A South Dakota Pooling and Servicing Agreement is a legally binding contract that outlines the terms and conditions of a mortgage loan sale from a company (the seller/service) to a trustee for inclusion in a trust fund. This agreement is crucial in the process of securitizing mortgage loans, where the loans are bundled together to create mortgage-backed securities (MBS) that can be sold to investors. The Pooling and Servicing Agreement (PSA) serves as a blueprint for how the mortgage loans will be pooled, serviced, and managed within the trust fund. It typically covers important aspects such as loan eligibility criteria, payment obligations, loan servicing responsibilities, representations and warranties, default and foreclosure procedures, and the allocation of any proceeds from the mortgage loans. There might be variations of South Dakota Pooling and Servicing Agreements depending on the specific requirements of the company or the type of mortgage loans being securitized. Some examples of different types of SAS in South Dakota could include: 1. Residential Mortgage Pooling and Servicing Agreement: This agreement involves the securitization of residential mortgage loans. It would outline the specific requirements for residential properties, such as eligibility criteria, loan sizes, and geographical restrictions. 2. Commercial Mortgage Pooling and Servicing Agreement: In the case of commercial properties, this type of agreement would govern the sale of commercial mortgage loans. It may include special provisions for commercial property types, such as retail, office, industrial, or multi-family. 3. Prime Mortgage Pooling and Servicing Agreement: A prime mortgage PSA would focus on the securitization of mortgage loans offered to borrowers with excellent credit ratings. The agreement may include stricter eligibility criteria and additional safeguards due to the higher quality of the loans. 4. Subprime Mortgage Pooling and Servicing Agreement: This type of agreement would be applicable to the securitization of mortgage loans offered to borrowers with lower credit scores or less favorable financial histories. It may involve unique provisions to cater to the higher risk associated with subprime loans. 5. Government-Backed Mortgage Pooling and Servicing Agreement: In the case of mortgage loans insured or guaranteed by government entities like the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA), a specific type of PSA may be needed to address the unique obligations and requirements of these loans. By adhering to the South Dakota Pooling and Servicing Agreement, the company can streamline the process of selling mortgage loans to the trustee, ensuring compliance with legal and regulatory guidelines. It provides a clear framework for loan administration and helps protect the interests of both the company and the investors in the trust fund.

South Dakota Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company

Description

How to fill out South Dakota Pooling And Servicing Agreement Contemplating The Sale Of Mortgage Loans To Trustee For Inclusion In The Trust Fund By The Company?

US Legal Forms - one of many greatest libraries of legitimate kinds in the USA - delivers a wide range of legitimate papers themes it is possible to download or print out. While using website, you may get a large number of kinds for company and individual uses, categorized by categories, claims, or key phrases.You will discover the latest variations of kinds much like the South Dakota Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company in seconds.

If you currently have a membership, log in and download South Dakota Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company from the US Legal Forms collection. The Down load option can look on every single form you perspective. You gain access to all in the past saved kinds within the My Forms tab of the profile.

If you wish to use US Legal Forms the very first time, listed here are simple instructions to obtain started:

