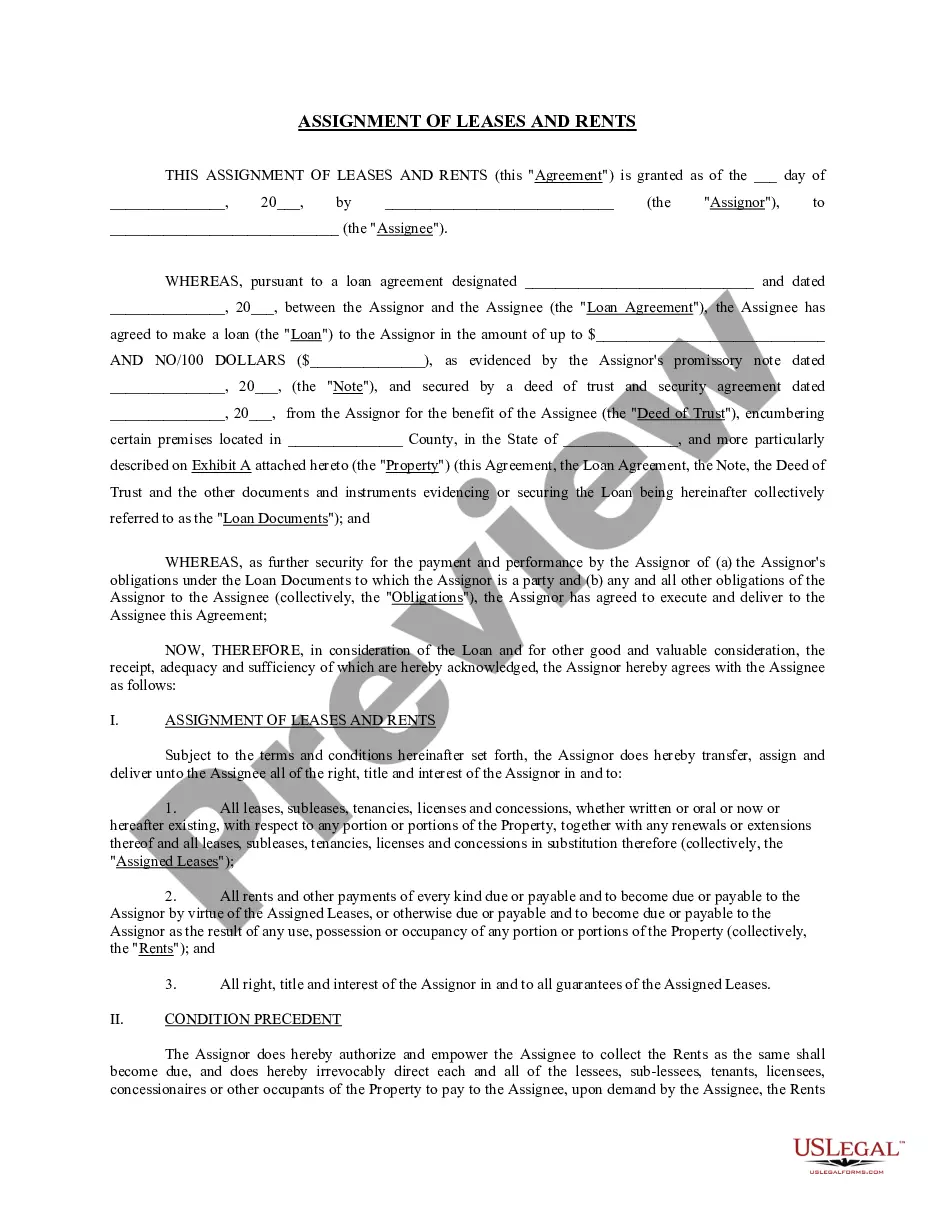

The South Dakota Stock Option Agreement of Maddox Networks, Inc. is a legally binding document that outlines the terms and conditions for stock options granted to employees or other individuals associated with the company. This agreement governs the rights, restrictions, and obligations related to the stock options granted in South Dakota, specifically for Maddox Networks, Inc. Under the South Dakota Stock Option Agreement, employees or individuals are provided with the opportunity to purchase a certain number of company stocks at a specified price, commonly known as the exercise price or strike price. The agreement sets forth the terms regarding the vesting schedule, exercise period, and other conditions that must be met before the stock options can be exercised. The primary purpose of the South Dakota Stock Option Agreement is to incentivize employees or individuals to contribute to the growth and success of Maddox Networks, Inc. through ownership in the company. By offering stock options, the company aims to align the interests of its employees with those of its shareholders, fostering loyalty, motivation, and a sense of ownership among the stock option holders. In some cases, there are different types of stock option agreements within Maddox Networks, Inc., each varying in terms of its conditions, vesting schedule, or exercise price. These variations may include: 1. Incentive Stock Options (SOS): These stock options