Keywords: South Dakota, renunciation and disclaimer, right to inheritance, inherit property, deceased, specific property. 1. Understanding South Dakota Renunciation and Disclaimer of Right to Inheritance: In South Dakota, individuals have the option to renounce or disclaim their right to inherit property from a deceased person. This legal process allows an individual to voluntarily give up their entitlement to a specific property or inheritance. Renunciation and disclaimer are important tools that enable individuals to manage their inheritance affairs according to their own wishes and circumstances. 2. The Purpose of Renunciation and Disclaimer: The renunciation and disclaimer process in South Dakota provides individuals with the flexibility to decline an inheritance, ensuring that they are not bound by any obligations or responsibilities associated with the specific property or inheritance. By renouncing their claim, individuals can avoid potential tax liabilities, debts, or legal disputes that may arise from accepting the inheritance. 3. Different Types of South Dakota Renunciation and Disclaimer: There are various types of renunciation and disclaimer options available in South Dakota, tailored to suit different circumstances. These include: — Renunciation of Right to Inherit Specific Property: Individuals may choose to renounce their right to inherit a specific piece of property, such as real estate, vehicles, or valuable assets. By renouncing the inheritance of a particular property, individuals can ensure their freedom from any obligations or burdens attached to it. — Disclaimer of Right to Inherit from a Deceased Individual: In some cases, individuals may choose to disclaim their right to inherit from a deceased individual entirely. This means that they are declining any entitlement to the deceased person's estate, which may include multiple properties, bank accounts, investments, or personal belongings. — Renunciation and Disclaimer Process: To effectively renounce or disclaim an inheritance in South Dakota, individuals must follow a specific legal process. This may involve filing a formal renunciation or disclaimer statement with the appropriate court or probate authority, clearly stating their intention to give up their rights to the specific property or inheritance. 4. Consultation with an Attorney: Given the complexity of renunciation and disclaimer processes, individuals considering such actions in South Dakota are advised to consult with an experienced attorney specializing in estate planning and inheritance laws. An attorney can provide expert guidance, review the details of the specific property or inheritance, and ensure compliance with all legal requirements. 5. Benefits and Considerations: By renouncing or disclaiming an inheritance in South Dakota, individuals can gain several benefits, including avoiding potential tax liabilities, debts, or legal complications associated with the inheritance. However, it is crucial to carefully consider the implications before making this decision, as it can have long-term financial and legal consequences. Seeking professional advice is essential to understand the pros and cons of renunciation and disclaimer in each unique situation. In summary, renunciation and disclaimer of the right to inheritance in South Dakota allow individuals to voluntarily give up their entitlement to a specific property or inheritance from a deceased person. Various types of renunciation and disclaimer options exist, catered to different circumstances. Seeking legal counsel is highly recommended navigating this process effectively.

