South Dakota Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute

Description

How to fill out Agreement And Plan Of Merger By Corning Inc, Apple Acquisition Corp, And Nichols Institute?

If you want to complete, obtain, or print authorized record web templates, use US Legal Forms, the most important selection of authorized types, that can be found on the web. Utilize the site`s simple and easy handy research to discover the papers you need. Different web templates for business and person uses are sorted by categories and suggests, or keywords and phrases. Use US Legal Forms to discover the South Dakota Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute within a handful of clicks.

Should you be presently a US Legal Forms consumer, log in in your bank account and click on the Down load switch to obtain the South Dakota Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute. You can also entry types you in the past saved from the My Forms tab of the bank account.

If you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for the correct metropolis/country.

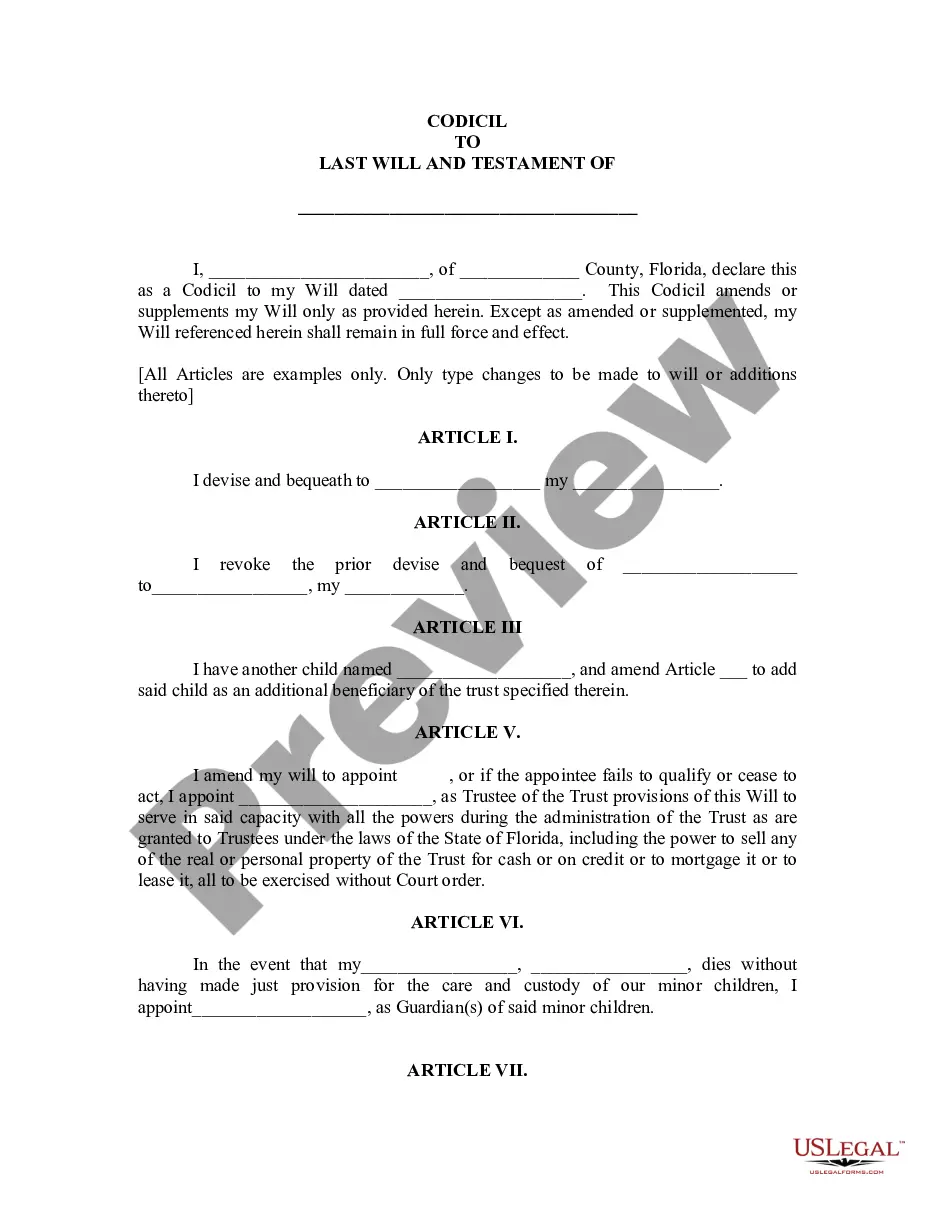

