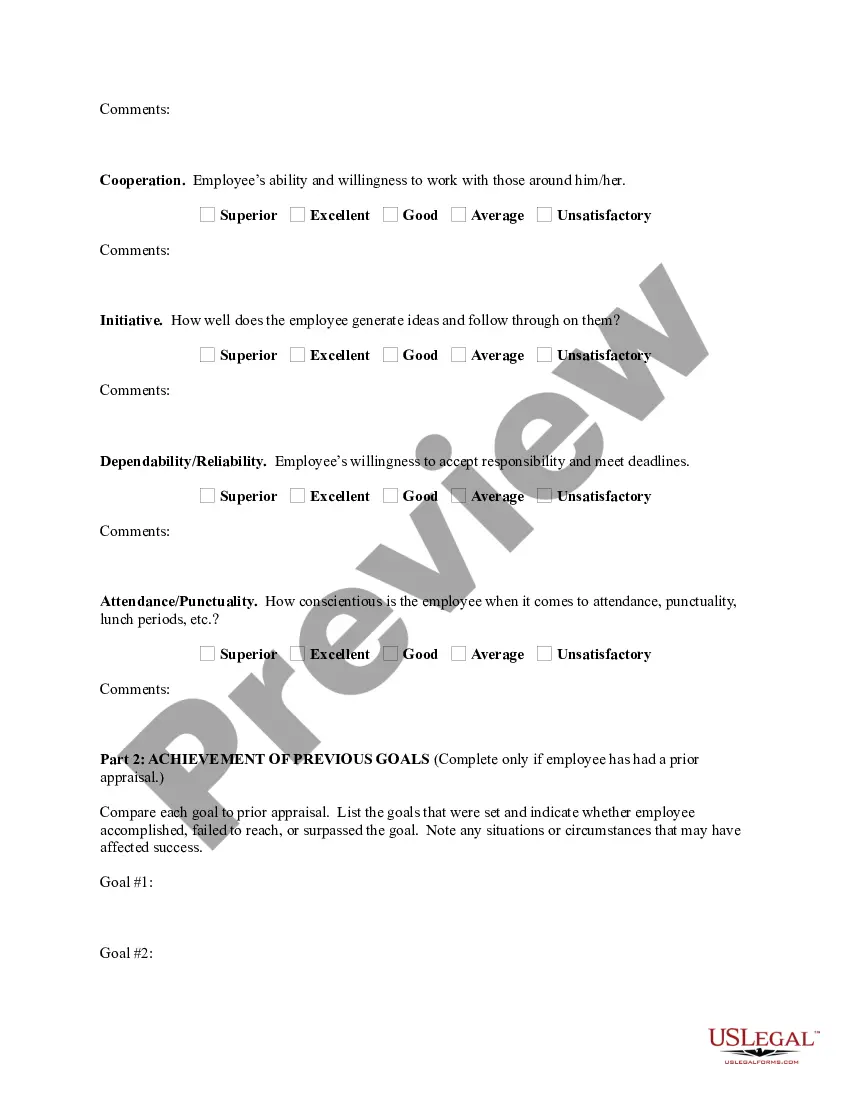

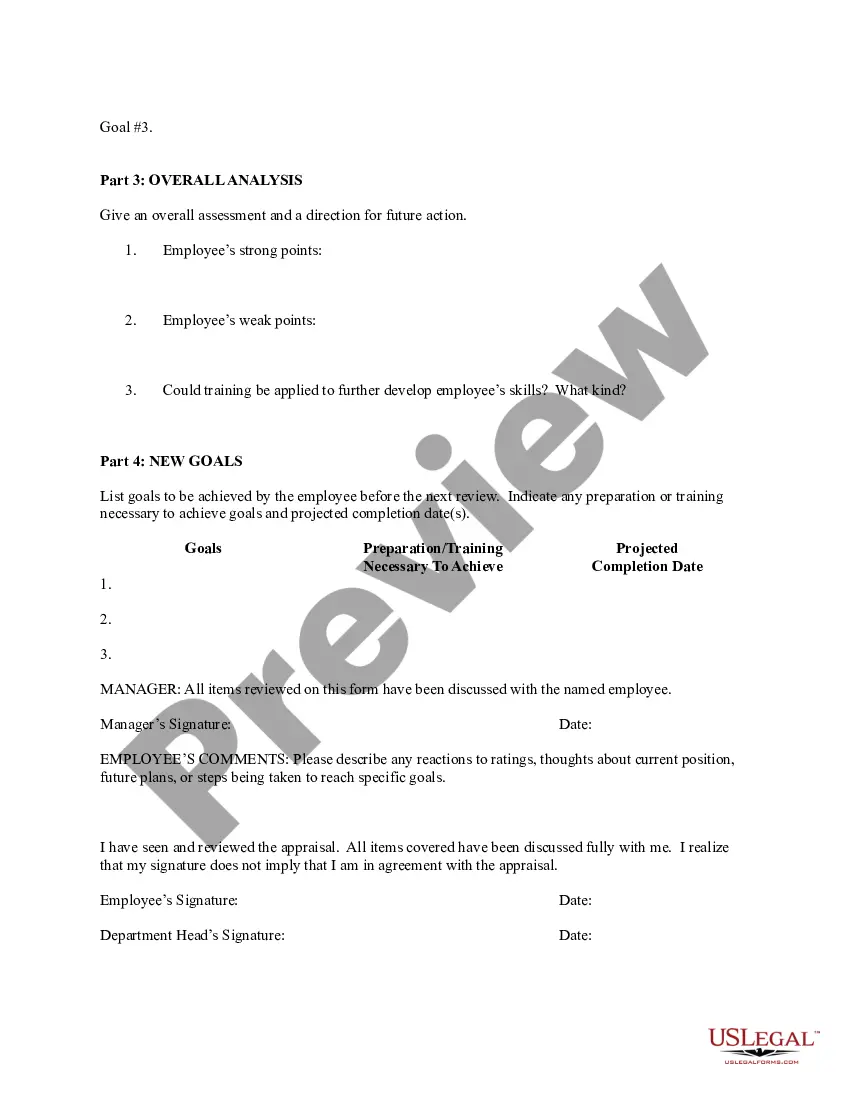

How to fill out South Dakota Employee Evaluation Form For Sole Trader?

Have you been inside a situation the place you will need papers for possibly organization or person functions nearly every time? There are plenty of legal document templates available on the net, but locating versions you can rely on isn`t easy. US Legal Forms delivers a large number of form templates, much like the South Dakota Employee Evaluation Form for Sole Trader, that are written to meet state and federal requirements.

If you are previously acquainted with US Legal Forms internet site and have a merchant account, simply log in. Next, you are able to acquire the South Dakota Employee Evaluation Form for Sole Trader template.

Should you not have an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Find the form you want and make sure it is to the right town/state.

- Take advantage of the Preview switch to examine the shape.

- See the information to actually have chosen the right form.

- When the form isn`t what you`re trying to find, utilize the Search field to get the form that fits your needs and requirements.

- Once you obtain the right form, click on Buy now.

- Choose the costs plan you would like, submit the required information to make your account, and buy the transaction using your PayPal or Visa or Mastercard.

- Pick a convenient paper file format and acquire your backup.

Locate all the document templates you might have purchased in the My Forms food selection. You may get a additional backup of South Dakota Employee Evaluation Form for Sole Trader whenever, if required. Just click the essential form to acquire or printing the document template.

