South Dakota Order Confirming Chapter 12 Plan - B 230A

Description

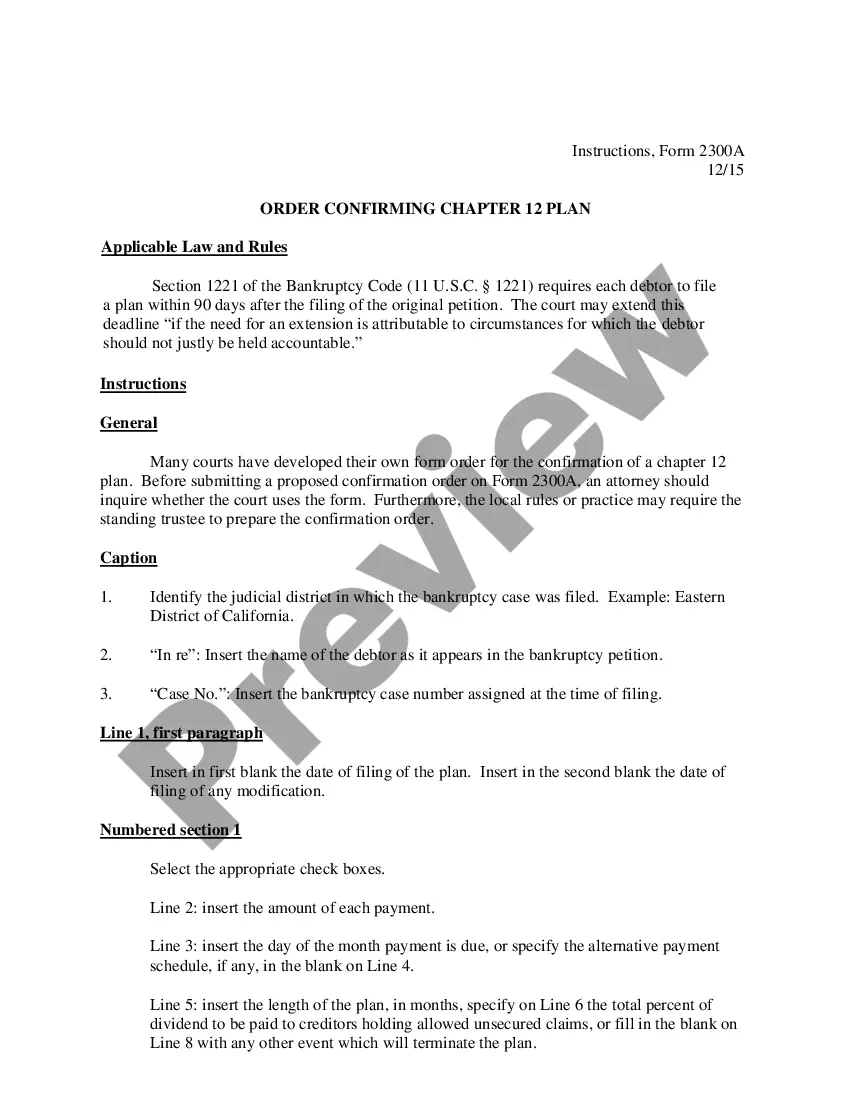

How to fill out Order Confirming Chapter 12 Plan - B 230A?

Are you presently inside a placement in which you will need papers for either company or individual uses just about every time? There are tons of authorized record layouts available on the net, but getting types you can rely on isn`t simple. US Legal Forms offers a large number of type layouts, just like the South Dakota Order Confirming Chapter 12 Plan - B 230A, which are composed to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms site and also have a merchant account, merely log in. Following that, you may down load the South Dakota Order Confirming Chapter 12 Plan - B 230A template.

Unless you offer an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the type you need and ensure it is for that right town/area.

- Utilize the Preview option to review the form.

- See the information to actually have selected the right type.

- When the type isn`t what you`re looking for, use the Search discipline to discover the type that meets your needs and specifications.

- Whenever you find the right type, click on Purchase now.

- Choose the costs prepare you want, submit the specified information and facts to create your bank account, and pay for the transaction making use of your PayPal or charge card.

- Pick a practical file structure and down load your backup.

Find each of the record layouts you have purchased in the My Forms food list. You can aquire a additional backup of South Dakota Order Confirming Chapter 12 Plan - B 230A anytime, if possible. Just select the required type to down load or print out the record template.

Use US Legal Forms, one of the most considerable variety of authorized forms, to save some time and prevent errors. The assistance offers expertly manufactured authorized record layouts which you can use for a variety of uses. Make a merchant account on US Legal Forms and commence making your way of life easier.

Form popularity

FAQ

Also known as plan. A comprehensive document prepared by a debtor or another party in interest detailing how the debtor will continue to operate or liquidate, and how it plans to pay the claims of its creditors over a fixed period of time.

Chapter 12 and Chapter 13 are basically the same filing, except that Chapter 12 is for family farmers and Chapter 13 is for other individuals. As long as you have a steady, reliable income, less than $269,250 in unsecured debt and less than $807,750 in secured debt, you can file Chapter 13.

Most Chapter 13 repayment plans last for either three years or five years. The length of the repayment plan depends on the filer's income, the amount of time needed to pay the required plan amount, and other factors. Certain debts must be paid fully within the plan.

Chapter 12 is designed for "family farmers" or "family fishermen" with "regular annual income." It enables financially distressed family farmers and fishermen to propose and carry out a plan to repay all or part of their debts.

Chapter 12 bankruptcy was devised to help farms and fisheries pay off their debts through a process of reorganization rather than liquidation. It recognizes the special challenges that these types of businesses face and is usually the best bankruptcy option for those that qualify.

Appointment of a trustee: In Chapter 7 and 13 bankruptcy cases, the order for relief triggers the appointment of a trustee. Notification to creditors: The order for relief informs the creditors of the debtor's bankruptcy filing, initiating the claims process.

The essential parts of a Chapter 12 repayment plan include the following. Required plan payments. During the plan period, the debtor must turn over all "disposable income" to the Chapter 12 trustee. ... Mortgages and other secured claims. ... Trustee fee. ... Discharge of debt.

"Cram down" simply means the process by which the bankruptcy court can, as part of the confirmation of a Chapter 12 Bankruptcy Plan, force treatment upon an objecting creditor, provided the Plan otherwise meets all of the other confirmation criteria under Section 1225 of the Bankruptcy Code.