South Dakota Proposal to Approve Material Terms of Stock Appreciation Right Plan The South Dakota Proposal to approve material terms of stock appreciation right plan is a significant step towards providing attractive incentives to employees and encouraging their long-term commitment to the company's success. This plan allows eligible employees to earn stock appreciation rights (SARS), which enable them to benefit from the company's stock price appreciation over time. The SARS function as a cash equivalent or bonus awarded to employees based on the increase in the market value of the company's stock. These rights are granted at a predetermined exercise price, allowing employees to purchase company stock at a future date when its market value exceeds the exercise price. Hence, it aligns the employees' interests with the company's performance and motivates them to contribute to its growth. Different types of South Dakota proposals to approve material terms of stock appreciation right plans may include: 1. Employee Stock Ownership Plan (ESOP) — This plan enables employees to earn ownership in the company by issuing shares or SARS to them, fostering a strong sense of ownership, loyalty, and dedication to the organization's long-term success. 2. Performance-Based SARS — These plans grant SARs to employees based on specific performance goals, such as achieving sales targets or meeting financial milestones. By linking the rewards to performance, the company promotes increased productivity and employee engagement. 3. Restricted Stock Unit (RSU) Plan — This type of plan grants employees a right to receive company stock or its cash equivalent after a certain vesting period, often tied to the length of employment. It encourages employee retention and loyalty by providing an incentive to stay with the company. 4. Phantom Stock Plan — This plan awards employees a cash bonus equivalent to the appreciation in company stock value, even though no actual stock is issued. It allows employees to benefit from the company's growth without diluting existing shareholders. 5. Stock Option Plan — Although not a stock appreciation right plan, stock options are frequently associated with such proposals. Stock options give employees the right to buy company shares at a predetermined price, offering potential financial rewards if the stock value rises. Approval of the South Dakota Proposal to approve material terms of stock appreciation right plan ensures that the company takes full advantage of its ability to incentivize and retain talented employees. Implementing such a plan can drive higher employee satisfaction, increased productivity, and improved company performance.

South Dakota Proposal to approve material terms of stock appreciation right plan

Description

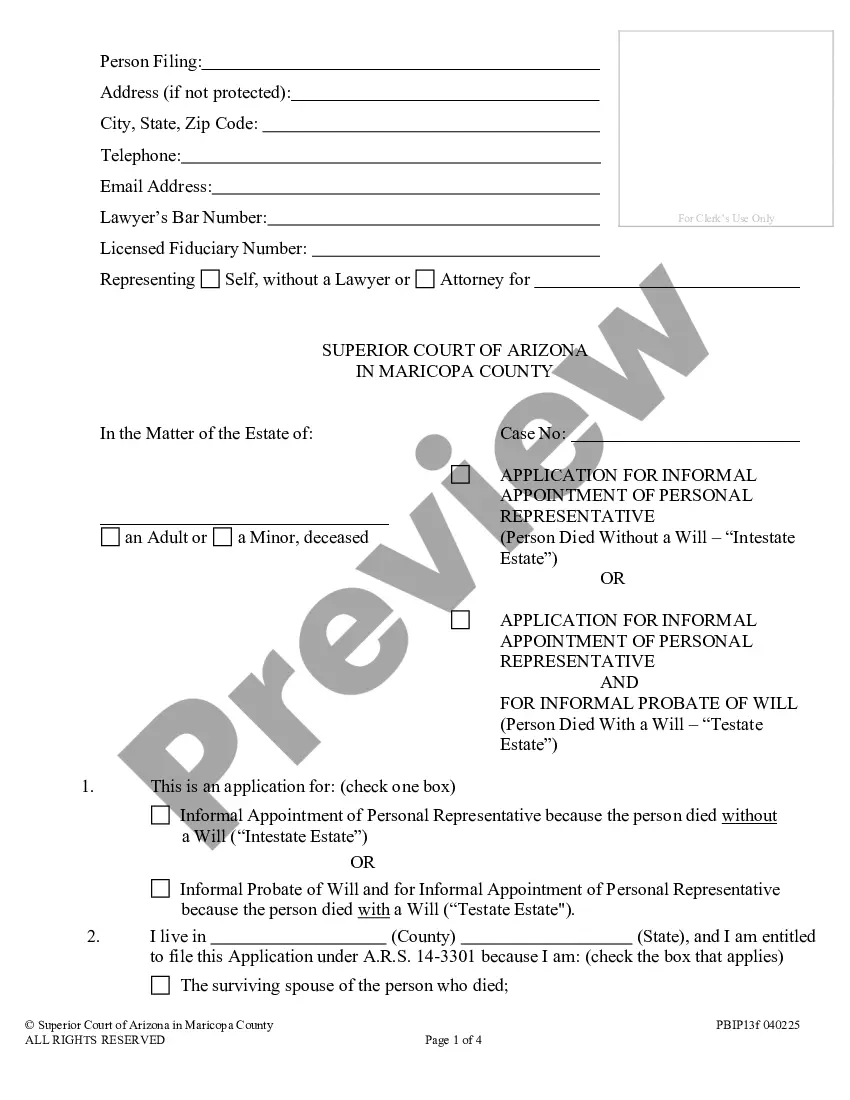

How to fill out South Dakota Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

US Legal Forms - one of several largest libraries of lawful kinds in the United States - delivers a wide range of lawful papers layouts you may obtain or printing. While using internet site, you may get thousands of kinds for enterprise and personal reasons, categorized by classes, says, or key phrases.You can get the most up-to-date versions of kinds such as the South Dakota Proposal to approve material terms of stock appreciation right plan within minutes.

If you already have a registration, log in and obtain South Dakota Proposal to approve material terms of stock appreciation right plan through the US Legal Forms library. The Down load option will appear on each and every type you perspective. You have accessibility to all previously saved kinds inside the My Forms tab of the bank account.

If you want to use US Legal Forms for the first time, listed here are basic recommendations to help you started:

- Ensure you have picked out the correct type to your area/area. Click on the Review option to check the form`s information. Read the type description to actually have selected the appropriate type.

- If the type does not suit your demands, utilize the Lookup discipline near the top of the screen to get the one that does.

- If you are happy with the form, confirm your selection by visiting the Purchase now option. Then, choose the rates strategy you want and give your qualifications to register for an bank account.

- Approach the purchase. Make use of charge card or PayPal bank account to complete the purchase.

- Choose the format and obtain the form on the system.

- Make modifications. Fill up, change and printing and sign the saved South Dakota Proposal to approve material terms of stock appreciation right plan.

Each and every format you put into your money does not have an expiration particular date and it is your own for a long time. So, if you want to obtain or printing an additional version, just go to the My Forms portion and click in the type you want.

Get access to the South Dakota Proposal to approve material terms of stock appreciation right plan with US Legal Forms, one of the most extensive library of lawful papers layouts. Use thousands of skilled and state-specific layouts that meet your organization or personal demands and demands.

Form popularity

FAQ

Employees can only exercise the stock appreciation rights after the shares have vested. The vesting period is the minimum period employees must hold the stocks before they can exercise the stock appreciation rights. Generally, employers offer stock appreciation rights along with stock options.

There are no federal income tax consequences when you are granted stock appreciation rights. However, at exercise you must recognize compensation income on the fair market value of the amount received at vesting. An employer is generally obligated to withhold taxes.

Stock appreciation rights are similar to stock options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a stock appreciation right vests, an employee can exercise it at any time prior to its expiration.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.