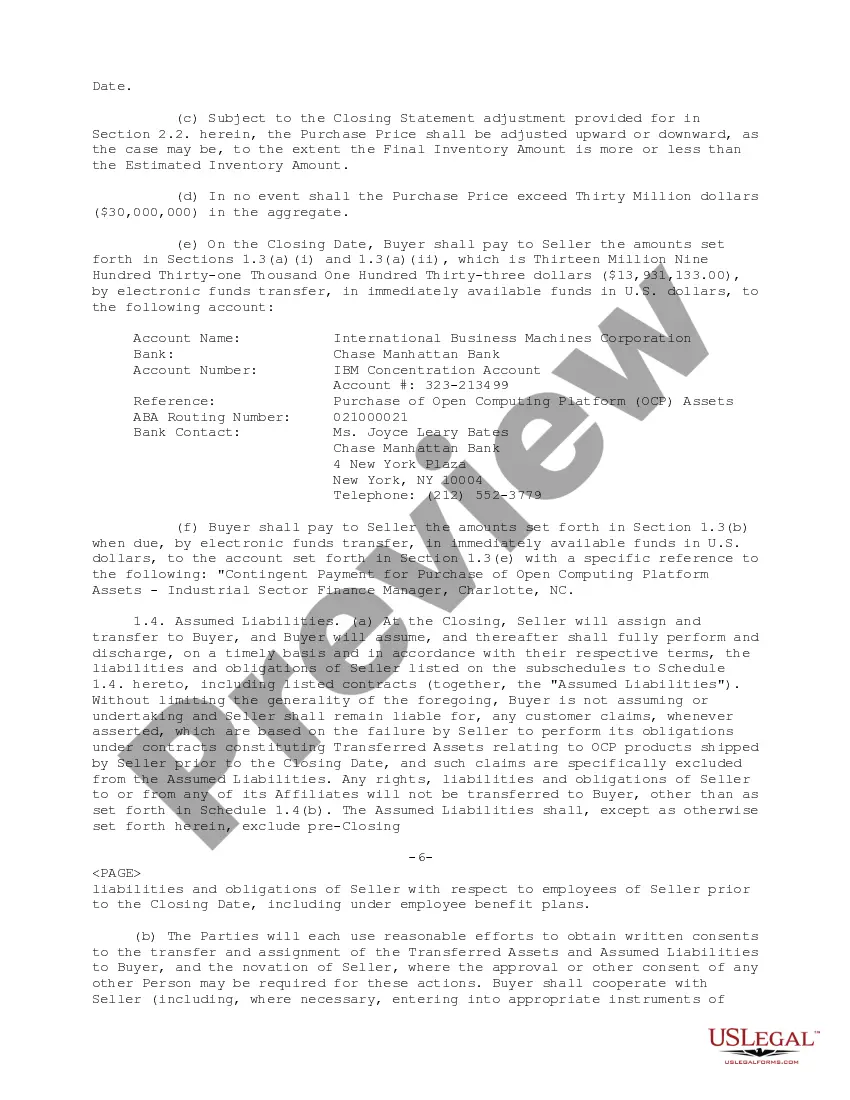

South Dakota Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample

Description

How to fill out Sample Asset Purchase Agreement Between RadiSys Corporation And International Business Machines Corporation - Sample?

US Legal Forms - one of the biggest libraries of lawful types in the States - gives a variety of lawful file themes you can acquire or printing. Utilizing the internet site, you may get a huge number of types for business and specific functions, sorted by categories, says, or key phrases.You can find the latest types of types such as the South Dakota Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample in seconds.

If you have a monthly subscription, log in and acquire South Dakota Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample from the US Legal Forms library. The Down load option will show up on each form you perspective. You get access to all in the past saved types within the My Forms tab of your respective account.

If you would like use US Legal Forms the very first time, here are easy directions to obtain started:

- Be sure to have picked out the proper form to your city/state. Click on the Review option to examine the form`s articles. Read the form description to actually have chosen the right form.

- In the event the form does not suit your specifications, use the Lookup area near the top of the screen to find the the one that does.

- In case you are pleased with the shape, confirm your selection by simply clicking the Get now option. Then, opt for the prices program you favor and provide your accreditations to register to have an account.

- Approach the purchase. Utilize your credit card or PayPal account to finish the purchase.

- Find the format and acquire the shape on your system.

- Make modifications. Complete, revise and printing and indication the saved South Dakota Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample.

Each template you added to your money lacks an expiry particular date and is also the one you have forever. So, if you wish to acquire or printing another copy, just go to the My Forms segment and then click about the form you want.

Gain access to the South Dakota Sample Asset Purchase Agreement between RadiSys Corporation and International Business Machines Corporation - Sample with US Legal Forms, one of the most extensive library of lawful file themes. Use a huge number of skilled and express-distinct themes that meet up with your small business or specific requirements and specifications.

Form popularity

FAQ

Any purchase agreement should include at least the following information: The identity of the buyer and seller. A description of the property being purchased. The purchase price. The terms as to how and when payment is to be made. The terms as to how, when, and where the goods will be delivered to the purchaser.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

How to Write a Business Purchase Agreement? Step 1 ? Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the contract. ... Step 2 ? Business Assets. ... Step 3 ? Business Liabilities. ... Step 4 ? Purchase Price. ... Step 5 ? Terms. ... Step 6 ? Signatures. Free Business Purchase Agreement Template | PDF & Word legaltemplates.net ? form ? business legaltemplates.net ? form ? business

All business contracts should include fundamentals such as: The date of the contract. The names of all parties or entities involved. Payment amounts and due dates. Contract expiration dates. Potential damages for breach of contract, missed deadlines or incomplete services.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value. Essential Features of an Asset Purchase Agreement - Ironclad ironcladapp.com ? journal ? contracts ? asset-purc... ironcladapp.com ? journal ? contracts ? asset-purc...

Either the buyer or the seller can prepare the purchase agreement. Like any contract, it can be a standard document that one party uses throughout the normal course of business or it can be the result of several rounds of back-and-forth negotiations.