South Dakota Reorganization of corporation as a Massachusetts business trust with plan of reorganization

Description

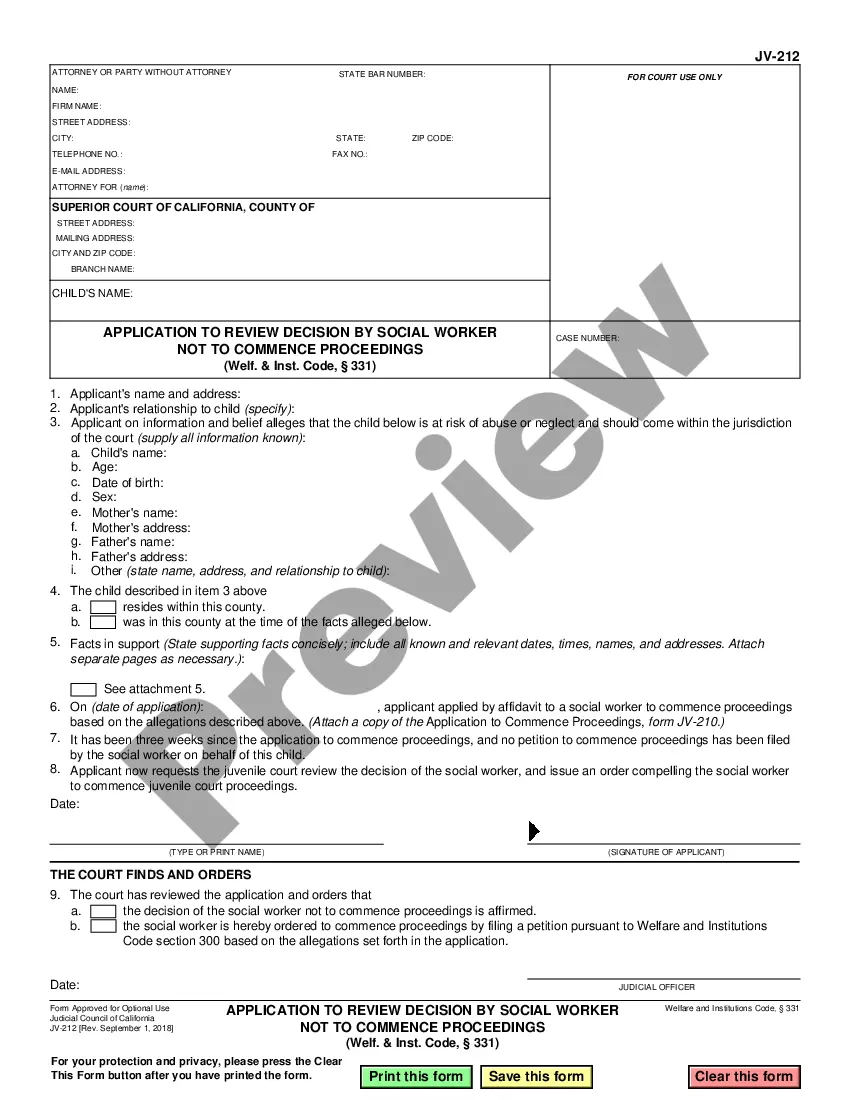

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

It is possible to commit hours on the Internet searching for the legitimate document template that meets the federal and state needs you require. US Legal Forms supplies thousands of legitimate kinds that happen to be analyzed by pros. You can actually down load or print out the South Dakota Reorganization of corporation as a Massachusetts business trust with plan of reorganization from your support.

If you currently have a US Legal Forms bank account, you are able to log in and click the Obtain option. Afterward, you are able to total, edit, print out, or sign the South Dakota Reorganization of corporation as a Massachusetts business trust with plan of reorganization. Every single legitimate document template you get is your own for a long time. To acquire yet another backup of the bought kind, go to the My Forms tab and click the related option.

Should you use the US Legal Forms site initially, adhere to the straightforward guidelines listed below:

- First, make sure that you have chosen the right document template for your state/town of your liking. Look at the kind explanation to make sure you have selected the correct kind. If offered, make use of the Preview option to appear throughout the document template also.

- In order to find yet another variation from the kind, make use of the Lookup area to obtain the template that meets your needs and needs.

- Once you have identified the template you desire, just click Buy now to continue.

- Select the costs prepare you desire, type in your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal bank account to fund the legitimate kind.

- Select the formatting from the document and down load it to the gadget.

- Make alterations to the document if necessary. It is possible to total, edit and sign and print out South Dakota Reorganization of corporation as a Massachusetts business trust with plan of reorganization.

Obtain and print out thousands of document layouts utilizing the US Legal Forms web site, which offers the greatest collection of legitimate kinds. Use professional and condition-certain layouts to take on your company or person needs.

Form popularity

FAQ

To claim the exemption, the buyer or their agent must provide the vendor with: A signed copy of Sales Tax Exempt Purchaser Certificate (Form ST-5) or Contractor's Sales Tax Exempt Purchase Certificate (Form ST-5C), and. A copy of the organization's Certificate of Exemption (Form ST-2) issued by DOR.

The Act, as amended, will prohibit Massachusetts from taxing telecommunications services purchased by Internet Service Providers to provide Internet access on and after November 1, 2005. The Massachusetts statutory definition of taxable telecommunication services is unchanged by the Act.

How Do I Get a Resale Certificate in Massachusetts Download Form ST-4, the Massachusetts resale certificate. Enter your business name and address. Fill out a description of your business. Enter your Federal Employer Identification Number (EIN) Describe the items being purchased. Include the name and address of the seller.

Massachusetts trusts (also known as common-law trusts, business trusts, or unincorporated business organizations) are a unique type of trust used by individuals to run a business outside the normal legal entities such as a corporation or partnership.

Telecommunications tax Massachusetts collects a 6.25 percent sales tax rate on most telecommunications services, including: Voice and non-voice telephone services. Long-distance calls billed per minute or otherwise billed separately, whether the call is made online or not.