South Dakota Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co.

Description

How to fill out Plan And Agreement Of Merger By Wheeling Pittsburgh Corp, WHX Corp, And WP Merger Co.?

Are you within a situation in which you need documents for sometimes organization or specific functions almost every working day? There are plenty of lawful file web templates available online, but locating types you can depend on is not effortless. US Legal Forms offers a huge number of type web templates, just like the South Dakota Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co., which are composed to satisfy federal and state specifications.

If you are presently informed about US Legal Forms website and have an account, just log in. Afterward, you can download the South Dakota Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. format.

Should you not provide an account and would like to begin using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for your correct metropolis/state.

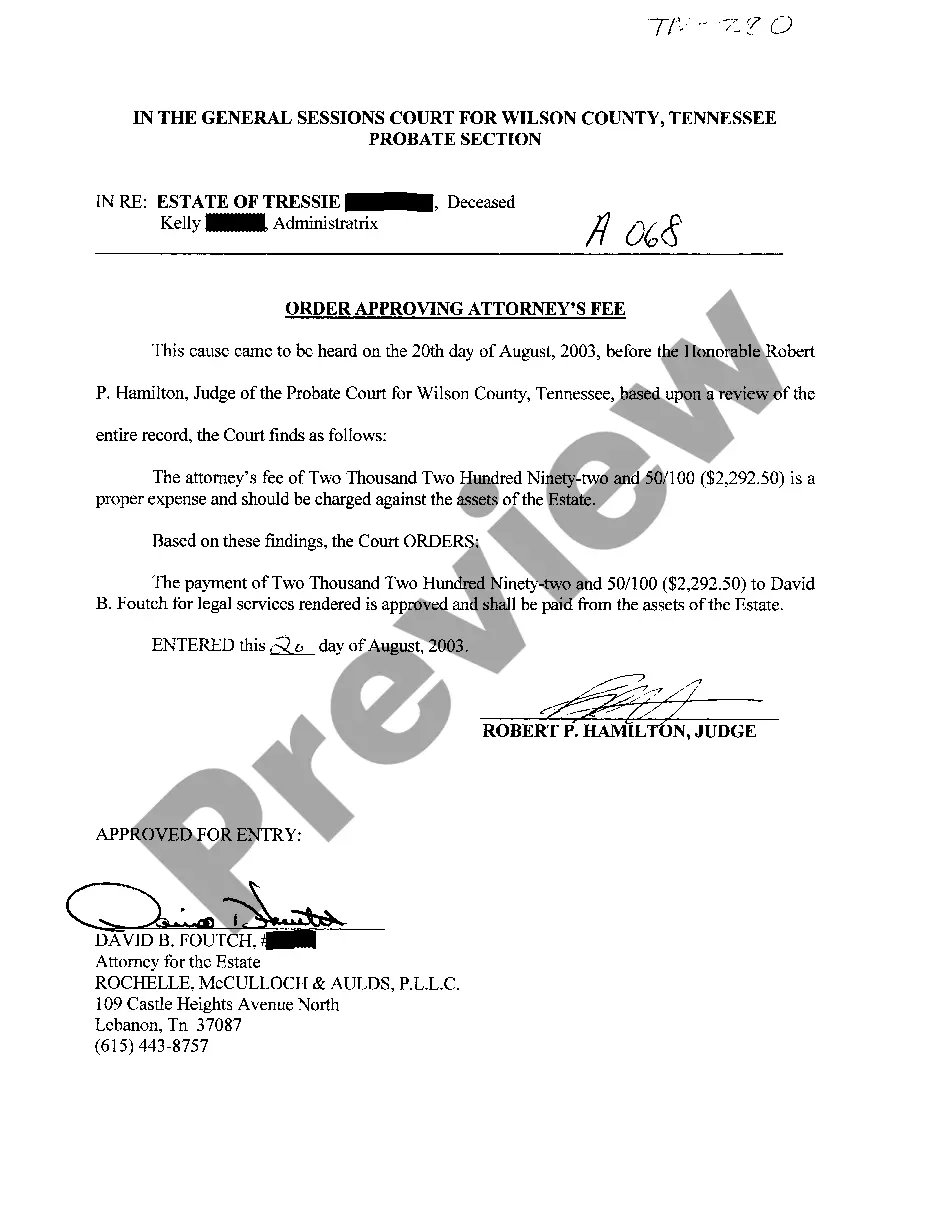

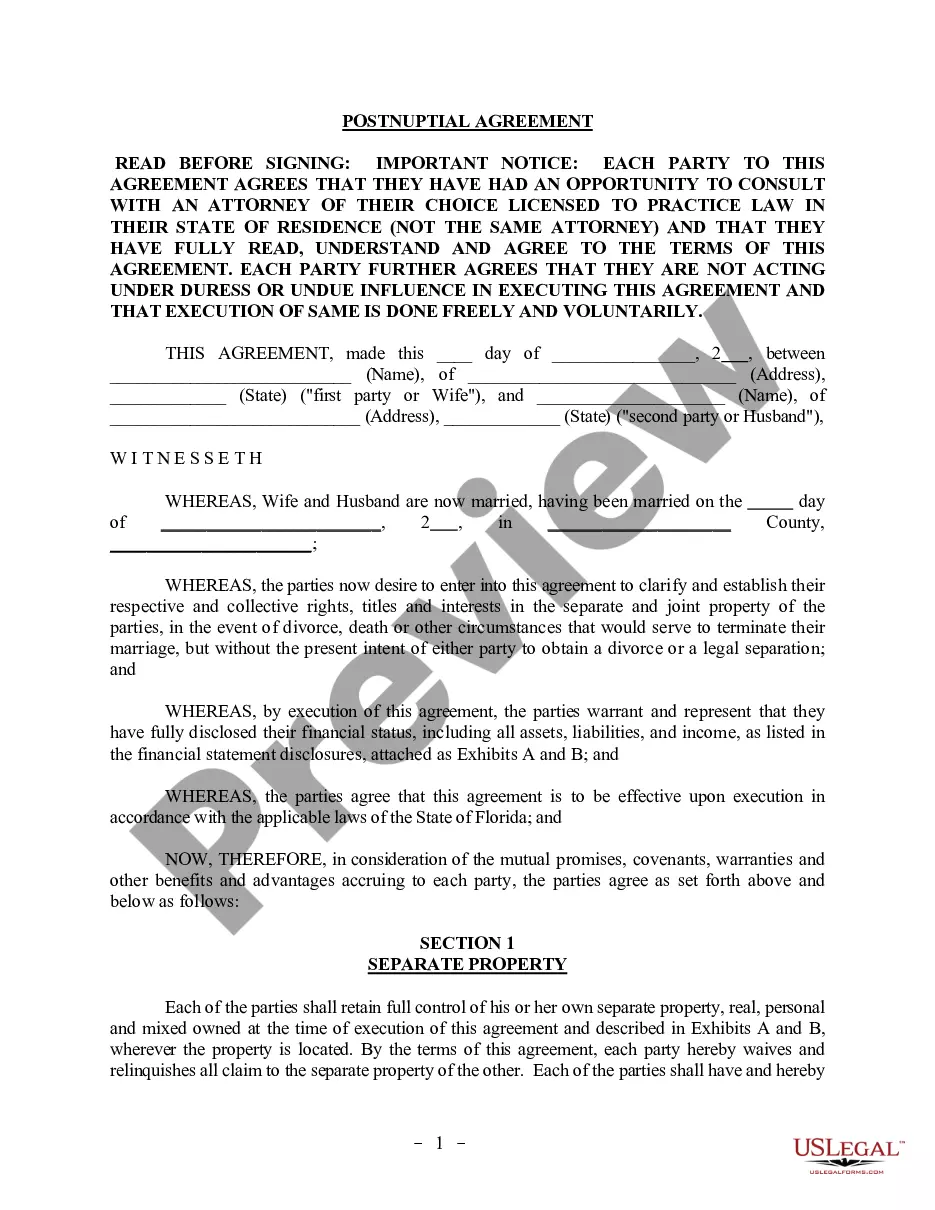