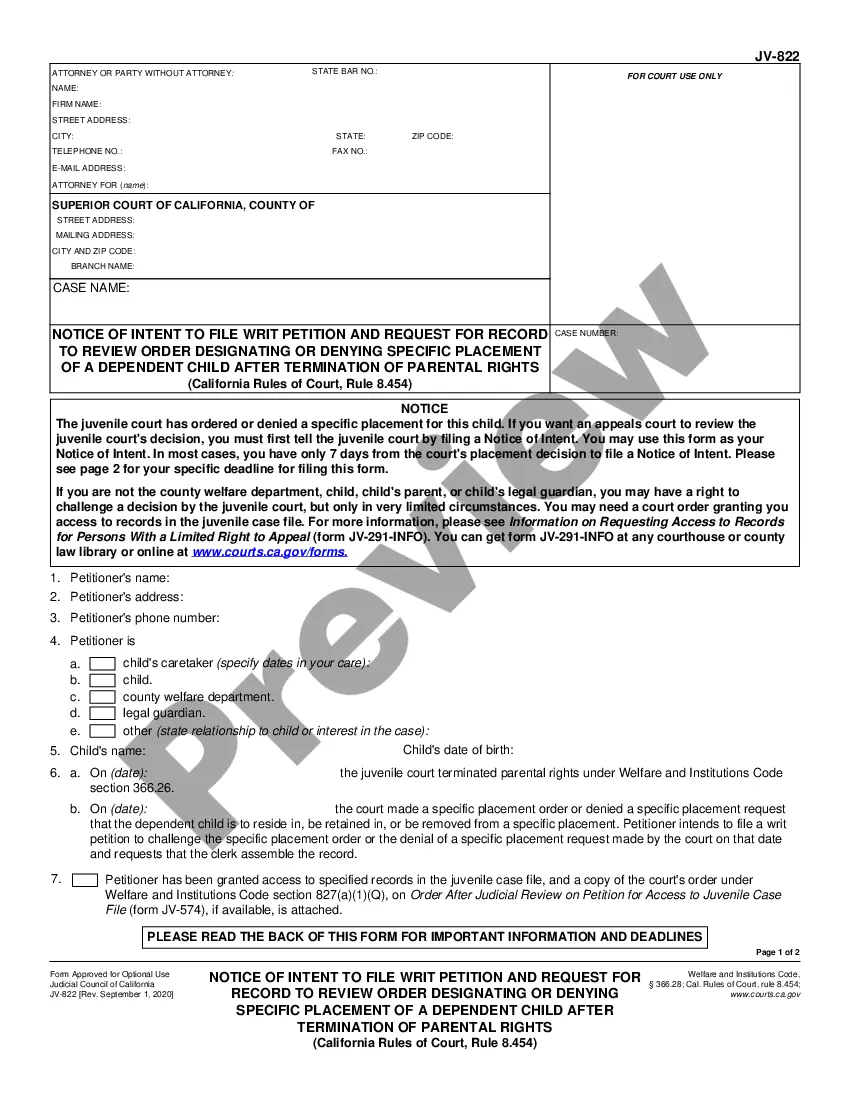

- Make sure you have chosen the right form for the city/state. Click the Preview option to check the form`s content. Read the form description to actually have selected the appropriate form.

- If the form doesn`t fit your specifications, take advantage of the Lookup area towards the top of the display screen to obtain the one who does.

- If you are content with the shape, affirm your option by clicking on the Buy now option. Then, opt for the costs prepare you favor and give your qualifications to register for an profile.

- Approach the deal. Utilize your bank card or PayPal profile to perform the deal.

- Find the structure and download the shape on the gadget.

- Make alterations. Complete, change and print out and sign the saved South Dakota Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company.

Every single template you put into your account does not have an expiration particular date which is yours permanently. So, if you wish to download or print out an additional backup, just proceed to the My Forms area and then click on the form you will need.

Obtain access to the South Dakota Pooling and Servicing Agreement contemplating the sale of mortgage loans to Trustee for inclusion in the Trust Fund by the company with US Legal Forms, one of the most extensive collection of legitimate papers themes. Use a large number of expert and status-distinct themes that meet your business or individual demands and specifications.

Form popularity

FAQ

A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. A mortgage pool is a group of home and other real estate loans that have been bundled so they can be sold. What Is a Mortgage Pool? - The Balance thebalancemoney.com ? what-is-a-mortgage... thebalancemoney.com ? what-is-a-mortgage...

PSA is used primarily to derive an implied prepayment speed of new production loans. 00% PSA assumes a prepayment rate of 2% per month in the first month following the date of issue, increasing at 2% percentage points per month thereafter until the 30th month. PSA Prepayment Rate Definition - Nasdaq nasdaq.com ? glossary ? psa-prepayment-rate nasdaq.com ? glossary ? psa-prepayment-rate

The ?Pooling and Servicing Agreement? is the legal document that contains the responsibilities and rights of the servicer, the trustee, and others over a pool of mortgage loans.

Mortgage servicing rights (MSR) refer to a contractual agreement in which the right to service an existing mortgage is sold by the original mortgage lender to another party that specializes in the various functions involved with servicing mortgages.

What is a Pooling Agreement? A pooling agreement is a type of contract where corporate shareholders create a voting trust by pooling their voting rights and transferring them to a trustee. This is also called a voting agreement or shareholder-control agreement since it is used to control the affairs of the corporation. Pooling Agreement: Definition & Sample - Contracts Counsel contractscounsel.com ? pooling-agreement contractscounsel.com ? pooling-agreement

An MBS is made up of a pool of mortgages purchased from issuing banks and then sold to investors. An MBS allows investors to benefit from the mortgage business without needing to buy or sell home loans themselves. What Are Mortgage-Backed Securities? rocketmortgage.com ? learn ? mortgage-bac... rocketmortgage.com ? learn ? mortgage-bac...

A Servicing Agreement (or Loan Servicing Agreement) is a document entered into in connection with a facility established for the securitization of various types of assets, most often loans, receivables or leases.