The South Dakota Agreement of Merger is a legally binding document that outlines the merger between VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. This agreement brings together these prominent companies from the oil and gas industry to consolidate their operations and resources for mutual growth and success. The South Dakota Agreement of Merger can be further categorized into two types — Vertical Merger and Horizontal Merger. 1. Vertical Merger: This type of merger occurs when two or more companies operating at different stages of the production process in the oil and gas industry join forces. VP Oil, Inc. and VP Acquisition Corp., both engaged in the exploration and production of oil and gas, merge with Big Piney Oil and Gas Co. and Big Piney Acquisition Corp., who specialize in the refining and distribution of petroleum products. By merging, these companies aim to streamline the supply chain and create efficiencies that benefit all stakeholders involved. 2. Horizontal Merger: This type of merger happens when two or more companies operating in the same industry and at the same stage of production combine their operations. In this case, VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc., all engaged in the exploration and production of oil and gas, come together to form a more formidable force in the industry. By pooling their resources, expertise, and market reach, these companies can increase their competitive advantage and expand their market share. The South Dakota Agreement of Merger outlines the terms and conditions of the merger, including the exchange of shares, the reorganization of assets and liabilities, the composition of the new executive team, and the future strategic direction of the merged entity. It also addresses any regulatory approvals required and the legal obligations of all parties involved. Keywords: South Dakota Agreement of Merger, VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., National Energy Group, Inc., merger, oil and gas industry, vertical merger, horizontal merger, exploration, production, refining, distribution, supply chain, efficiencies, stakeholders, streamlining, petroleum products, competitive advantage, market share, reorganization, assets, liabilities, executive team, strategic direction, regulatory approvals, legal obligations.

South Dakota Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.

Description

How to fill out South Dakota Agreement Of Merger By VP Oil, Inc., VP Acquisition Corp., Big Piney Oil And Gas Co., Big Piney Acquisition Corp., And National Energy Group, Inc.?

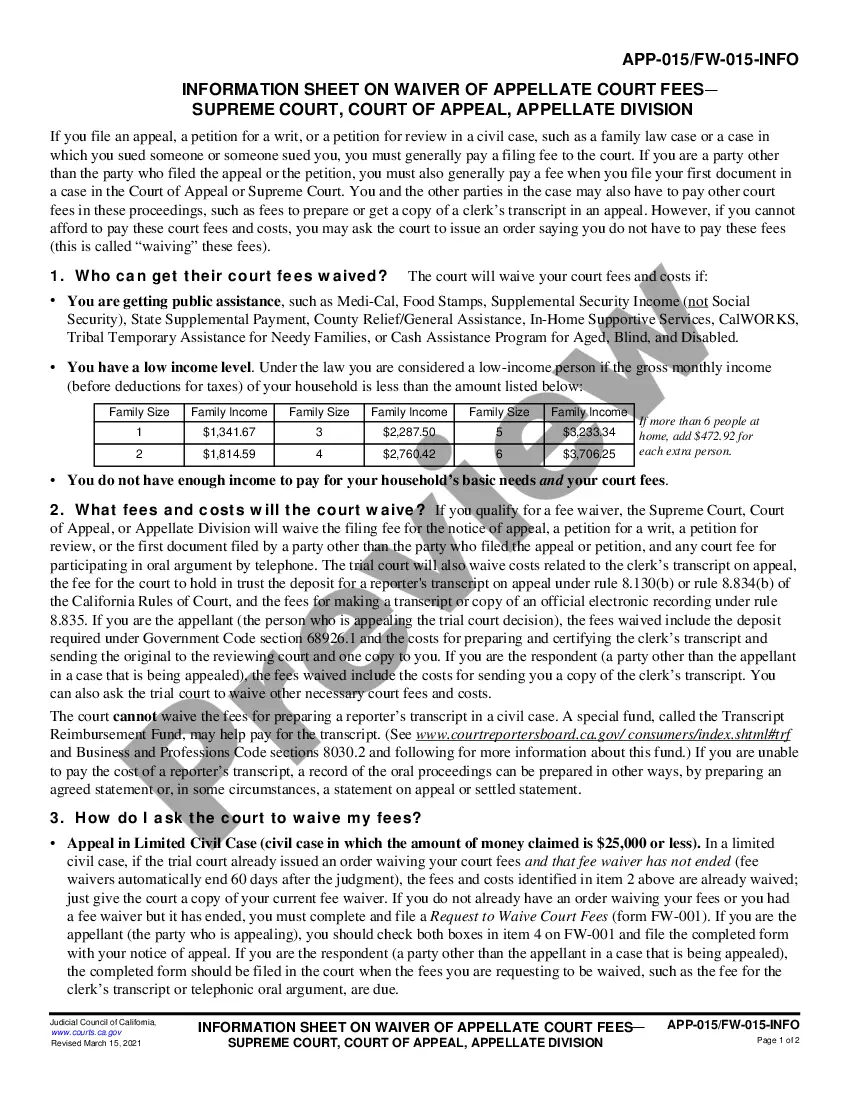

You are able to spend hours on the Internet searching for the legitimate papers template that meets the state and federal needs you want. US Legal Forms supplies thousands of legitimate types which are examined by experts. You can easily obtain or print out the South Dakota Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc. from your services.

If you currently have a US Legal Forms profile, you can log in and click on the Down load key. After that, you can complete, change, print out, or signal the South Dakota Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc.. Every single legitimate papers template you get is yours permanently. To obtain one more copy associated with a purchased develop, check out the My Forms tab and click on the corresponding key.

If you work with the US Legal Forms site the very first time, follow the straightforward instructions beneath:

- Very first, ensure that you have chosen the right papers template for the area/city of your choice. See the develop description to make sure you have chosen the proper develop. If available, take advantage of the Review key to appear from the papers template as well.

- In order to find one more edition of your develop, take advantage of the Research industry to discover the template that meets your needs and needs.

- After you have identified the template you desire, click on Acquire now to continue.

- Select the costs prepare you desire, key in your qualifications, and register for your account on US Legal Forms.

- Comprehensive the transaction. You may use your credit card or PayPal profile to pay for the legitimate develop.

- Select the file format of your papers and obtain it to your gadget.

- Make modifications to your papers if necessary. You are able to complete, change and signal and print out South Dakota Agreement of Merger by VP Oil, Inc., VP Acquisition Corp., Big Piney Oil and Gas Co., Big Piney Acquisition Corp., and National Energy Group, Inc..

Down load and print out thousands of papers web templates making use of the US Legal Forms website, which provides the most important variety of legitimate types. Use specialist and express-certain web templates to handle your company or person demands.