The South Dakota Approval of Option Grant is a legal process that allows companies to issue stock options to their employees or other individuals. This approval is necessary to ensure compliance with South Dakota state laws and regulations governing stock option grants. There are several types of South Dakota Approval of Option Grant, each designed to cater to different business scenarios and requirements. These include: 1. Employee Stock Option Plan (ESOP) Approval: This type of grant is aimed at providing employees with the opportunity to buy company stocks at a predetermined price, commonly known as the strike price. The ESOP Approval is crucial in outlining the terms, conditions, and eligibility criteria of the stock option plan. 2. Non-Employee Stock Option Plan (AESOP) Approval: This variant of the approval is tailored for granting stock options to non-employees, such as consultants, vendors, or independent contractors. AESOP Approval ensures that these individuals are legally allowed to acquire company stocks through options and that the terms align with South Dakota regulations. 3. Incentive Stock Option (ISO) Approval: ISO Approval is specific to grants that qualify under the federal tax code as Incentive Stock Options. These options provide certain tax advantages to employees upon exercise and sale, and the South Dakota Approval ensures compliance with both state and federal laws governing SOS. 4. Non-Qualified Stock Option (NO) Approval: NO Approval is required for stock option grants that do not meet the criteria set by the tax code for Incentive Stock Options. These grants are more flexible in terms of eligibility and vesting schedules, and the South Dakota Approval ensures that they are granted in accordance with state regulations. 5. Restricted Stock Unit (RSU) Approval: Although not strictly categorized as an option grant, RSU Approval is essential for the issuance of restricted stock units to employees. RSS grant employees the right to receive company shares at a future date, subject to certain conditions. The South Dakota Approval ensures compliance with relevant laws governing RSU grants. Overall, the South Dakota Approval of Option Grant plays a pivotal role in regulating and formalizing the process of granting stock options or restricted stock units to employees or other individuals. It safeguards the interests of both the company and recipients, ensures compliance with state laws, and outlines the terms and conditions for these grants.

