South Dakota Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York

Description

How to fill out Trust Agreement Between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., And The Bank Of New York?

Choosing the best authorized papers template could be a have difficulties. Obviously, there are a lot of templates available on the net, but how will you get the authorized type you want? Make use of the US Legal Forms internet site. The support gives a huge number of templates, for example the South Dakota Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York, that can be used for enterprise and personal requirements. All of the forms are checked by pros and meet state and federal requirements.

Should you be currently authorized, log in to your accounts and click on the Acquire switch to find the South Dakota Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York. Use your accounts to search throughout the authorized forms you might have ordered in the past. Check out the My Forms tab of the accounts and have another duplicate of the papers you want.

Should you be a brand new end user of US Legal Forms, here are straightforward directions that you should follow:

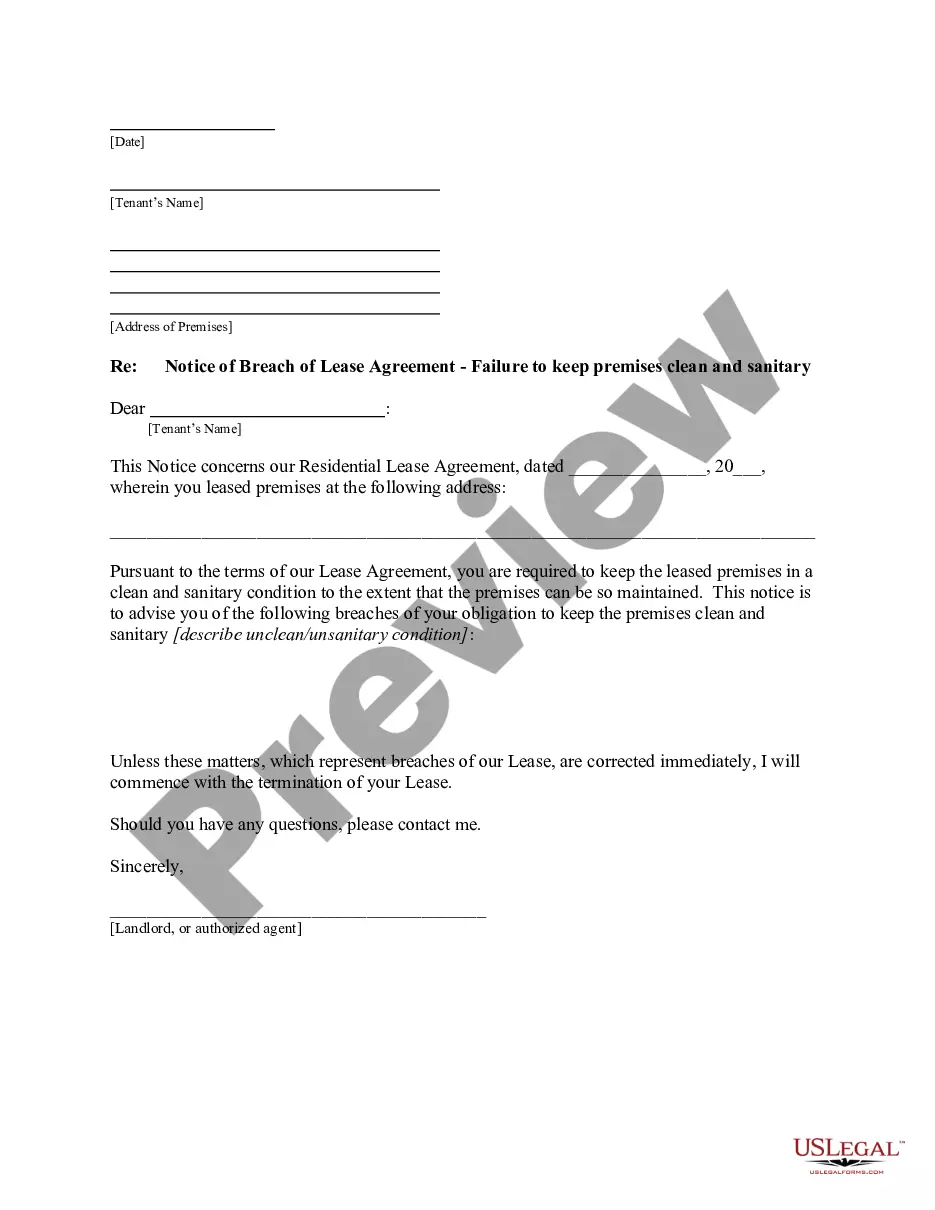

- Very first, make sure you have selected the appropriate type for your town/region. You may look through the shape using the Review switch and read the shape description to make sure this is the right one for you.

- When the type will not meet your preferences, make use of the Seach discipline to discover the correct type.

- When you are sure that the shape is proper, go through the Purchase now switch to find the type.

- Opt for the costs prepare you would like and enter the essential info. Make your accounts and pay money for the transaction utilizing your PayPal accounts or Visa or Mastercard.

- Select the document structure and download the authorized papers template to your product.

- Comprehensive, revise and produce and sign the acquired South Dakota Trust Agreement between Van Kampen Foods, Inc., American Portfolio Evaluation Services, Van Kampen Investment Advisory Corp., and The Bank of New York.

US Legal Forms will be the biggest library of authorized forms for which you can find a variety of papers templates. Make use of the company to download appropriately-manufactured files that follow state requirements.