South Dakota Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc.

Description

How to fill out Agreement Of Merger By CP National Corp., Alltel Corp., And Alltel California, Inc.?

Have you been inside a situation the place you need to have files for both organization or person uses just about every day? There are a variety of authorized papers layouts available on the net, but getting types you can rely is not straightforward. US Legal Forms gives thousands of type layouts, much like the South Dakota Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc., that happen to be created to meet federal and state demands.

When you are previously informed about US Legal Forms web site and get your account, simply log in. Next, you may acquire the South Dakota Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc. design.

Unless you offer an account and want to begin using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for that right metropolis/area.

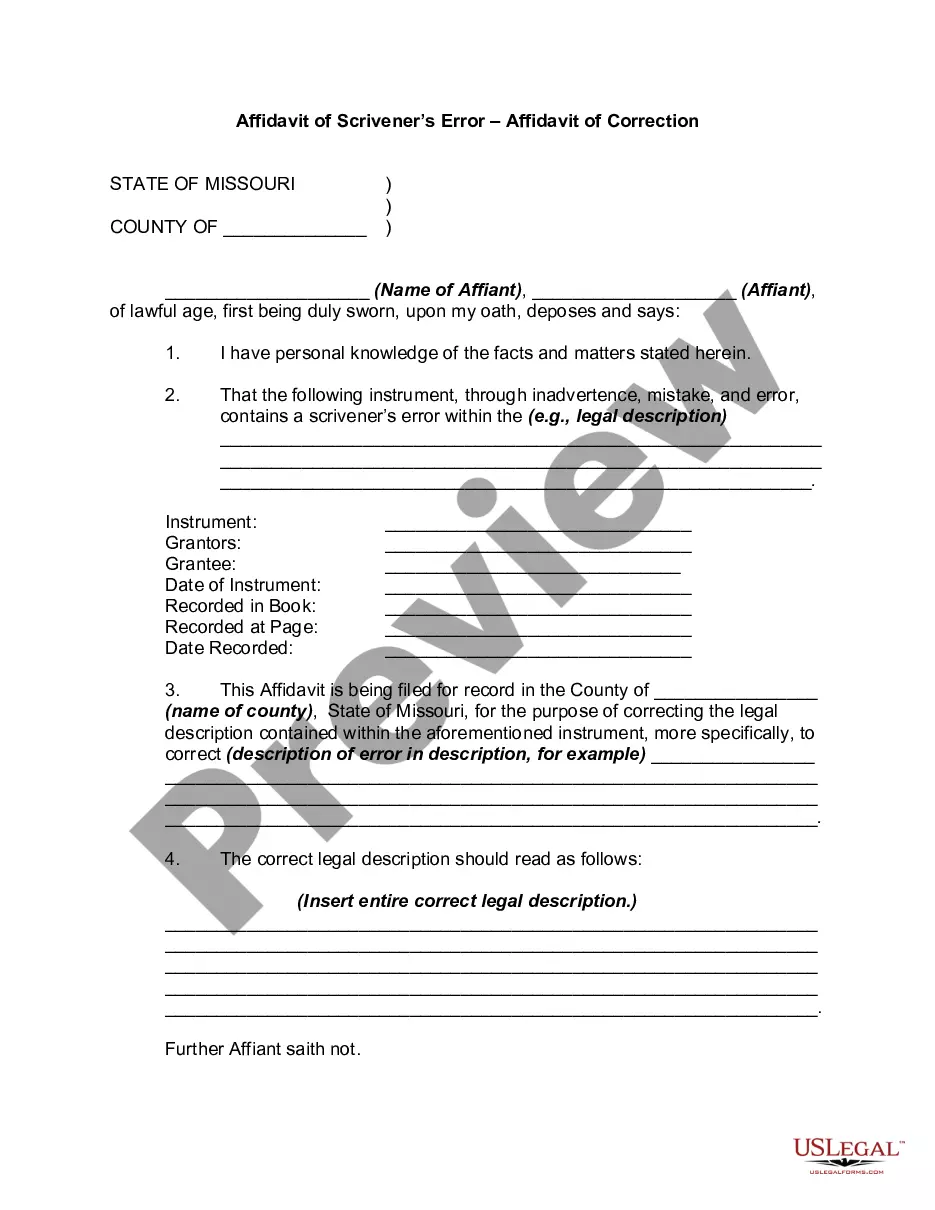

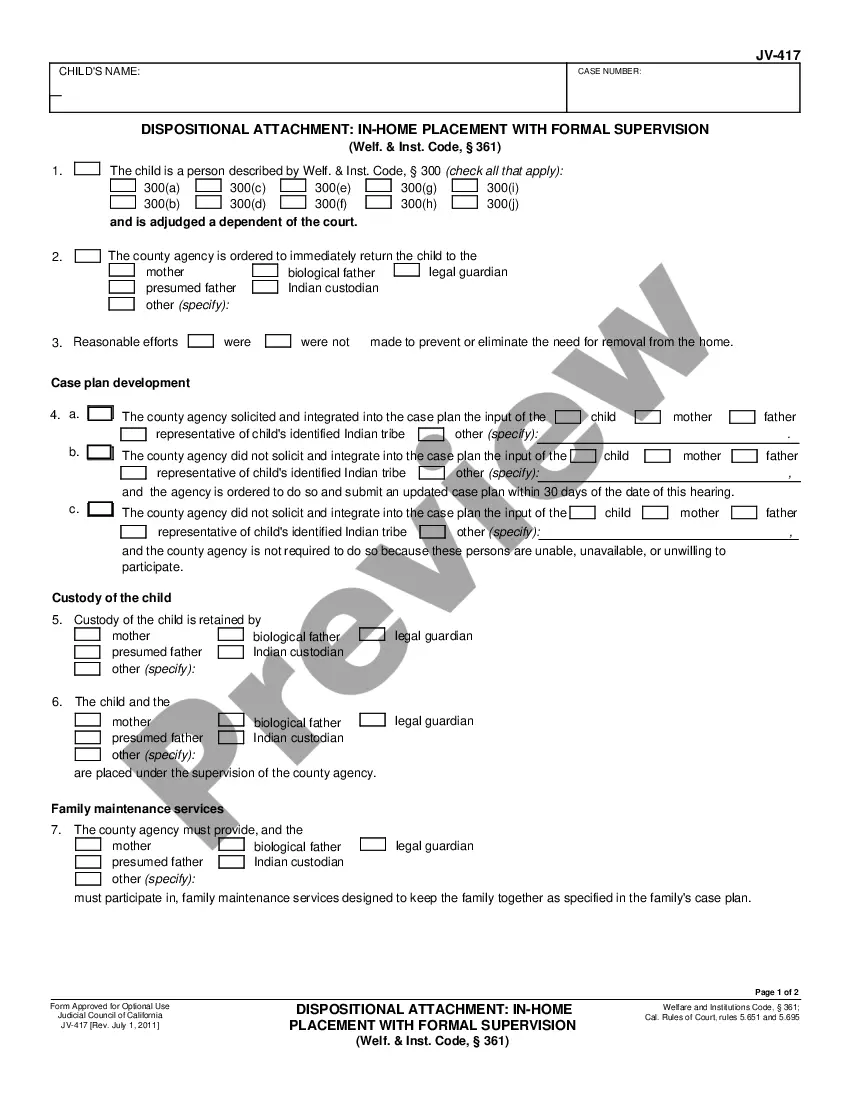

- Use the Preview key to review the shape.

- See the explanation to ensure that you have chosen the appropriate type.

- In the event the type is not what you`re seeking, utilize the Research discipline to get the type that suits you and demands.

- Once you get the right type, click Purchase now.

- Opt for the pricing strategy you need, fill out the required info to create your bank account, and pay money for an order with your PayPal or Visa or Mastercard.

- Select a convenient document formatting and acquire your copy.

Find each of the papers layouts you possess purchased in the My Forms food list. You may get a extra copy of South Dakota Agreement of Merger by CP National Corp., Alltel Corp., and Alltel California, Inc. at any time, if necessary. Just click on the essential type to acquire or produce the papers design.

Use US Legal Forms, probably the most considerable variety of authorized forms, in order to save time as well as prevent mistakes. The support gives professionally made authorized papers layouts which can be used for a variety of uses. Make your account on US Legal Forms and commence producing your lifestyle a little easier.