South Dakota Plan of complete liquidation and dissolution

Description

How to fill out Plan Of Complete Liquidation And Dissolution?

Choosing the best lawful papers web template might be a battle. Needless to say, there are plenty of themes available online, but how will you obtain the lawful form you want? Use the US Legal Forms web site. The support provides 1000s of themes, like the South Dakota Plan of complete liquidation and dissolution, which can be used for enterprise and personal requirements. Every one of the types are checked out by experts and fulfill state and federal needs.

Should you be presently registered, log in to your profile and click on the Acquire switch to find the South Dakota Plan of complete liquidation and dissolution. Utilize your profile to look through the lawful types you have acquired previously. Go to the My Forms tab of the profile and obtain one more backup of your papers you want.

Should you be a brand new end user of US Legal Forms, listed here are easy instructions for you to stick to:

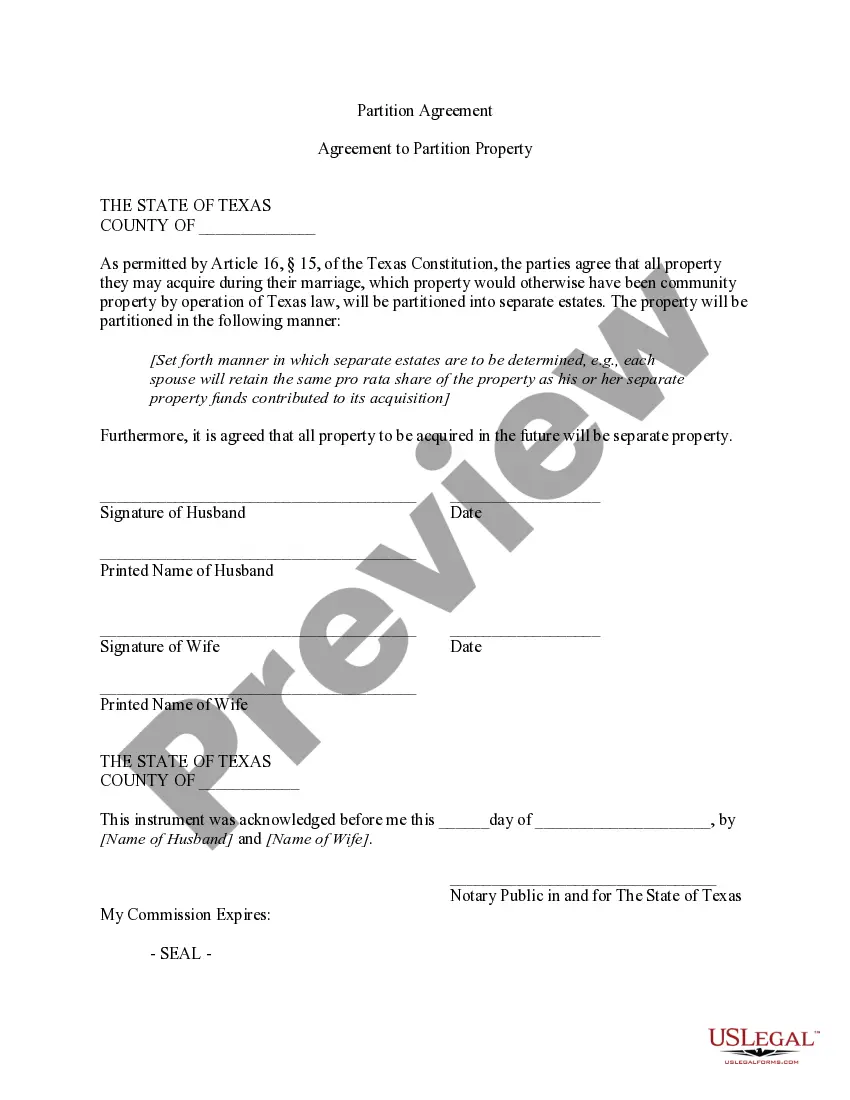

- Very first, make certain you have selected the correct form for the town/county. It is possible to look over the form making use of the Review switch and look at the form description to make sure this is basically the right one for you.

- In case the form fails to fulfill your preferences, take advantage of the Seach discipline to find the proper form.

- When you are certain the form is proper, click the Acquire now switch to find the form.

- Pick the rates prepare you desire and type in the required information. Build your profile and buy an order utilizing your PayPal profile or charge card.

- Select the submit formatting and acquire the lawful papers web template to your system.

- Total, modify and print and indication the received South Dakota Plan of complete liquidation and dissolution.

US Legal Forms is the most significant local library of lawful types that you can discover a variety of papers themes. Use the service to acquire skillfully-created documents that stick to express needs.

Form popularity

FAQ

When a corporation dissolves, it generally must stop conducting all business, and liquidate its assets to pay off creditors and shareholders. When a corporation's assets are liquidated they first must be used to pay off any outstanding debts the corporation owes, including those owed to shareholders.

How do you dissolve/terminate a South Dakota Limited Liability Company? To dissolve/terminate your domestic LLC in South Dakota, you must submit the completed Articles of Termination form to the South Dakota Secretary of State by mail or in person and in duplicate along with the filing fee.

Dissolution. The first step to closing up shop is receiving shareholder approval to formally close the corporation. The board of directors should adopt a resolution to dissolve the corporation and receive approval for the action.

6 Steps to Dissolve a Corporation #1 ? Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors. ... #2 ? File Articles of Dissolution. ... #3 ? Finalize Taxes. ... #4 ? Notify Creditors. ... #5 ? Liquidate and Distribute Assets. ... #6 ? Wrap Up Operations.

To dissolve a corporation, California's default rules call for written consent by shareholders holding at least 50% of the voting power?the same minimum requirement if there was a vote at a meeting. However, the corporation's articles can require a higher voting percentage.

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.