South Dakota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

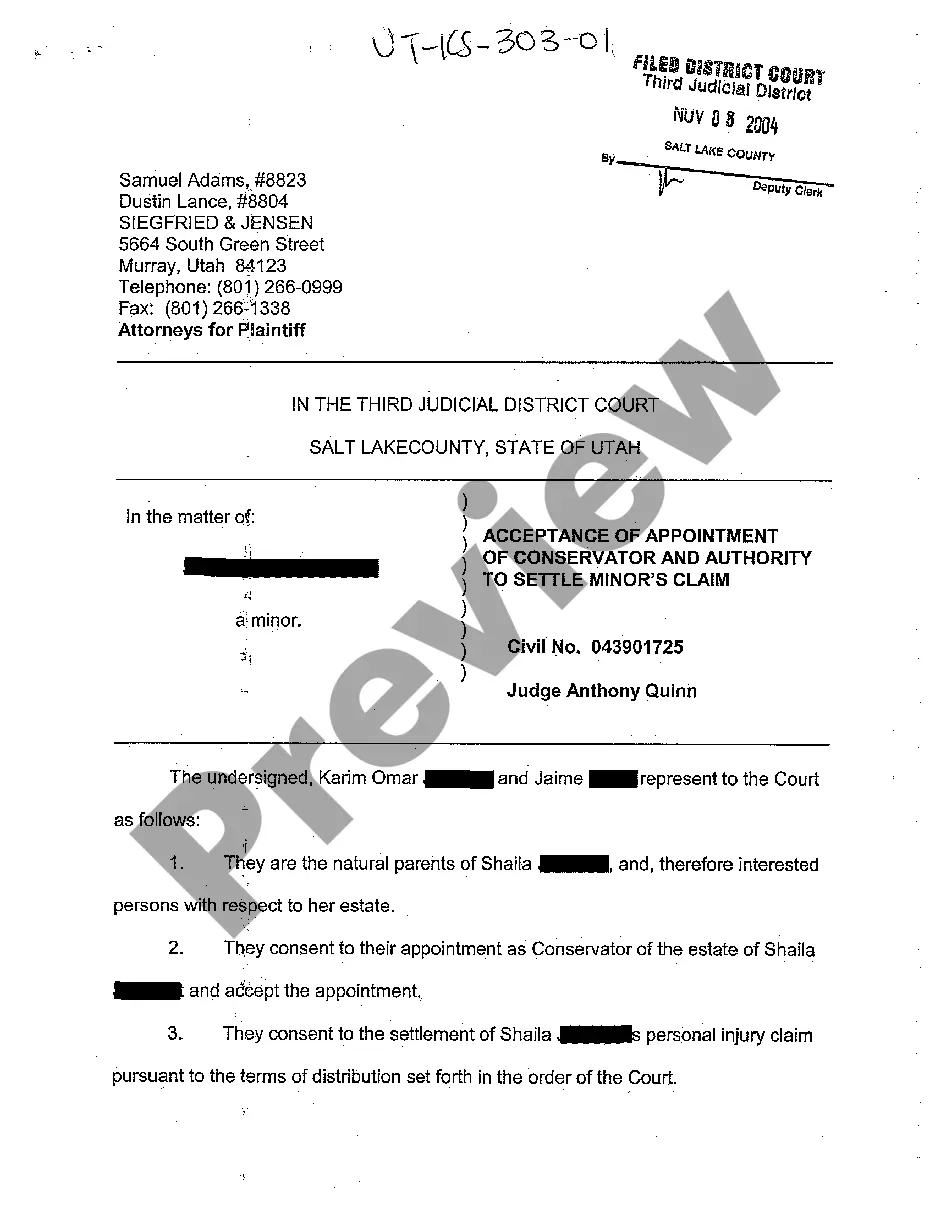

How to fill out South Dakota Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

US Legal Forms - among the greatest libraries of authorized kinds in the States - offers an array of authorized document templates you may down load or printing. Making use of the internet site, you will get a huge number of kinds for enterprise and personal purposes, categorized by categories, says, or keywords and phrases.You can get the newest models of kinds like the South Dakota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property within minutes.

If you already possess a membership, log in and down load South Dakota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property through the US Legal Forms local library. The Obtain key will appear on each and every form you perspective. You have access to all previously downloaded kinds from the My Forms tab of your bank account.

If you want to use US Legal Forms for the first time, listed here are easy guidelines to get you began:

- Be sure you have picked out the best form to your town/region. Click on the Preview key to examine the form`s content. See the form information to ensure that you have selected the right form.

- If the form does not suit your demands, utilize the Lookup field on top of the display screen to get the one that does.

- In case you are pleased with the form, validate your selection by visiting the Get now key. Then, opt for the costs program you favor and supply your accreditations to register to have an bank account.

- Method the transaction. Use your charge card or PayPal bank account to accomplish the transaction.

- Select the file format and down load the form on the gadget.

- Make alterations. Load, edit and printing and sign the downloaded South Dakota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

Every format you put into your bank account does not have an expiry date and is also the one you have for a long time. So, if you would like down load or printing another copy, just proceed to the My Forms segment and click on the form you will need.

Obtain access to the South Dakota Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property with US Legal Forms, one of the most extensive local library of authorized document templates. Use a huge number of expert and express-particular templates that meet up with your company or personal demands and demands.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

When you disclaim an inheritance, you will not receive the inheritance and it will instead pass onto the next Beneficiary. It is important to note that when you disclaim an inheritance, you do not get to choose who the Beneficiary will be in your place. Reasons to Disclaim an Inheritance - Trust & Will Trust & Will ? learn ? reasons-to-disclaim-a... Trust & Will ? learn ? reasons-to-disclaim-a...

When a person files a disclaimer he can disclaim all or any portion of the inheritance. It is not an ?all or nothing? proposition. For example, if the estate was $500,000, the beneficiary could disclaim $100,000 so that amount would pass to his children. The beneficiary would retain the remaining $400,000. Using Disclaimers in Post-Modern Estate Planning - Farr Law Firm farr.com ? using-disclaimers-in-post-modern-estat... farr.com ? using-disclaimers-in-post-modern-estat...

A Disclaimer of Inheritance is a written statement in which a potential heir or beneficiary voluntarily renounces or disclaims their right to inherit assets or property from a deceased person's estate. Disclaimer of Inheritance - Sign Templates - Jotform jotform.com ? pdf-templates ? disclaimer-of... jotform.com ? pdf-templates ? disclaimer-of...

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

Though the difference between a qualified disclaimer and a non-qualified disclaimer, is simple, the tax implications to the disclaimant can be dire: if a disclaimant executes a non-qualified disclaimer of an asset, they are treated as making a gift of the asset to the ?next person in line? for the asset, whereas, if a ... Disclaimers - What is it, and what you need to know - Trustate trustate.com ? post ? disclaimers-what-is-it-a... trustate.com ? post ? disclaimers-what-is-it-a...

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

Disclaiming an inheritance is when a potential heir renounces their right to inherit any assets or property left to them. This decision must be made before the heir takes any possession or control of the inheritance. There are no reversals.