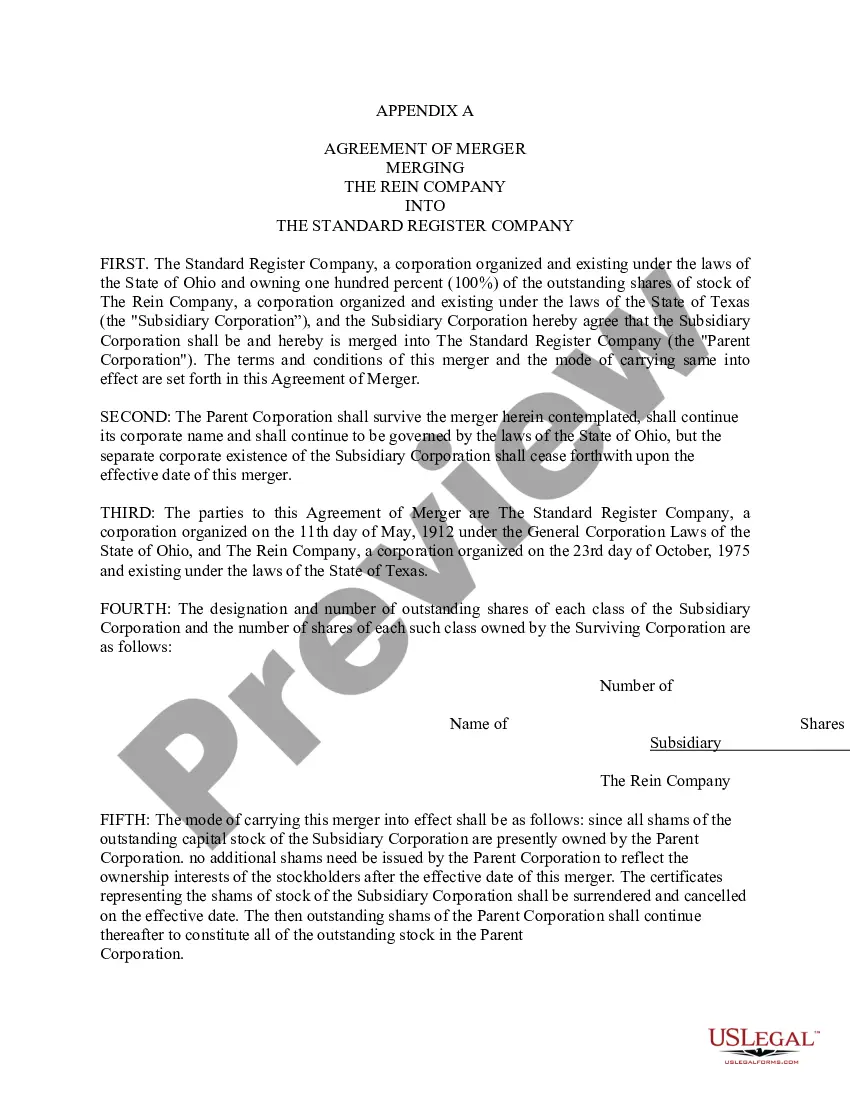

South Dakota Proposal to approve agreement of merger with copy of agreement

Description

How to fill out Proposal To Approve Agreement Of Merger With Copy Of Agreement?

US Legal Forms - one of many most significant libraries of legitimate types in the USA - gives a wide array of legitimate file web templates you may obtain or printing. Utilizing the site, you will get 1000s of types for company and person purposes, categorized by classes, says, or search phrases.You will discover the most up-to-date versions of types like the South Dakota Proposal to approve agreement of merger with copy of agreement within minutes.

If you already have a monthly subscription, log in and obtain South Dakota Proposal to approve agreement of merger with copy of agreement from your US Legal Forms library. The Down load option can look on each and every form you perspective. You have accessibility to all formerly delivered electronically types in the My Forms tab of your respective account.

If you would like use US Legal Forms initially, here are basic instructions to get you started off:

- Make sure you have selected the correct form to your city/region. Go through the Review option to review the form`s information. Look at the form explanation to actually have selected the right form.

- When the form does not suit your requirements, utilize the Search field near the top of the screen to find the the one that does.

- When you are happy with the shape, affirm your choice by clicking the Purchase now option. Then, pick the pricing program you favor and provide your qualifications to sign up for the account.

- Procedure the purchase. Use your bank card or PayPal account to complete the purchase.

- Pick the file format and obtain the shape on the product.

- Make changes. Load, revise and printing and sign the delivered electronically South Dakota Proposal to approve agreement of merger with copy of agreement.

Each and every template you added to your money does not have an expiration date which is yours for a long time. So, if you would like obtain or printing one more duplicate, just go to the My Forms portion and click on around the form you require.

Get access to the South Dakota Proposal to approve agreement of merger with copy of agreement with US Legal Forms, probably the most considerable library of legitimate file web templates. Use 1000s of skilled and express-distinct web templates that fulfill your company or person requires and requirements.