A South Dakota Stockholders Agreement is a legal document that outlines the terms and conditions between America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. pertaining to their stock ownership and related matters. This agreement governs the rights and obligations of the companies and their respective stockholders in the state of South Dakota. Here are some important details regarding this agreement: 1. Purpose: The purpose of the South Dakota Stockholders Agreement is to establish the guidelines for ownership, management, and decision-making processes related to the stocks held by America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. This agreement ensures a clear understanding and establishes a framework for operating as a unified entity. 2. Parties involved: The primary parties involved in the South Dakota Stockholders Agreement are America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. Each company owns a specific number of shares in the other companies, and this agreement governs their relationships. 3. Stock ownership: The agreement specifies the number and type of shares held by each company. It outlines the rights, privileges, and restrictions associated with these shares, including voting rights, dividend entitlements, and transferability. 4. Decision-making: The South Dakota Stockholders Agreement determines the decision-making process concerning matters such as major investments, mergers, acquisitions, or changes in corporate structure. It may outline the requirement for unanimous consent or a specified majority for important decisions. 5. Transfers and restrictions: The agreement may contain provisions regarding the transfer of shares between the companies or to third parties. It can include preemption rights, right of refusal, or restrictions on transferring shares without the consent of other parties. 6. Board representation: The agreement may address the composition of the board of directors of each company and the process of appointing directors. It may specify the representation rights or voting power associated with different classes of stock. 7. Confidentiality and non-competition: Certain South Dakota Stockholders Agreements include provisions to protect the companies' trade secrets, confidential information, and competitive interests. It may prohibit stockholders from engaging in similar business activities or sharing sensitive information with competitors. Note: It's worth mentioning that while these details provide a general idea of what a South Dakota Stockholders Agreement may contain, the specifics may vary depending on the terms negotiated between the parties involved. Therefore, it is advisable to refer to the actual agreement for precise information. Different types of South Dakota Stockholders Agreements may include variations or specific clauses tailored to the unique circumstances and requirements of America Online, Inc., ME Acquisition, Inc., and MapQuest. Com, Inc. These variations depend on factors such as the percentage of stock ownership, the purpose of the agreement, the anticipated business operations, and the long-term goals of the companies involved.

South Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc.

Description

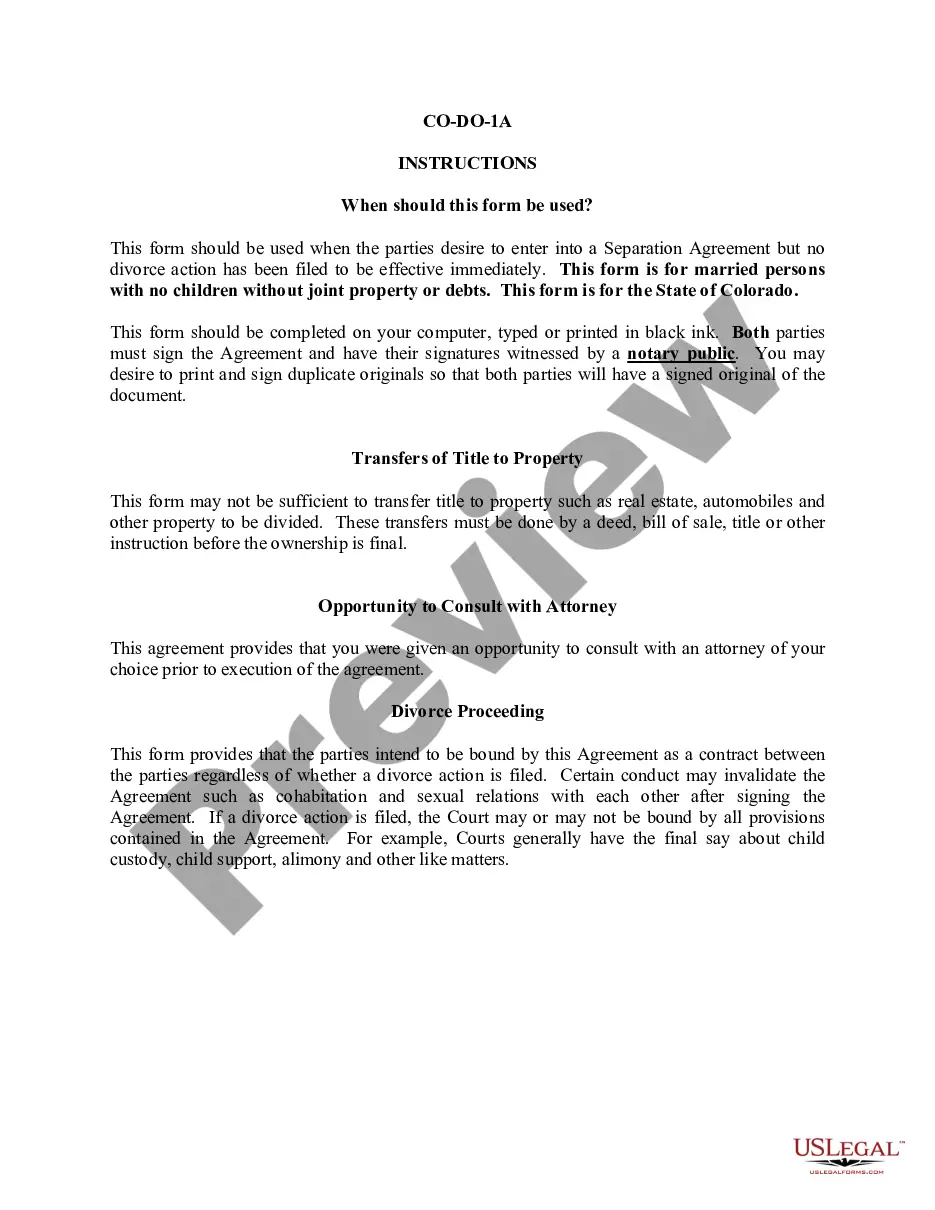

How to fill out South Dakota Stockholders Agreement Between America Online, Inc., MQ Acquisition, Inc., And Mapquest.Com, Inc.?

Are you in a situation where you need to have papers for sometimes business or personal functions almost every day? There are a variety of authorized papers layouts accessible on the Internet, but locating kinds you can depend on is not simple. US Legal Forms provides thousands of form layouts, just like the South Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc., which are composed to fulfill federal and state requirements.

Should you be currently familiar with US Legal Forms web site and also have a free account, merely log in. Following that, you can obtain the South Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc. design.

If you do not come with an bank account and wish to begin using US Legal Forms, adopt these measures:

- Find the form you require and ensure it is for the correct area/state.

- Make use of the Review switch to analyze the form.

- Read the information to actually have chosen the right form.

- In the event the form is not what you are trying to find, use the Search discipline to obtain the form that meets your requirements and requirements.

- If you discover the correct form, click on Buy now.

- Pick the prices program you would like, fill in the desired details to create your account, and buy an order with your PayPal or Visa or Mastercard.

- Select a hassle-free data file file format and obtain your backup.

Discover all the papers layouts you might have bought in the My Forms food list. You can aquire a extra backup of South Dakota Stockholders Agreement between America Online, Inc., MQ Acquisition, Inc., and Mapquest.Com, Inc. at any time, if possible. Just click on the needed form to obtain or produce the papers design.

Use US Legal Forms, by far the most comprehensive variety of authorized types, to save lots of time as well as steer clear of errors. The services provides appropriately made authorized papers layouts that can be used for an array of functions. Make a free account on US Legal Forms and begin generating your daily life a little easier.