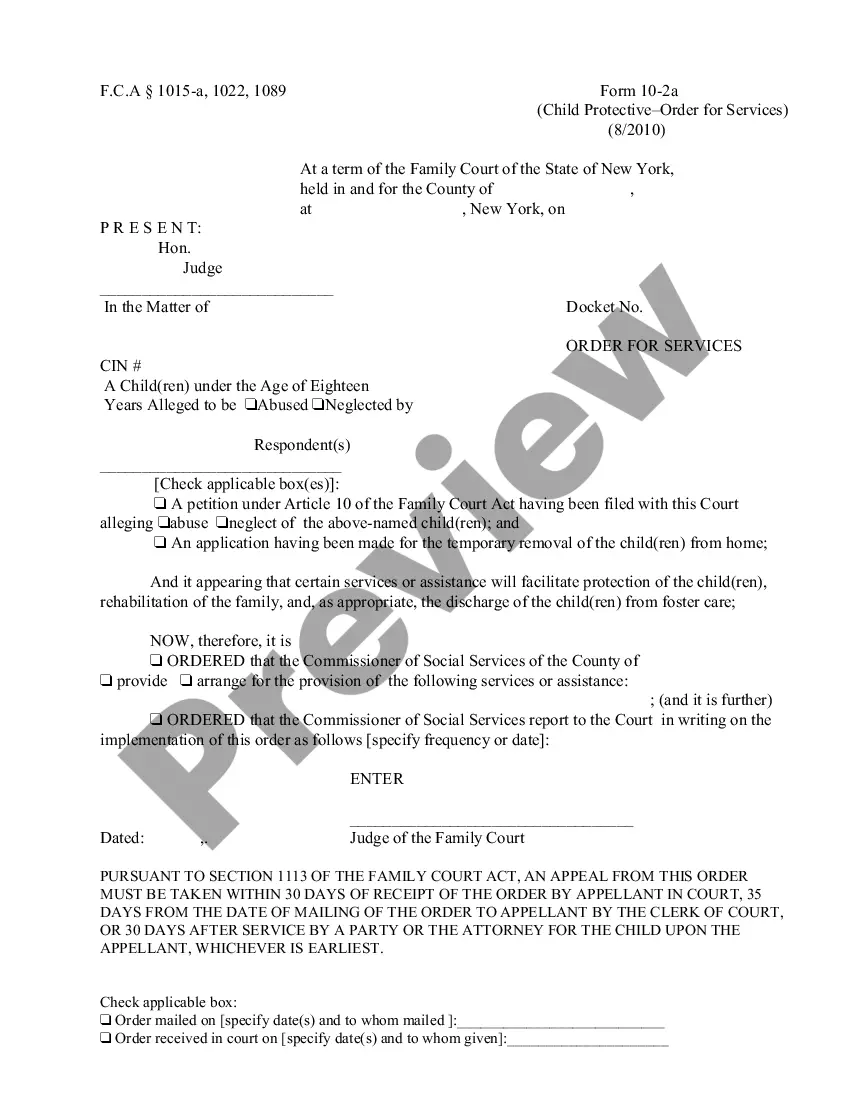

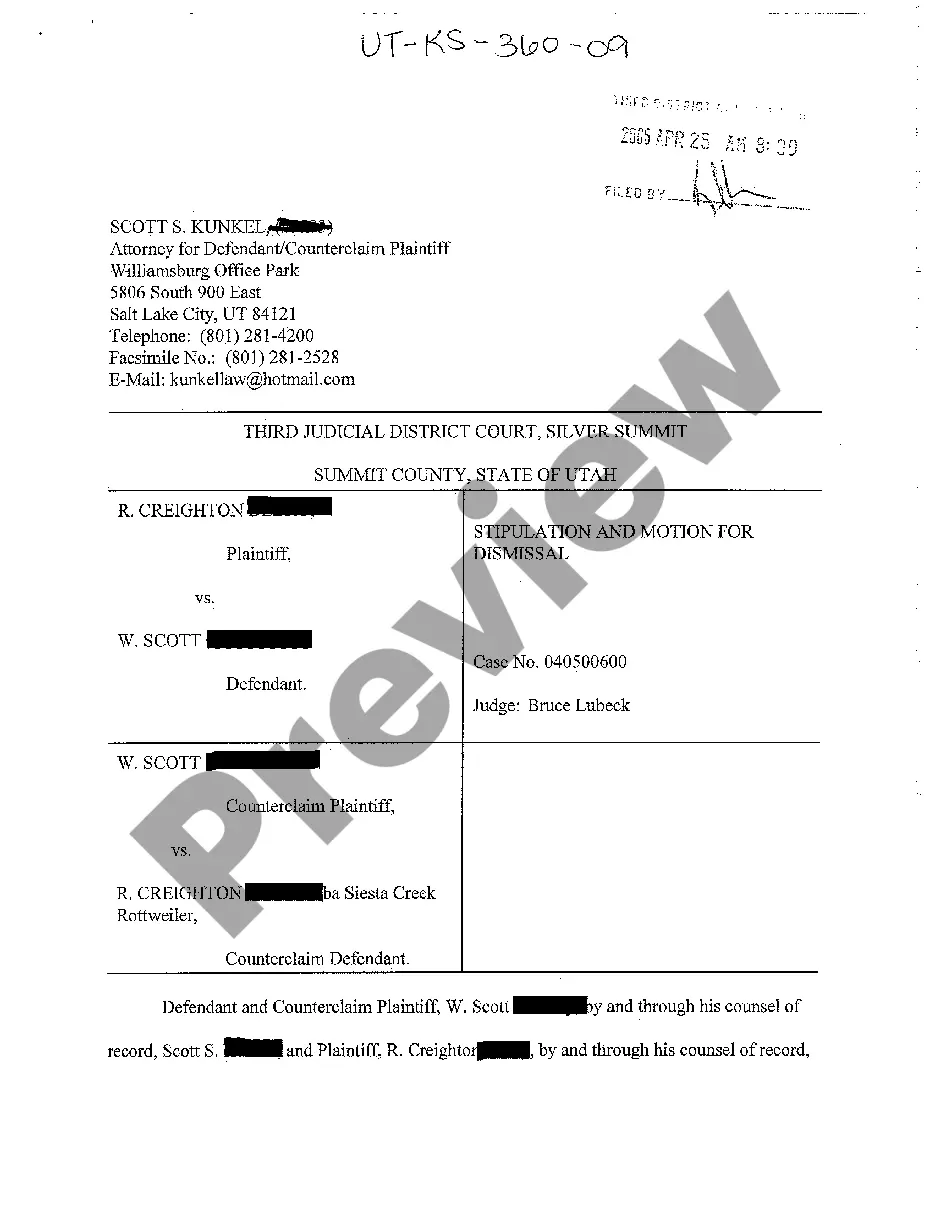

- Step 2. Use the Preview method to look through the form`s information. Don`t forget to learn the outline.

- Step 3. Should you be not satisfied with all the develop, take advantage of the Research discipline near the top of the display screen to find other variations of your authorized develop web template.

- Step 4. When you have located the shape you need, go through the Get now switch. Opt for the rates prepare you like and add your accreditations to register for the bank account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal bank account to complete the purchase.

- Step 6. Choose the format of your authorized develop and obtain it in your gadget.

- Step 7. Complete, revise and print or indicator the South Dakota Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute.

Every authorized record web template you buy is your own property for a long time. You have acces to every single develop you saved with your acccount. Click the My Forms section and select a develop to print or obtain yet again.

Contend and obtain, and print the South Dakota Agreement and Plan of Merger by Corning Inc, Apple Acquisition Corp, and Nichols Institute with US Legal Forms. There are thousands of professional and condition-particular types you can utilize to your business or person requires.

Form popularity

FAQ

In contract law, a merger clause, or integration clause, absorbs an inferior form of contract into a superior form of contract on the same subject matter, making the final written contract complete and binding.

What is an Agreement Of Merger? An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

?parties? means Parent, Merger Sub and the Company.

Your Operating Agreement gives confidence and impacts the price to those who would offer you riches to merge, acquire, or buy your business. The Operating Agreement protects the owner's personal assets.

An integration clause?sometimes called a merger clause or an entire agreement clause?is a legal provision in Contract Law that states that the terms of a contract are the complete and final agreement between the parties.