A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

South Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

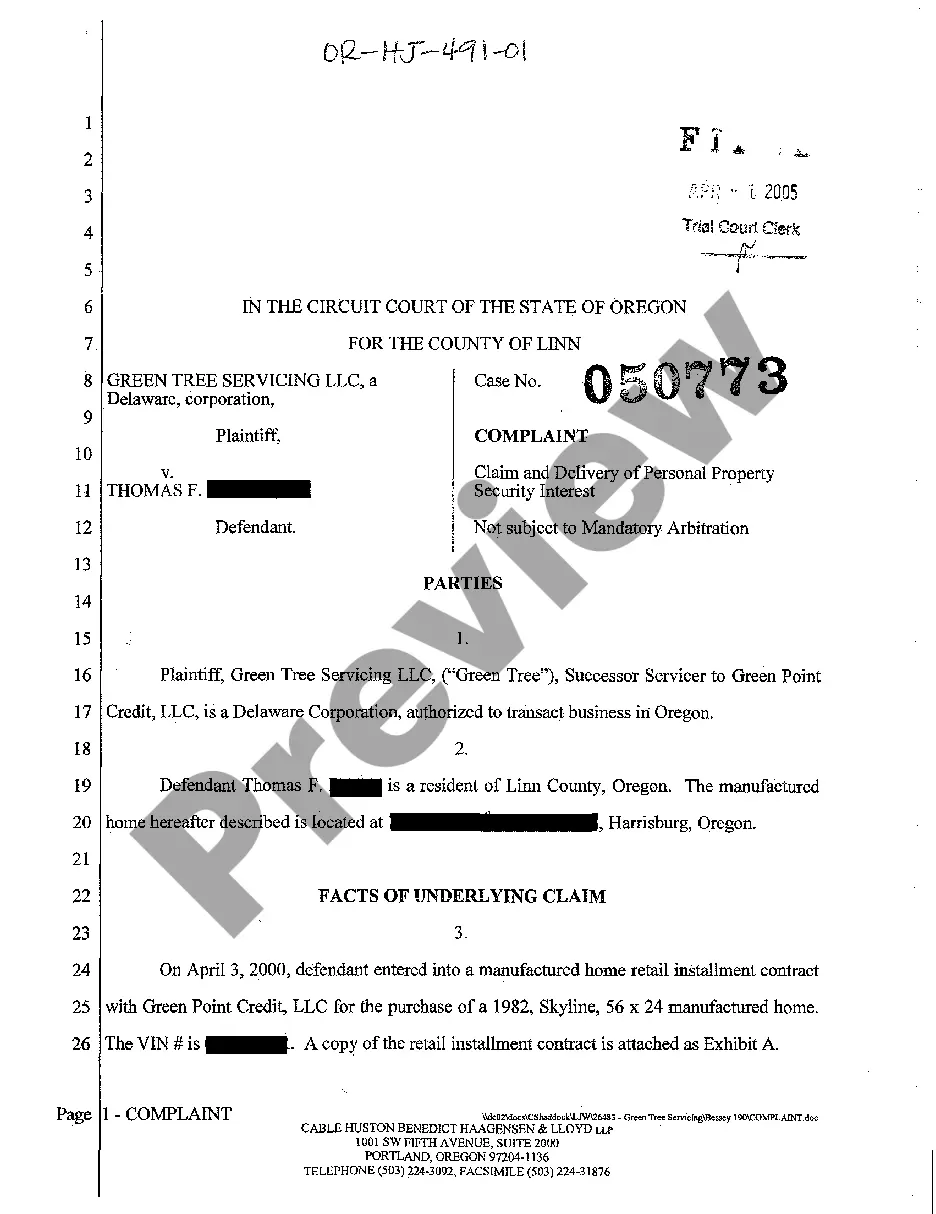

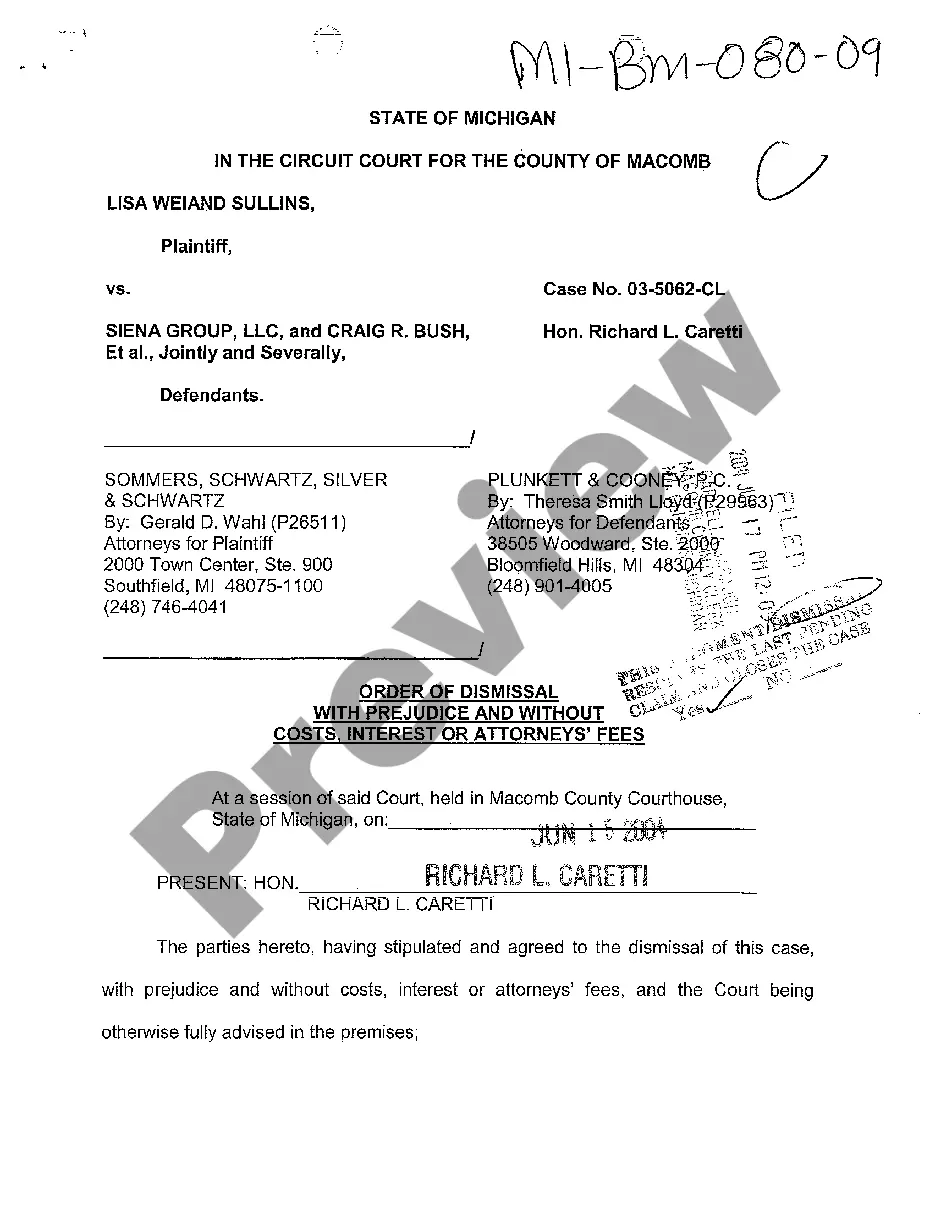

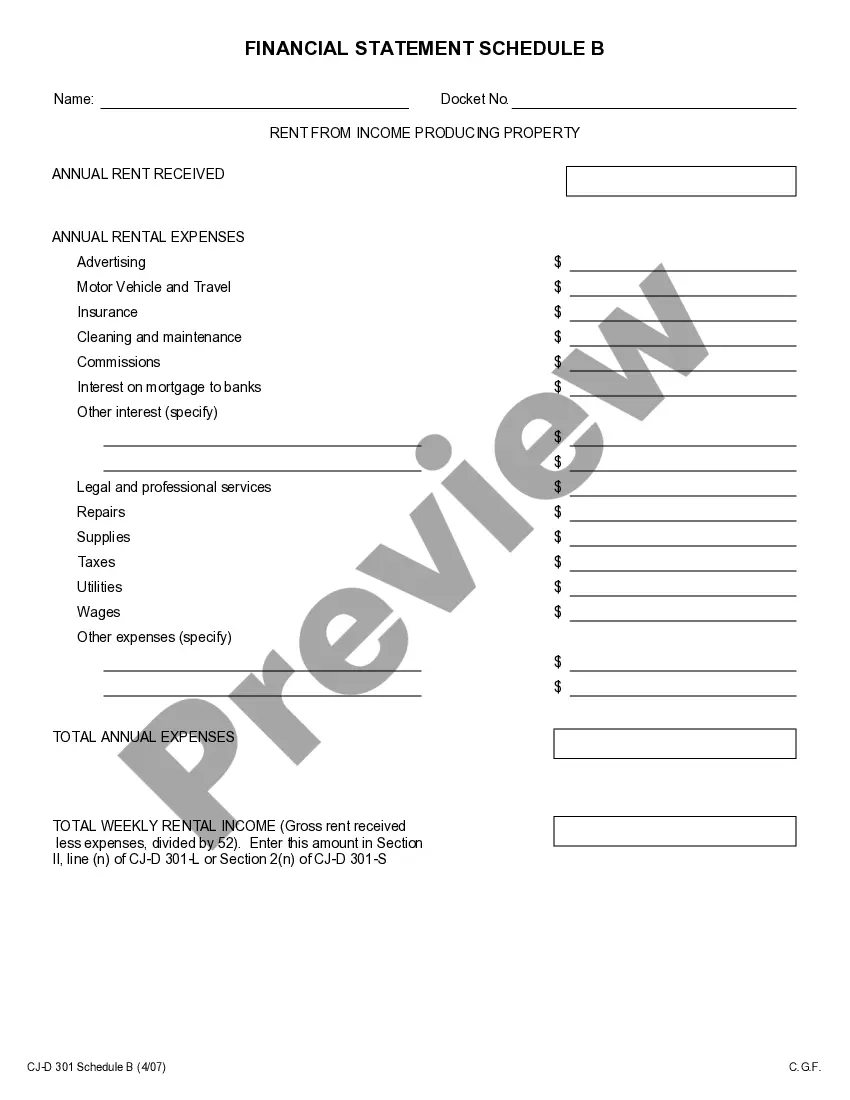

How to fill out South Dakota Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you have to full, download, or print lawful record layouts, use US Legal Forms, the greatest assortment of lawful forms, that can be found online. Take advantage of the site`s simple and easy convenient lookup to obtain the paperwork you will need. Different layouts for organization and specific functions are sorted by groups and says, or search phrases. Use US Legal Forms to obtain the South Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with a couple of click throughs.

In case you are currently a US Legal Forms client, log in in your profile and click on the Down load option to have the South Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. Also you can accessibility forms you previously saved within the My Forms tab of the profile.

