The South Dakota Eligible Directors' Stock Option Plan of Kyle Electronics is a comprehensive program designed to incentivize and reward eligible directors of the company. This plan offers a range of benefits and opportunities for directors to acquire and benefit from stock options. One type of the South Dakota Eligible Directors' Stock Option Plan is the Nonqualified Stock Option (NO). Under this provision, participating directors have the right to purchase company stock at a predetermined price within a specified period. This option allows directors to acquire stock at a potentially lower price, enabling them to benefit from future growth in the company's value. Another type of the plan is the Incentive Stock Option (ISO). Directors who opt for this type of option enjoy certain tax advantages as the gains from exercising SOS are subject to favorable tax treatment. SOS are subject to specific holding periods and other requirements outlined in the plan. The South Dakota Eligible Directors' Stock Option Plan comes with various eligibility criteria and allocation procedures. Directors who meet the established standards are granted specified numbers of stock options depending on their level of contribution and tenure with the company. These options usually vest over a predetermined period, incentivizing director retention and long-term commitment to Kyle Electronics. The plan is carefully structured to ensure fairness and alignment with shareholder interests. The exercise price and vesting schedules are determined in accordance with market conditions and industry benchmarks. This strategy encourages directors to actively contribute to the company's success, as their stock options will only become valuable when the company's stock price increases. Furthermore, the plan safeguards against any potential conflicts of interest in imposing strict guidelines and disclosure requirements. Directors must comply with applicable regulations and disclose any conflicts or potential conflicts of interest to the company and its shareholders. Overall, the South Dakota Eligible Directors' Stock Option Plan of Kyle Electronics provides a means for eligible directors to align their interests with those of the company and its shareholders. It incentivizes long-term commitment, fosters loyalty, and encourages active participation in driving the company's growth and success. Keywords: South Dakota, Eligible Directors' Stock Option Plan, Kyle Electronics, Nonqualified Stock Option, Incentive Stock Option, stock options, incentive, rewards, directors, acquisition, growth, value, eligibility, allocation, vesting, shareholder interests, conflicts of interest, disclosure, commitment, loyalty, participation, success.

South Dakota Eligible Directors' Stock Option Plan of Wyle Electronics

Description

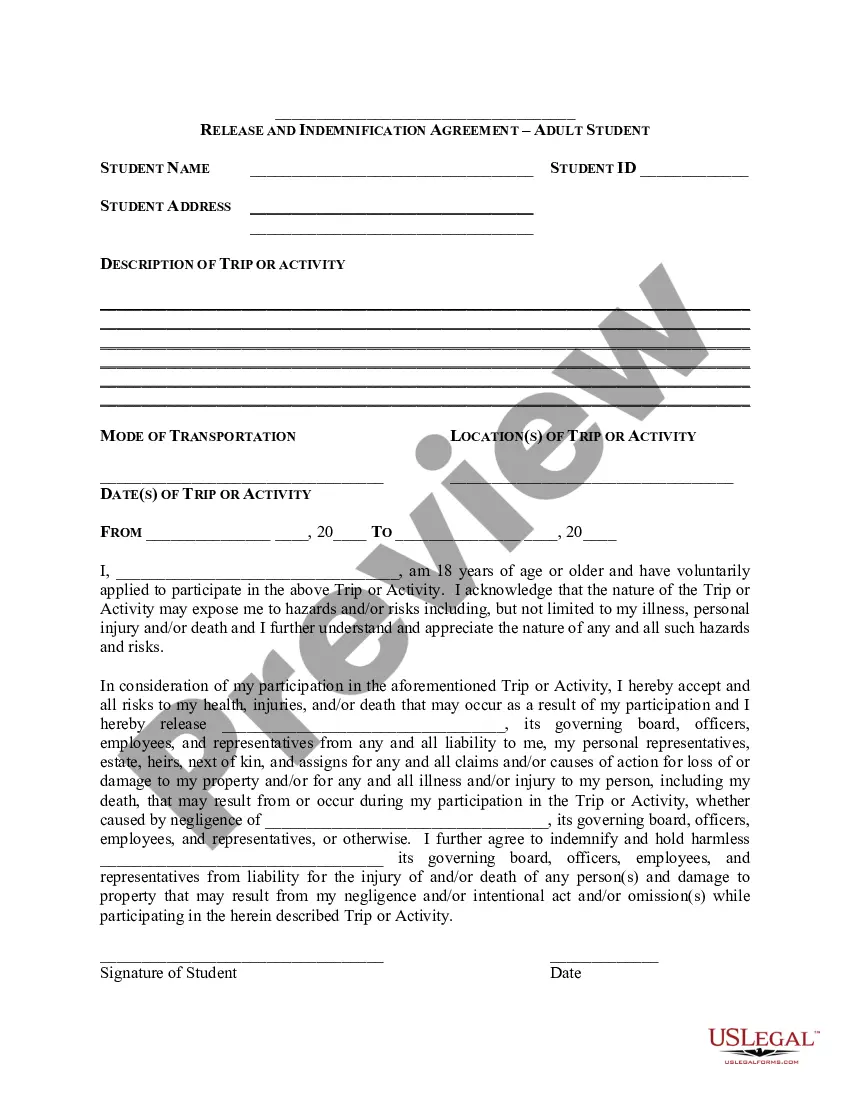

How to fill out South Dakota Eligible Directors' Stock Option Plan Of Wyle Electronics?

US Legal Forms - among the largest libraries of legitimate forms in the USA - delivers a wide range of legitimate papers templates you may download or printing. Utilizing the website, you can find thousands of forms for enterprise and individual purposes, sorted by types, says, or key phrases.You will find the most up-to-date types of forms such as the South Dakota Eligible Directors' Stock Option Plan of Wyle Electronics within minutes.

If you currently have a registration, log in and download South Dakota Eligible Directors' Stock Option Plan of Wyle Electronics in the US Legal Forms local library. The Download switch will appear on each type you look at. You gain access to all earlier acquired forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms initially, here are basic guidelines to get you began:

- Ensure you have selected the best type to your metropolis/area. Select the Review switch to review the form`s content. Read the type outline to actually have chosen the right type.

- When the type does not suit your requirements, take advantage of the Search field on top of the screen to discover the one who does.

- If you are pleased with the form, affirm your decision by simply clicking the Buy now switch. Then, choose the prices plan you like and offer your accreditations to sign up to have an bank account.

- Approach the financial transaction. Utilize your bank card or PayPal bank account to finish the financial transaction.

- Pick the file format and download the form in your gadget.

- Make changes. Fill out, edit and printing and indication the acquired South Dakota Eligible Directors' Stock Option Plan of Wyle Electronics.

Every single web template you included in your account does not have an expiration day and is your own property permanently. So, if you wish to download or printing one more backup, just proceed to the My Forms portion and click on on the type you will need.

Obtain access to the South Dakota Eligible Directors' Stock Option Plan of Wyle Electronics with US Legal Forms, by far the most extensive local library of legitimate papers templates. Use thousands of expert and state-certain templates that meet your company or individual requires and requirements.