South Dakota Employees' Stock Deferral Plan for Norwest Corp.

Description

How to fill out Employees' Stock Deferral Plan For Norwest Corp.?

If you want to full, obtain, or produce lawful record themes, use US Legal Forms, the largest assortment of lawful types, which can be found on-line. Utilize the site`s easy and convenient search to obtain the paperwork you want. Various themes for organization and person reasons are sorted by categories and suggests, or search phrases. Use US Legal Forms to obtain the South Dakota Employees' Stock Deferral Plan for Norwest Corp. in just a couple of mouse clicks.

Should you be currently a US Legal Forms client, log in for your profile and click the Down load button to get the South Dakota Employees' Stock Deferral Plan for Norwest Corp.. You can even accessibility types you earlier downloaded inside the My Forms tab of the profile.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have selected the form to the correct metropolis/land.

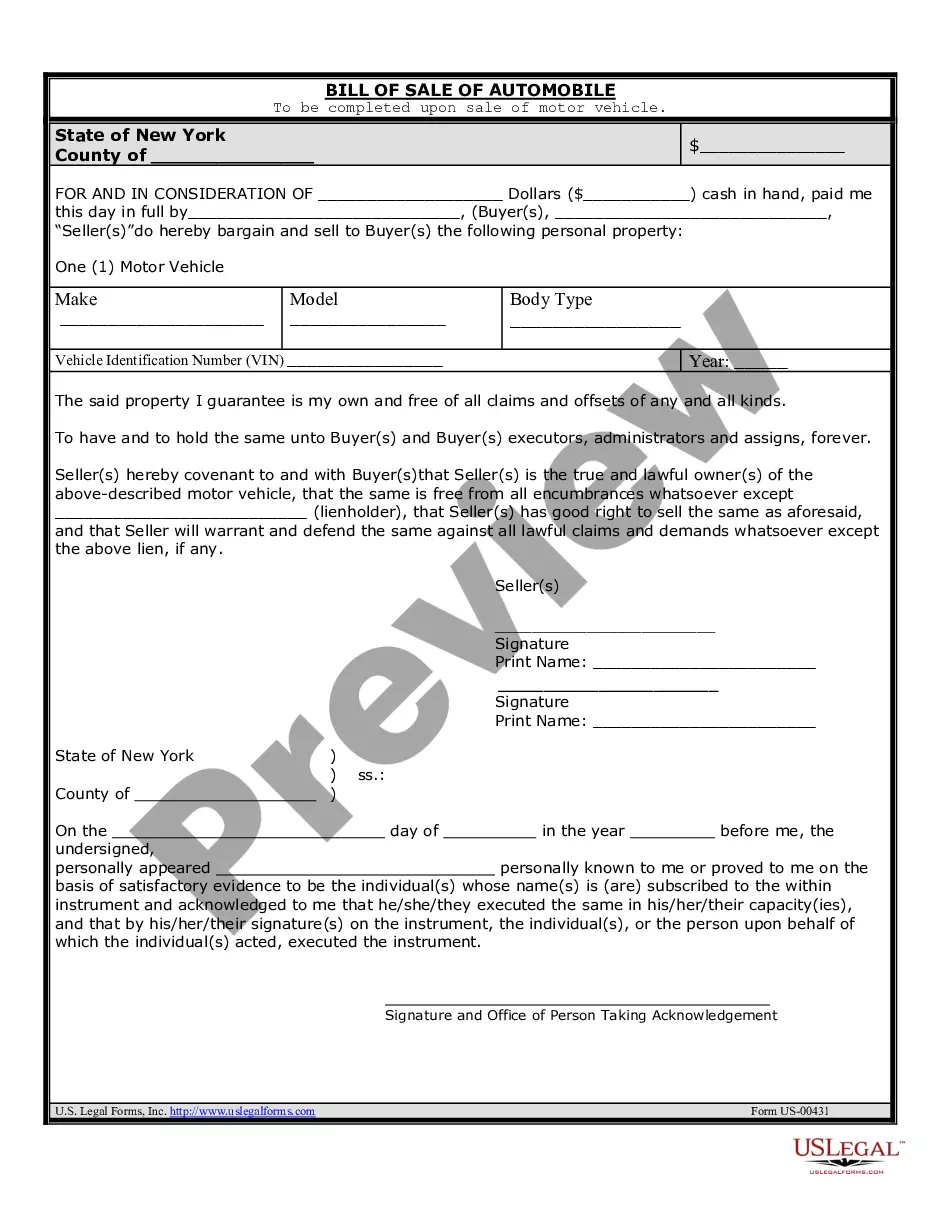

- Step 2. Make use of the Review method to examine the form`s articles. Never neglect to read through the explanation.

- Step 3. Should you be not satisfied using the kind, use the Lookup field towards the top of the display to discover other versions from the lawful kind design.

- Step 4. After you have located the form you want, click the Acquire now button. Choose the rates strategy you favor and add your credentials to sign up on an profile.

- Step 5. Procedure the purchase. You can use your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Find the format from the lawful kind and obtain it on your product.

- Step 7. Complete, revise and produce or sign the South Dakota Employees' Stock Deferral Plan for Norwest Corp..

Every single lawful record design you acquire is yours eternally. You may have acces to each and every kind you downloaded in your acccount. Click on the My Forms area and pick a kind to produce or obtain again.

Be competitive and obtain, and produce the South Dakota Employees' Stock Deferral Plan for Norwest Corp. with US Legal Forms. There are many expert and status-particular types you may use for the organization or person demands.