South Dakota Key Employee Stock Option Award Agreement

Description

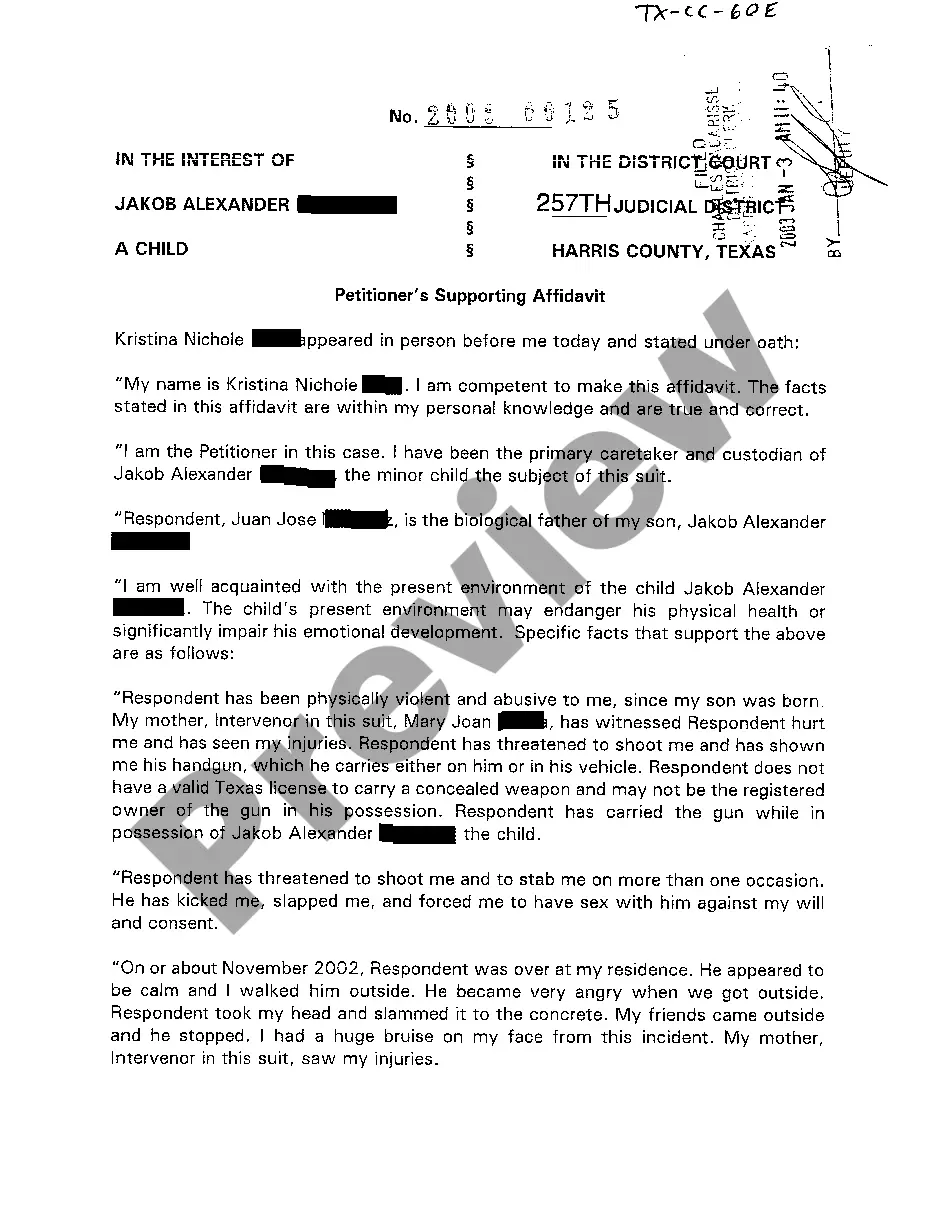

How to fill out Key Employee Stock Option Award Agreement?

Are you currently in a placement in which you need paperwork for either enterprise or specific reasons nearly every day time? There are a lot of authorized papers layouts available on the net, but getting ones you can rely on is not effortless. US Legal Forms delivers thousands of type layouts, such as the South Dakota Key Employee Stock Option Award Agreement, which are written to satisfy federal and state demands.

If you are already acquainted with US Legal Forms internet site and get an account, simply log in. Afterward, it is possible to acquire the South Dakota Key Employee Stock Option Award Agreement template.

If you do not offer an account and would like to start using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for the proper city/county.

- Use the Review key to analyze the shape.

- Look at the outline to ensure that you have selected the right type.

- If the type is not what you are searching for, utilize the Research industry to obtain the type that suits you and demands.

- When you obtain the proper type, simply click Buy now.

- Select the prices program you desire, fill out the required information and facts to produce your money, and buy an order utilizing your PayPal or credit card.

- Select a hassle-free data file structure and acquire your copy.