come with certain tax advantages for the employees if they satisfy specific requirements outlined by the Internal Revenue Service (IRS). SOS are subject to strict limitations on the number of shares granted and a prescribed exercise price. 2. Non-Qualified Stock Options (Nests): Unlike SOS, Nests do not meet the IRS criteria for special tax treatment. They offer more flexibility in terms of the number of shares granted, exercise price, and eligibility criteria. Nests are subject to standard income tax rates upon exercise. 3. Restricted Stock Units (RSS): Although not technically stock options, RSS are often considered alongside stock option agreements. RSS represents a commitment by the company to grant a specific number of shares at a predetermined future date. Once vested, the employee receives the shares directly, without the need for any additional exercise price. Overall, the South Dakota Stock Option Agreement of Maddox Networks, Inc. serves as a critical tool for the company to attract, retain, and motivate talented individuals by providing them with an opportunity to share in the success of the organization through stock ownership. It establishes the terms and conditions that govern the stock options, promoting a stronger and more committed workforce.

South Dakota Stock Option Agreement of Gadzoox Networks, Inc.

Description

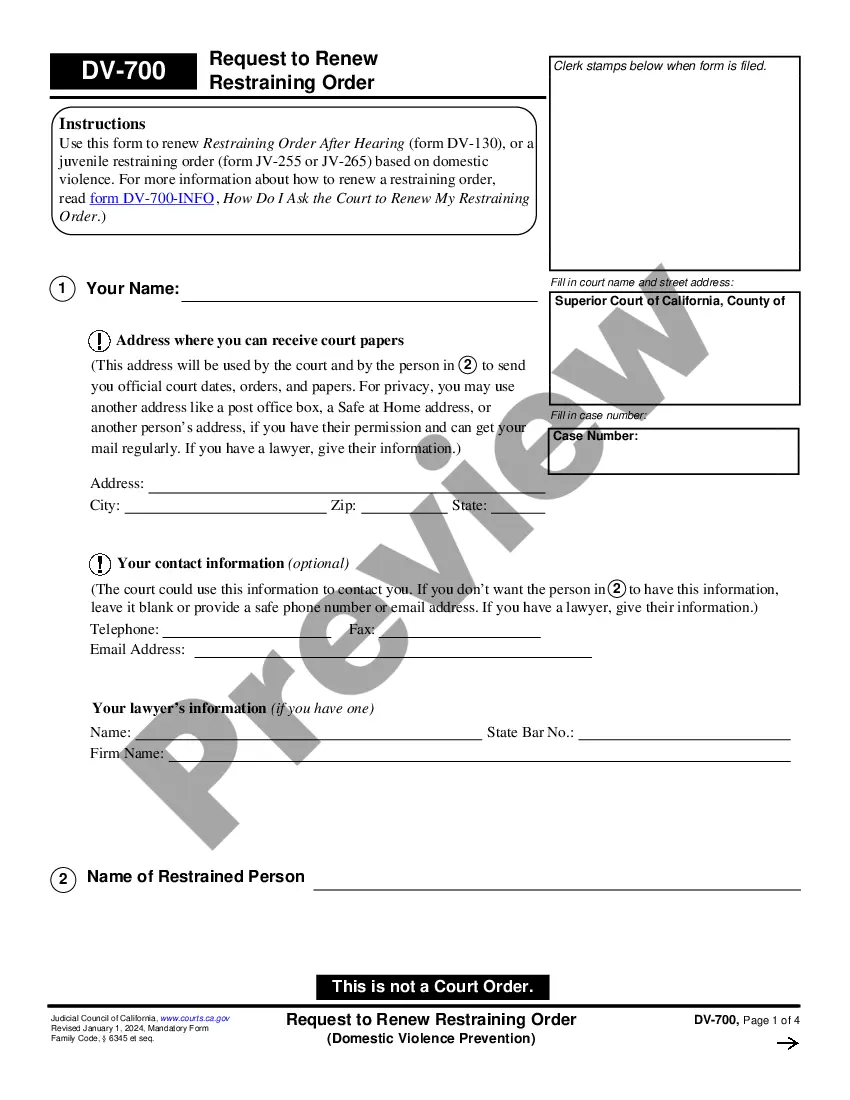

How to fill out South Dakota Stock Option Agreement Of Gadzoox Networks, Inc.?

