South Dakota Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.

Description

How to fill out Trust Agreement Between Nike Securities, L.P., The Chase Manhattan Bank And First Trust Advisors, L.P.?

You can commit time on the Internet looking for the legal papers template that fits the state and federal demands you will need. US Legal Forms provides a large number of legal kinds that happen to be analyzed by pros. It is possible to download or print the South Dakota Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P. from my support.

If you already have a US Legal Forms profile, you are able to log in and click the Obtain option. After that, you are able to complete, change, print, or indication the South Dakota Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P.. Every single legal papers template you buy is your own forever. To get yet another backup for any acquired type, visit the My Forms tab and click the corresponding option.

Should you use the US Legal Forms web site the first time, stick to the simple recommendations below:

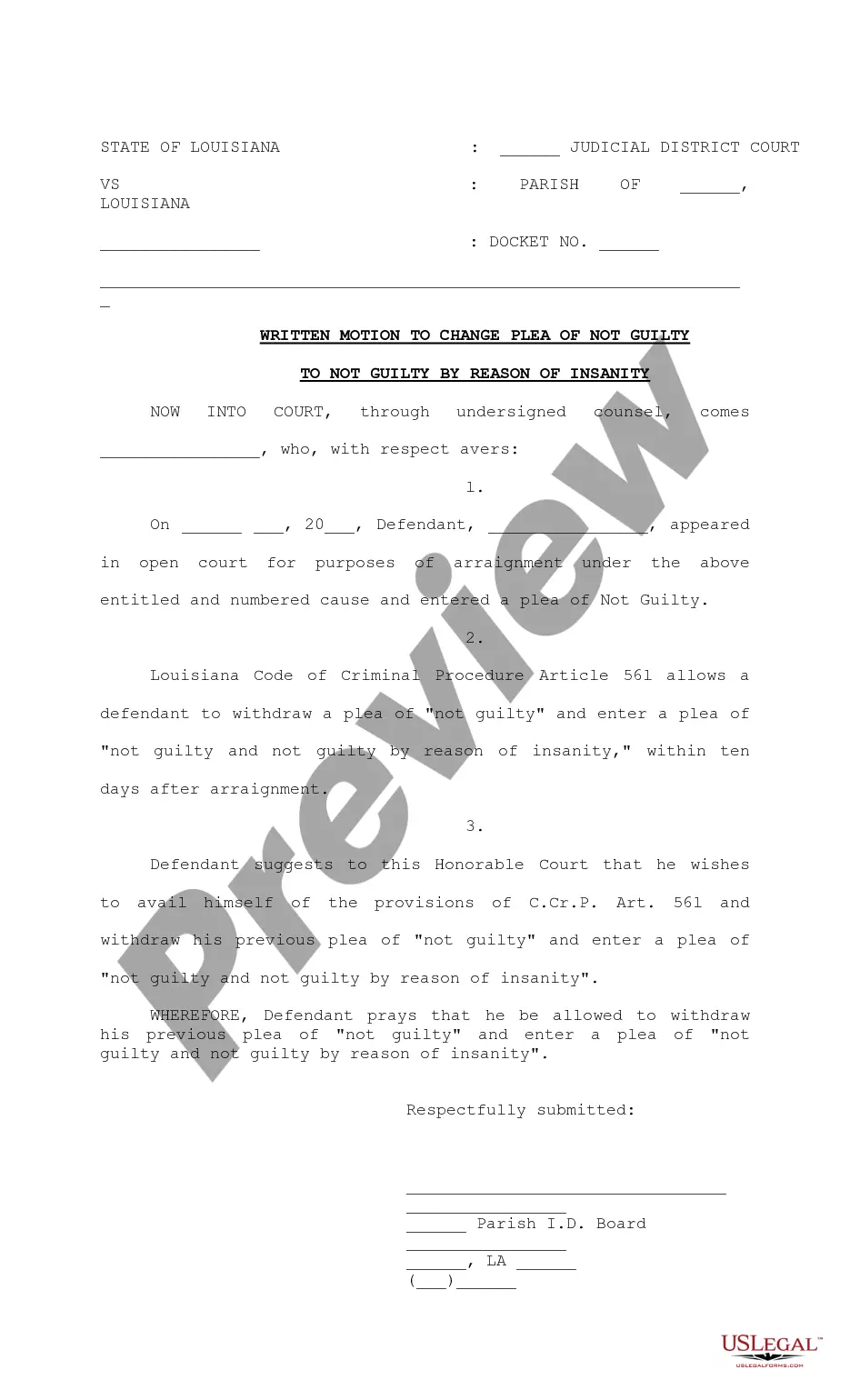

- First, ensure that you have selected the proper papers template to the state/metropolis that you pick. Look at the type explanation to ensure you have selected the right type. If available, utilize the Review option to search throughout the papers template as well.

- If you want to discover yet another model from the type, utilize the Research discipline to discover the template that meets your requirements and demands.

- Once you have identified the template you want, click Acquire now to move forward.

- Find the costs prepare you want, type in your accreditations, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your charge card or PayPal profile to fund the legal type.

- Find the structure from the papers and download it to the device.

- Make alterations to the papers if required. You can complete, change and indication and print South Dakota Trust Agreement between Nike Securities, L.P., The Chase Manhattan Bank and First Trust Advisors, L.P..

Obtain and print a large number of papers web templates using the US Legal Forms site, which offers the greatest assortment of legal kinds. Use professional and state-distinct web templates to handle your business or specific requires.