Get each of the papers layouts you may have purchased in the My Forms menus. You can get a more copy of South Dakota Key Employee Stock Option Award Agreement at any time, if required. Just go through the essential type to acquire or print out the papers template.

Use US Legal Forms, by far the most comprehensive collection of authorized forms, to save efforts and prevent faults. The service delivers expertly manufactured authorized papers layouts that can be used for a range of reasons. Make an account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

The types of equity compensation you're most likely to encounter fall into four categories: incentive stock options (ISOs), non-qualified stock options (NSOs), restricted stock or restricted stock units (RSUs) and employee stock purchase plans (ESPPs).

A state constitutional amendment passed in 1946 prohibits any person's right to work from being ?denied or abridged on account of membership or nonmembership in any labor union, or labor organization.? Currently, South Dakota is one of the twenty-five states in the country to enact right to work laws.

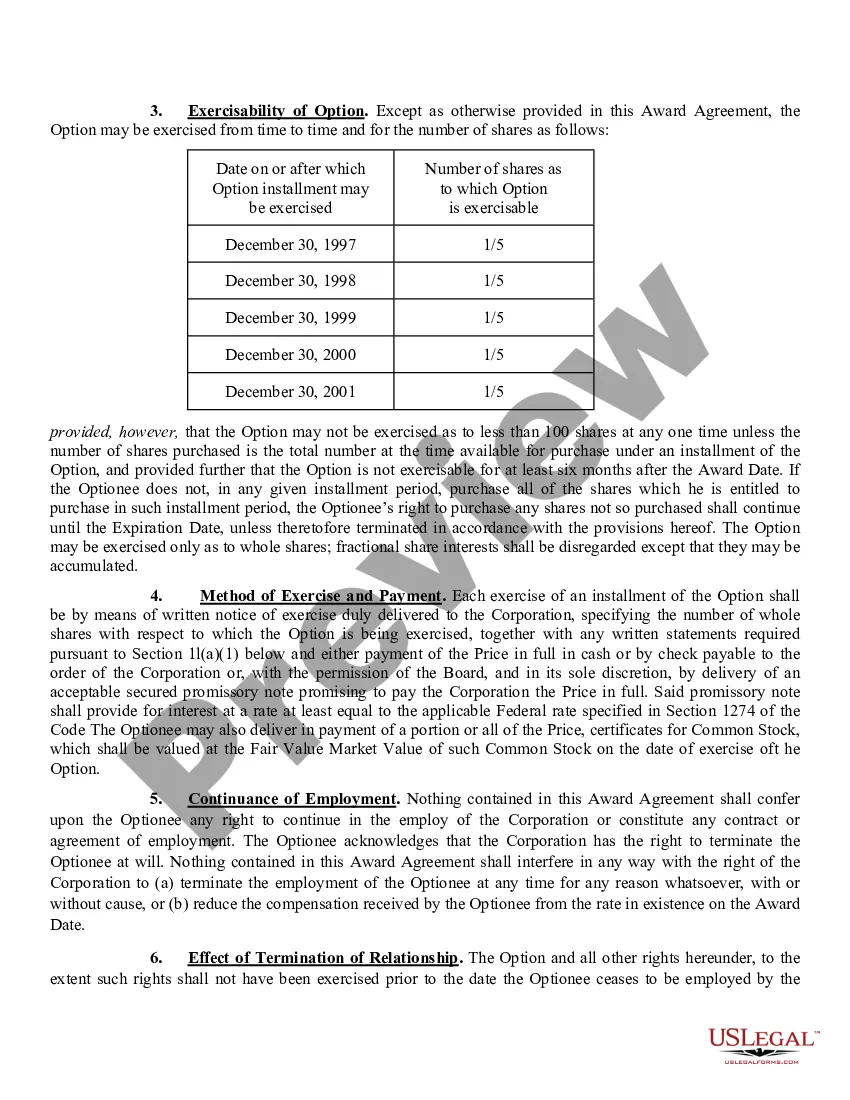

A stock award agreement is a contract between an employer and employee that outlines the terms and conditions of the employee's stock award. The agreement typically includes information about the number of shares being awarded, the vesting schedule, and any other restrictions or conditions.

When you receive an RSU, you don't have any immediate tax liability. You only have to pay taxes when your RSU vests and you receive an actual payout of stock shares. At that point, you have to report income based on the fair market value of the stock.

A stock option award is a type of compensation contract that companies use to incentivize employees. This contract is an agreement between the company and employee that gives them the right, but not the obligation, to purchase shares of company stock at a set price in the future (usually for pennies on the dollar).

Restricted stock awards represent actual ownership of stock and come with conditions on the timing of their sale. An employee benefits from stock options when they buy the stock at the exercise price and then sell it at a higher price.

Stock awards provide corporations a way to pay their executives based on company performance so their compensation aligns with the expectations of the shareholders. Companies may also grant stock awards to lower-level employees to incentivize them to take ownership of the company's performance and retain their loyalty.