South Dakota Approval of option grant

Description

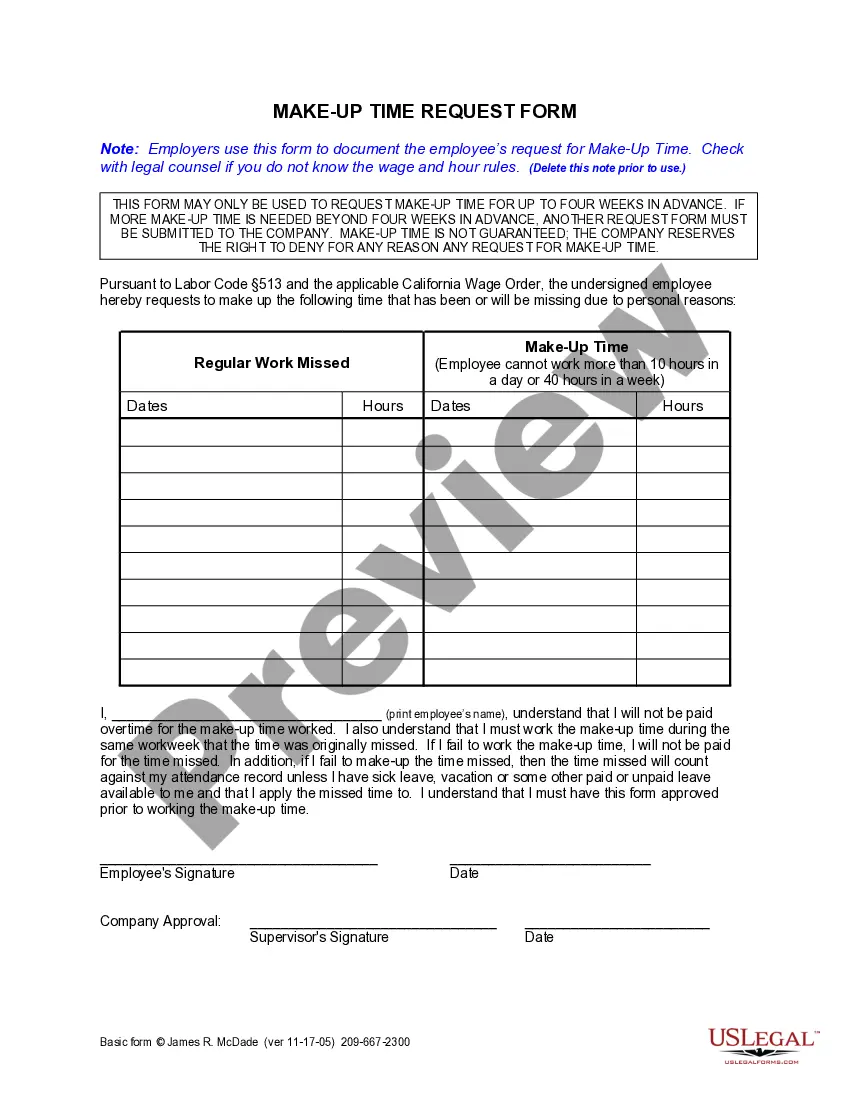

How to fill out South Dakota Approval Of Option Grant?

US Legal Forms - among the biggest libraries of lawful kinds in America - gives a wide array of lawful file templates you are able to acquire or printing. Making use of the web site, you may get 1000s of kinds for organization and person uses, sorted by types, says, or key phrases.You can get the most recent versions of kinds such as the South Dakota Approval of option grant in seconds.

If you already possess a membership, log in and acquire South Dakota Approval of option grant in the US Legal Forms catalogue. The Acquire switch will show up on each develop you see. You have access to all formerly saved kinds inside the My Forms tab of your bank account.

If you want to use US Legal Forms initially, allow me to share easy instructions to help you began:

- Be sure to have picked out the right develop for your personal city/area. Go through the Preview switch to review the form`s content. Browse the develop description to actually have chosen the right develop.

- If the develop doesn`t match your needs, make use of the Research area at the top of the screen to obtain the one that does.

- If you are happy with the shape, verify your decision by clicking the Get now switch. Then, select the costs program you want and supply your accreditations to register for an bank account.

- Approach the transaction. Utilize your credit card or PayPal bank account to finish the transaction.

- Find the structure and acquire the shape on your own system.

- Make alterations. Complete, modify and printing and sign the saved South Dakota Approval of option grant.

Each template you put into your bank account does not have an expiration date and is also yours permanently. So, if you wish to acquire or printing an additional backup, just go to the My Forms area and click on about the develop you need.

Get access to the South Dakota Approval of option grant with US Legal Forms, the most comprehensive catalogue of lawful file templates. Use 1000s of specialist and express-certain templates that meet up with your organization or person requirements and needs.

Form popularity

FAQ

It is a written document that remains valid even if you should later become unable to make your own decisions. With a durable power of attorney, you are able to appoint an agent to manage your financial affairs, make health care decisions, or conduct other business for you during your incapacitation.

South Dakota's Human Relations Act makes it illegal for an employer to refuse to hire a person, to discharge or lay off an employee, harass or to treat persons differently in the terms and conditions of employment because of race, color, creed, religion, sex, ancestry, disability or national origin.

We're the only state in the nation with no corporate income tax, no personal income tax, no personal property tax, no business inventory tax and no inheritance tax.

Proving a hostile work environment means showing that you are being harassed or discriminated against, and the behavior is ?severe and pervasive? enough to leave you feeling threatened and unsafe in the workplace. Work provides many different things for employees, like financial security, purpose, and self-fulfillment.

An employee is not required to endure a hostile work environment, especially after providing his or her employer with notice of the hostile work environment when the employer fails to take action to remedy the situation.

The program allows for project owners to receive a reinvestment payment, not to exceed the South Dakota sales and use tax paid on project costs, for new or expanded facilities with project costs in excess of $20,000,000 or for equipment upgrades with project costs in excess of $2,000,000.

A horrible workplace, also known as a hostile work environment, is one where employees feel uncomfortable, scared, or intimidated due to unwelcome conduct. This can include harassment, discrimination, victimization, violence, and other offensive behaviors.

Anyone who disrupts the business in any way whatsoever should be dealt with. I think there are a few things that should be done before termination, but yes, someone can be fired for creating a hostile work environment.