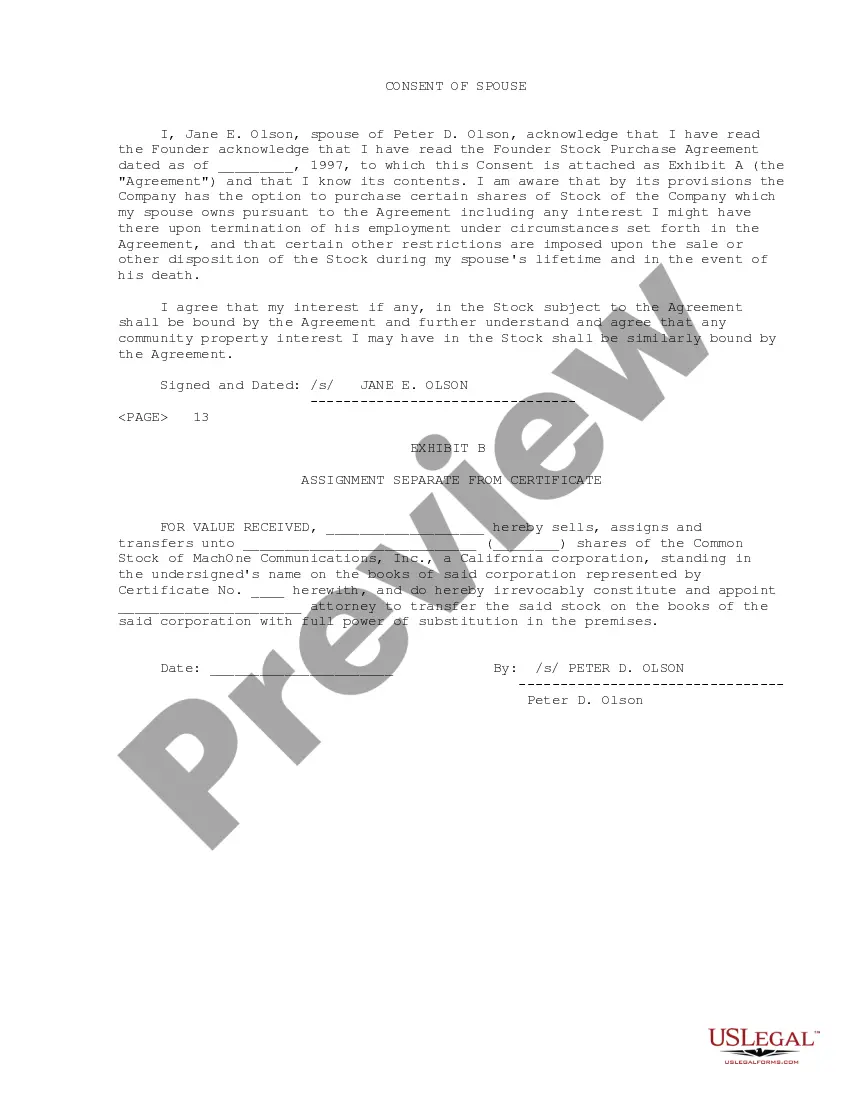

South Dakota Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson

Description

How to fill out Sample Founder Stock Purchase Agreement Between MachOne Communications, Inc. And Peter D. Olson?

You may commit several hours online attempting to find the legitimate papers format that fits the federal and state needs you will need. US Legal Forms gives 1000s of legitimate types that happen to be examined by pros. It is possible to acquire or printing the South Dakota Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson from our service.

If you already have a US Legal Forms account, you are able to log in and click the Obtain button. After that, you are able to comprehensive, edit, printing, or sign the South Dakota Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson. Every single legitimate papers format you get is yours permanently. To get an additional version for any acquired develop, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms site the first time, adhere to the basic guidelines below:

- First, ensure that you have chosen the correct papers format for your county/area that you pick. Read the develop description to ensure you have picked out the proper develop. If available, take advantage of the Preview button to look from the papers format at the same time.

- If you want to find an additional edition of your develop, take advantage of the Search field to discover the format that suits you and needs.

- Upon having located the format you desire, click on Acquire now to carry on.

- Select the rates strategy you desire, key in your credentials, and register for a free account on US Legal Forms.

- Total the purchase. You may use your charge card or PayPal account to fund the legitimate develop.

- Select the format of your papers and acquire it to your device.

- Make modifications to your papers if required. You may comprehensive, edit and sign and printing South Dakota Sample Founder Stock Purchase Agreement between MachOne Communications, Inc. and Peter D. Olson.

Obtain and printing 1000s of papers templates while using US Legal Forms Internet site, that offers the most important selection of legitimate types. Use expert and status-certain templates to take on your organization or person needs.

Form popularity

FAQ

Founders stock refers to the shares issued to the originators of a company. Often, the stock does not receive any returns up to the point that a dividend is payable to the common stockholders. Founders stock comes with a vesting schedule, which determines when the shares are exercisable.

A Restricted Stock Purchase Agreement (RSPA) is an agreement issuing restricted stock. RSPAs are typically granted to founders to prevent the founder from leaving the company prematurely and taking a lot of the ownership with her. The RSPA establishes when the shares will fully vest and belong to the founder.

A Founders' Agreement is a contract that a company's founders enter into that governs their business relationships. The Agreement lays out the rights, responsibilities, liabilities, and obligations of each founder. Generally speaking, it regulates matters that may not be covered by the company's operating agreement.

An RSPA will typically allow the Company to buyback shares from the founder through a repurchase option. The repurchase option can be triggered by a number of events, including the founder being fired or force to quit. Single / Double Trigger Acceleration.

This agreement allows the founders to document their initial ownership in the Company, including standard transfer restrictions and any vesting provisions with respect to their shares.

A founder stock purchase agreement is an agreement that documents ownership of a company in its beginning stages. This legal contract is not mandatory but is beneficial to establish a shareholder's stake in the company and determine the terms and conditions of that ownership.

A Shareholders Agreement is usually created when the company brings on external investors. A Founders Agreement focuses on the roles and responsibilities of the founders. It also sets out the equity allocation and who can decide what. It typically also addresses vesting and leaver arrangements for the founders.