Should you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your appropriate city/land.

- Step 2. Take advantage of the Review solution to examine the form`s content. Do not overlook to see the information.

- Step 3. In case you are unhappy together with the type, use the Lookup field towards the top of the screen to discover other models from the lawful type template.

- Step 4. After you have identified the form you will need, click on the Buy now option. Opt for the pricing plan you choose and add your references to sign up to have an profile.

- Step 5. Method the purchase. You can use your Мisa or Ьastercard or PayPal profile to finish the purchase.

- Step 6. Choose the format from the lawful type and download it in your product.

- Step 7. Full, modify and print or indication the South Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Each lawful record template you get is yours forever. You possess acces to every single type you saved within your acccount. Select the My Forms area and select a type to print or download once again.

Be competitive and download, and print the South Dakota Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with US Legal Forms. There are thousands of specialist and condition-particular forms you can use for the organization or specific requirements.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

In South Dakota, the statute of limitations is six years. If a debt collector attempts to collect a debt that is older than what is permitted under state law, you may be able to sue them.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

How long does a judgment lien last in South Dakota? A judgment lien in South Dakota will remain attached to the debtor's property (even if the property changes hands) for ten years.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

Creditors, debt collectors, and debt buyers have the legal right to garnish your wages in South Dakota once they have a court judgment.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.