South Dakota Third Party Financing Agreement Workform

Description

How to fill out South Dakota Third Party Financing Agreement Workform?

Discovering the right authorized papers design might be a struggle. Obviously, there are a variety of layouts accessible on the Internet, but how do you discover the authorized type you want? Take advantage of the US Legal Forms site. The services offers a large number of layouts, including the South Dakota Third Party Financing Agreement Workform, which you can use for organization and private requires. Each of the varieties are examined by professionals and fulfill state and federal specifications.

In case you are already registered, log in to the account and click the Acquire button to find the South Dakota Third Party Financing Agreement Workform. Make use of account to look throughout the authorized varieties you possess purchased previously. Visit the My Forms tab of your own account and obtain another version of your papers you want.

In case you are a whole new consumer of US Legal Forms, listed below are basic recommendations so that you can comply with:

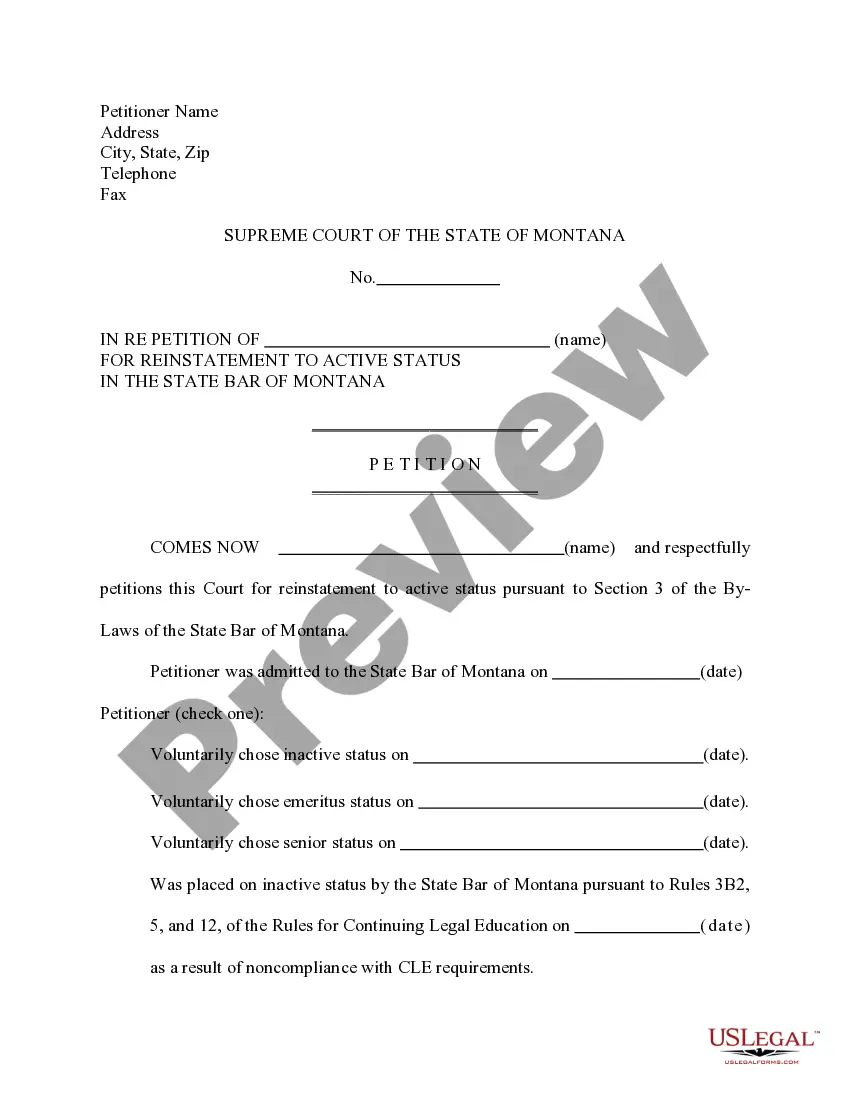

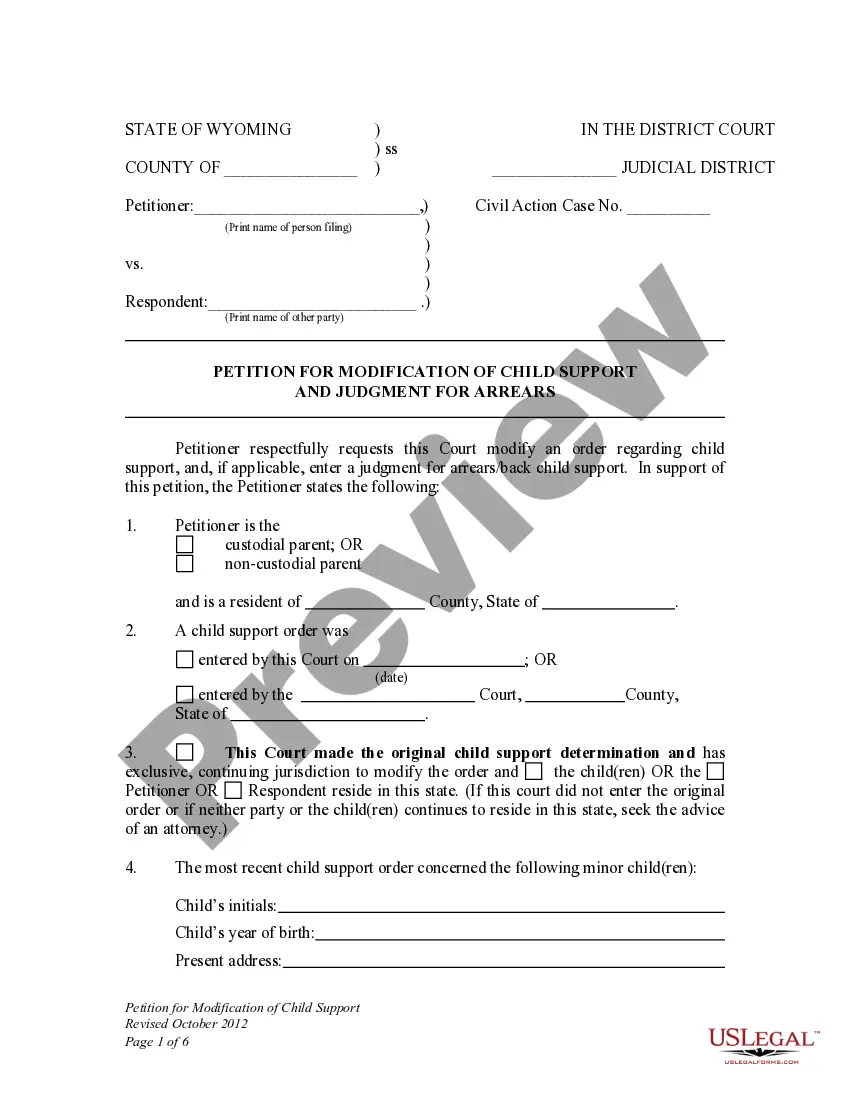

- Initially, ensure you have selected the right type to your metropolis/county. You are able to examine the shape making use of the Preview button and study the shape explanation to make certain this is basically the right one for you.

- If the type does not fulfill your requirements, take advantage of the Seach discipline to discover the right type.

- When you are certain that the shape would work, click on the Purchase now button to find the type.

- Pick the prices program you would like and enter the needed info. Build your account and buy the order with your PayPal account or Visa or Mastercard.

- Opt for the data file formatting and download the authorized papers design to the device.

- Comprehensive, revise and printing and indicator the obtained South Dakota Third Party Financing Agreement Workform.

US Legal Forms is definitely the most significant collection of authorized varieties for which you can discover different papers layouts. Take advantage of the service to download appropriately-manufactured papers that comply with state specifications.