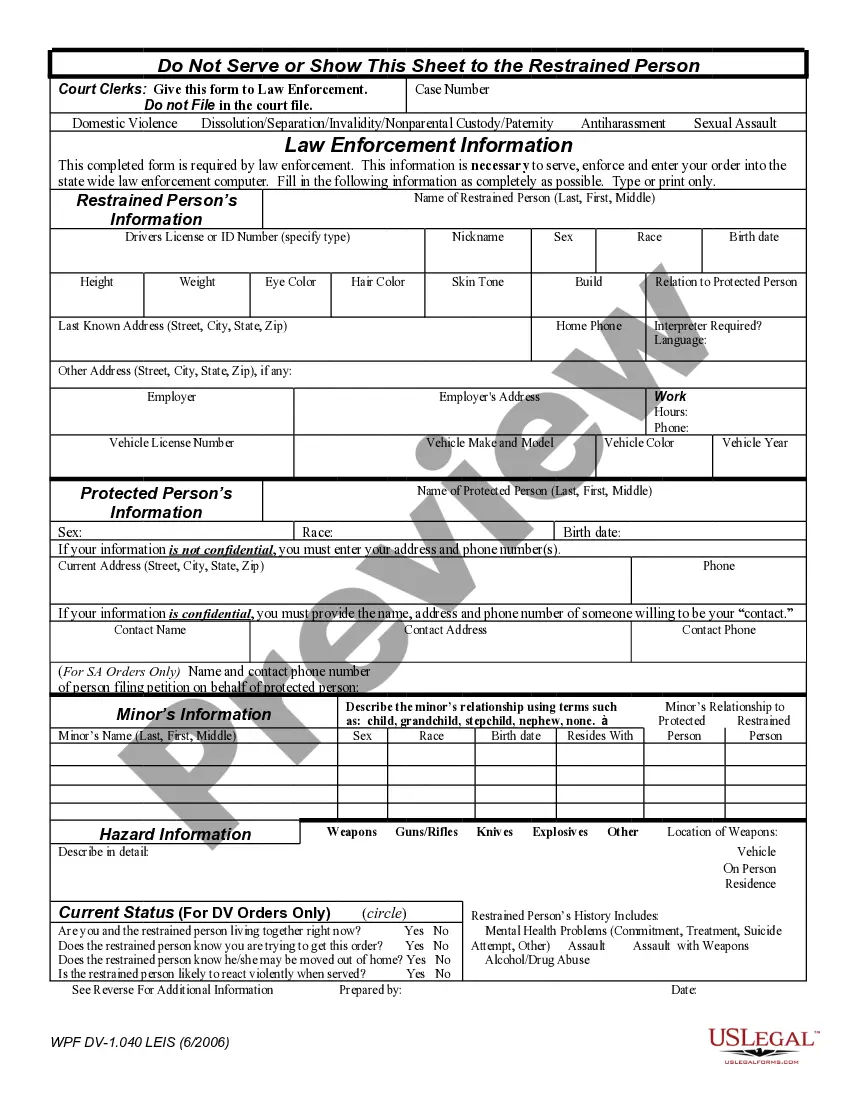

If you have to complete, download, or print out authorized papers layouts, use US Legal Forms, the most important assortment of authorized forms, which can be found online. Take advantage of the site`s easy and hassle-free research to obtain the files you will need. Different layouts for organization and specific reasons are sorted by groups and suggests, or keywords. Use US Legal Forms to obtain the South Dakota Stock Option Agreement of Gadzoox Networks, Inc. with a handful of clicks.

If you are currently a US Legal Forms buyer, log in for your account and then click the Down load button to get the South Dakota Stock Option Agreement of Gadzoox Networks, Inc.. You can also access forms you previously acquired inside the My Forms tab of your account.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape to the correct city/land.

- Step 2. Take advantage of the Preview option to look over the form`s articles. Don`t forget about to read the information.

- Step 3. If you are not satisfied with all the form, utilize the Lookup industry on top of the display to find other versions from the authorized form template.

- Step 4. Upon having found the shape you will need, go through the Get now button. Choose the prices plan you like and put your accreditations to register for an account.

- Step 5. Method the transaction. You can use your Мisa or Ьastercard or PayPal account to perform the transaction.

- Step 6. Select the file format from the authorized form and download it on your own device.

- Step 7. Complete, change and print out or sign the South Dakota Stock Option Agreement of Gadzoox Networks, Inc..

Every authorized papers template you acquire is your own property for a long time. You possess acces to each form you acquired in your acccount. Go through the My Forms portion and choose a form to print out or download once more.

Be competitive and download, and print out the South Dakota Stock Option Agreement of Gadzoox Networks, Inc. with US Legal Forms. There are thousands of skilled and express-specific forms you may use to your organization or specific needs.