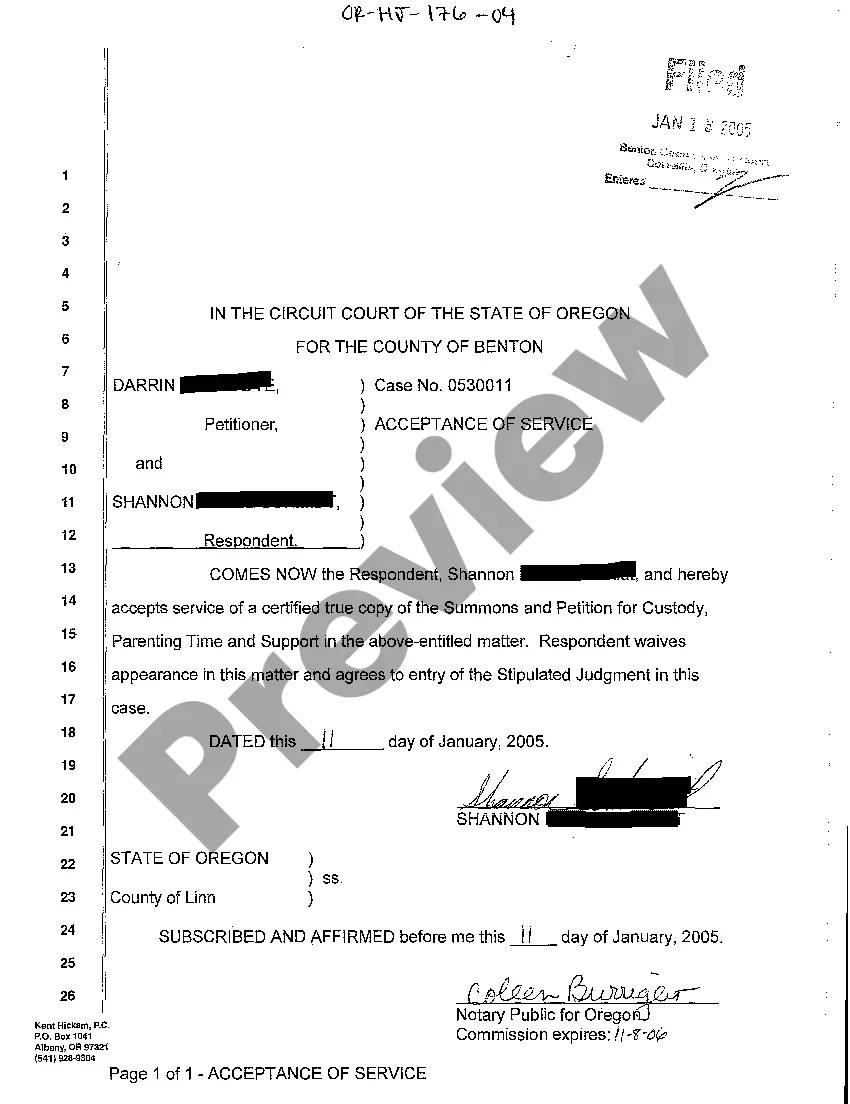

- Take advantage of the Preview switch to analyze the shape.

- See the explanation to ensure that you have chosen the proper type.

- When the type is not what you`re looking for, take advantage of the Research area to find the type that suits you and specifications.

- If you find the correct type, click Buy now.

- Opt for the costs plan you want, submit the specified information to generate your bank account, and buy your order making use of your PayPal or credit card.

- Pick a handy paper formatting and download your copy.

Discover all the file web templates you possess purchased in the My Forms menus. You can get a further copy of South Dakota Plan and Agreement of Merger by Wheeling Pittsburgh Corp, WHX Corp, and WP Merger Co. whenever, if required. Just select the necessary type to download or print out the file format.

Use US Legal Forms, by far the most considerable variety of lawful kinds, to save lots of time as well as steer clear of errors. The support offers professionally created lawful file web templates that you can use for a range of functions. Create an account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

12.2 Merger Clause. This Agreement and the other agreements, documents or instruments contemplated hereby shall constitute the entire agreement between the Parties, and shall supersede all prior agreements, understandings and negotiations between the Parties with respect to the subject matter hereof.

A merger agreement (or ?definitive merger agreement?) is the legal contract that is drawn up and signed by both parties when two companies merge. Its terms and conditions can be quite detailed, and it usually spells out several parameters regarding staffing actions to be implemented.

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

Questions to Ask During a Merger or Acquisition Company. ? What is the timeframe for change? When can customers expect to see changes to the company or products? ... People. ? What will happen to the current leadership team? ... Products. ? Are there any plans to sunset the brand of one of the companies?