South Dakota Ratification of stock bonus plan of First West Chester Corp.

Description

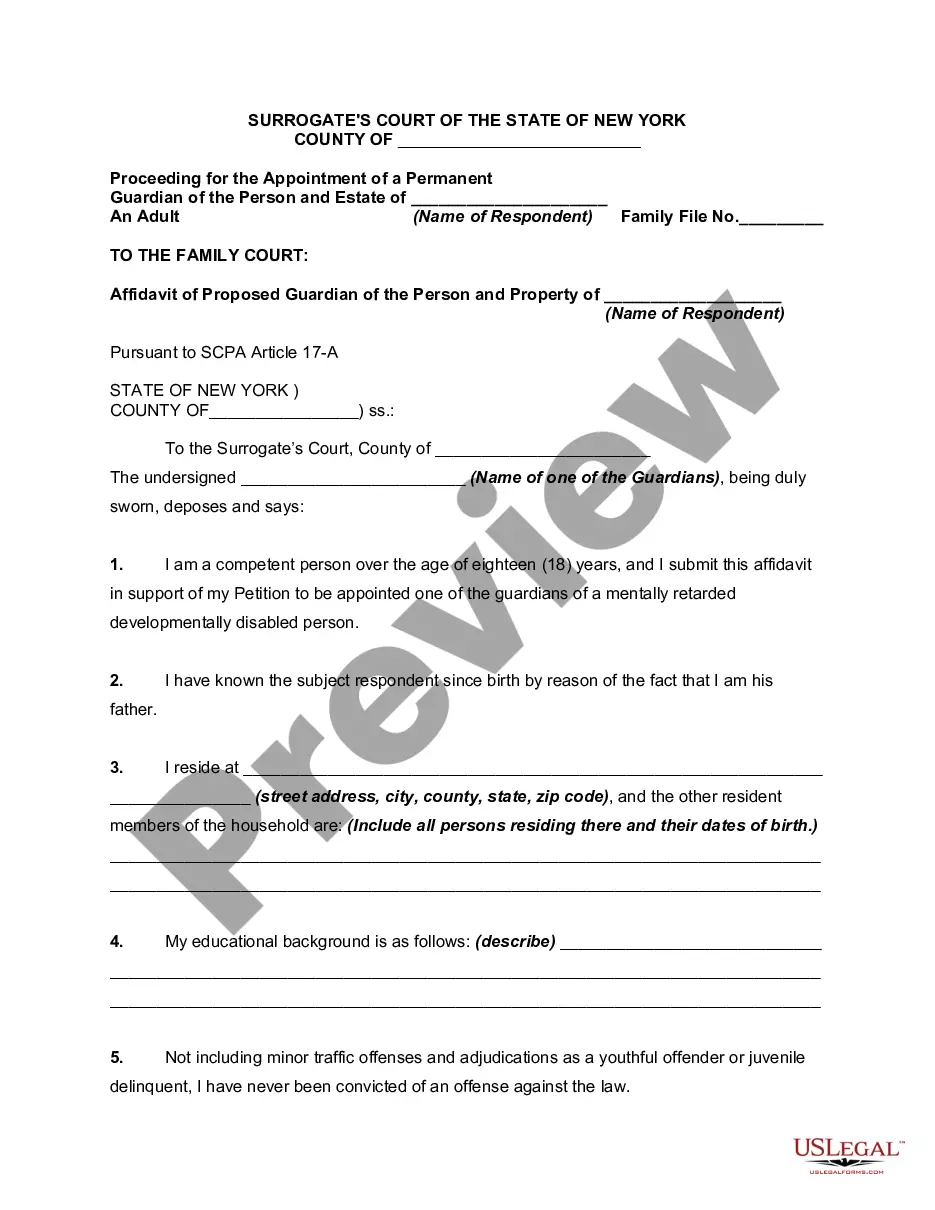

How to fill out Ratification Of Stock Bonus Plan Of First West Chester Corp.?

It is possible to invest hrs on the web searching for the authorized record template which fits the federal and state requirements you require. US Legal Forms offers a huge number of authorized types that are examined by professionals. You can easily acquire or produce the South Dakota Ratification of stock bonus plan of First West Chester Corp. from my service.

If you currently have a US Legal Forms profile, you may log in and click the Download button. After that, you may total, change, produce, or sign the South Dakota Ratification of stock bonus plan of First West Chester Corp.. Each authorized record template you buy is the one you have permanently. To obtain one more backup of any acquired develop, go to the My Forms tab and click the corresponding button.

If you use the US Legal Forms site the very first time, keep to the easy recommendations beneath:

- Initially, be sure that you have selected the correct record template to the state/city of your choosing. See the develop explanation to make sure you have selected the right develop. If accessible, take advantage of the Review button to appear through the record template as well.

- If you want to discover one more model of the develop, take advantage of the Look for area to discover the template that fits your needs and requirements.

- After you have located the template you need, just click Purchase now to carry on.

- Choose the costs plan you need, type in your qualifications, and sign up for your account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal profile to purchase the authorized develop.

- Choose the format of the record and acquire it in your product.

- Make alterations in your record if necessary. It is possible to total, change and sign and produce South Dakota Ratification of stock bonus plan of First West Chester Corp..

Download and produce a huge number of record templates using the US Legal Forms web site, that provides the greatest variety of authorized types. Use professional and state-certain templates to tackle your business or personal demands.