Form popularity

FAQ

South Dakota Trust Company (SDTC) can assist a family or a family office with the setup, operation and administration of a cost-effective South Dakota regulated trust company by serving as Corporate Agent.

The Third Party Financing Addendum is designed to limit the maximum amount of interest and loan fees that a buyer would be obligated to pay as part of his loan contingency.

The Third-Party Financing refers solely to debt financing. The project financing comes from a third party, usually a financial institution or other investor, or the ESCO, which is not the user or customer.

South Dakota is home to 63 public trust companies and 43 private trust companies. A private trust company limits activities to management of private assets, typically for the benefit of a single-family lineage.

A third (3rd) party financing addendum is attached to a sales contract that outlines the terms of a loan (e.g., conventional, FHA, VA) that is agreeable to the buyer in order to close on the property. The sales contract is usually contingent upon the buyer receiving the loan as detailed in the addendum.

South Dakota Administrative Fee 2018 The fee is 0.02% for all applicable employers.

Based on these considerations, some of the most common jurisdictions for private trust companies are Alaska, Delaware, Nevada, New Hampshire, South Dakota, Tennessee, and Wyoming.

South Dakota offers everything a wealthy person setting up a trust could want. There is no state income tax or capital gains tax, so investment gains on assets placed in the trust are tax-free if it's structured correctly. Robust protections provide anonymity and shield assets from creditors.

The UI tax funds unemployment compensation programs for eligible employees. In South Dakota, state UI tax is one of the primary taxes that employers must pay. Unlike most other states, South Dakota does not have state withholding taxes.

The minimum annual fee is $3,750 and the maximum annual fee is $20,000 for private trust companies, while the minimum annual fee is $4,500 and the maximum annual fee is $30,000 for public trust companies.