Use US Legal Forms, probably the most considerable collection of legal forms, to save lots of time and avoid mistakes. The support delivers professionally manufactured legal document templates which can be used for an array of functions. Produce a merchant account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

An Investment Fee of 0.55% is added to newly liable employers' tax rates.

Along with the UI tax, a so-called investment fee is also assessed. In the last few years, the UI tax rate has been 1.2%, and the investment fee has been . 55%, for a total effective tax rate of 1.75%.

South Dakota does not have a personal income tax, so there is no withholding.

South Dakota does not impose a corporate income tax.

South Dakota is one of only a very few states that does not have a personal income tax or a corporation income tax. Consequently, for most LLCs, including those that may have elected to be taxed as corporations, no state income taxes are due.

If you want to avoid income taxes, you should consider relocating to South Dakota, as there's no income tax in the state. This means your income from wages, salaries, capital gains, interest and dividends are not taxed at the state level. Furthermore, taxpayers in South Dakota do not need to file a state tax return.

South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent. South Dakota's tax system ranks 2nd overall on our 2022 State Business Tax Climate Index.

South Dakota Administrative Fee 2018 The fee is 0.02% for all applicable employers.

To comply with federal and state government regulations, employers must file state unemployment insurance (SUI) reports.

South Dakota and Wyoming are the only states that levy neither a corporate income nor gross receipts tax.

More info

Passers Ballot Access Request County Ballot Access Request Statewide County Candidates Local Candidates County Canvassers Search by Keyword Other State Keyword: Search for keyword.