South Dakota Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company

Description

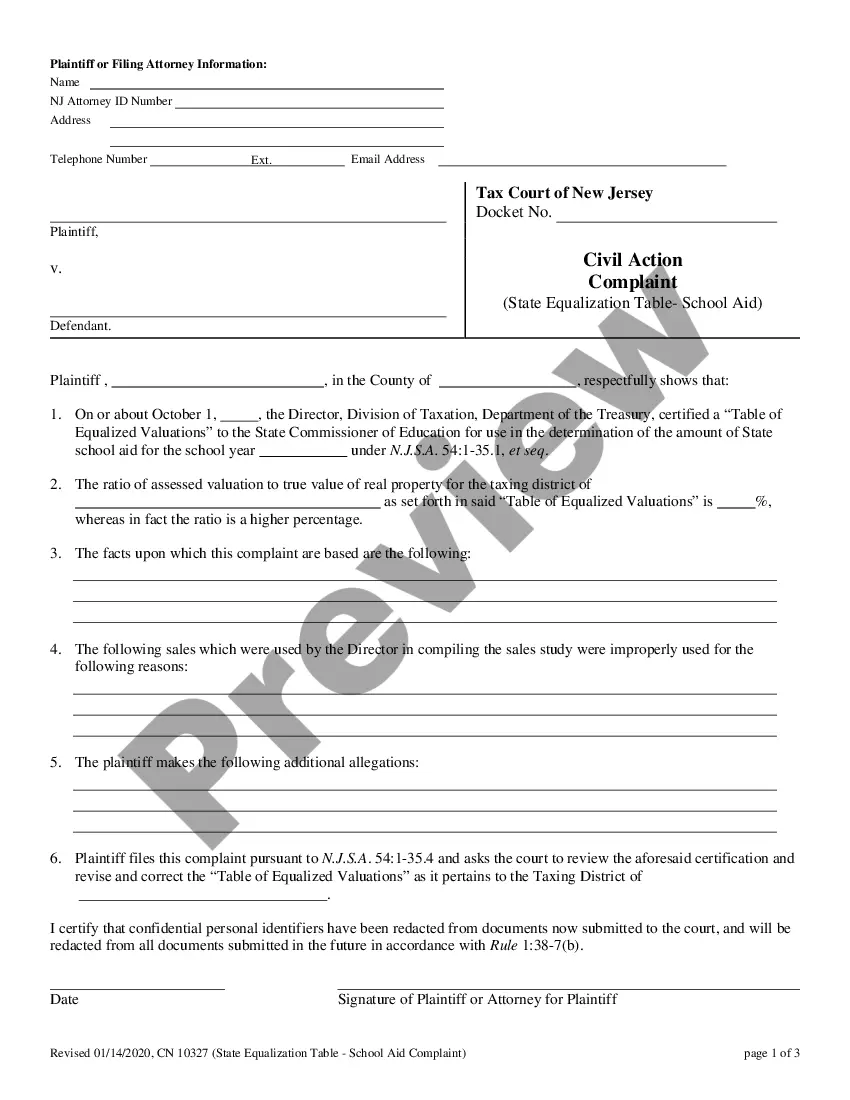

How to fill out Amendment To Trust Agreement Agreement Between Polaris Industries, Inc. And Fidelity Management Trust Company?

US Legal Forms - one of the biggest libraries of authorized forms in America - gives an array of authorized record web templates you are able to obtain or produce. Using the site, you may get a huge number of forms for company and individual uses, categorized by categories, says, or key phrases.You can get the most recent types of forms such as the South Dakota Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company within minutes.

If you currently have a subscription, log in and obtain South Dakota Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company in the US Legal Forms catalogue. The Down load switch will appear on each and every kind you see. You gain access to all in the past saved forms from the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed below are straightforward recommendations to obtain started off:

- Be sure you have selected the proper kind for the metropolis/area. Go through the Review switch to review the form`s information. Look at the kind information to actually have selected the correct kind.

- If the kind does not fit your needs, utilize the Search discipline at the top of the monitor to find the one who does.

- Should you be content with the shape, confirm your choice by simply clicking the Purchase now switch. Then, opt for the costs plan you favor and give your qualifications to register for an accounts.

- Procedure the deal. Use your bank card or PayPal accounts to complete the deal.

- Pick the formatting and obtain the shape on your product.

- Make changes. Load, revise and produce and sign the saved South Dakota Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company.

Each and every template you included with your bank account lacks an expiration particular date which is the one you have eternally. So, in order to obtain or produce yet another backup, just visit the My Forms section and click on about the kind you will need.

Obtain access to the South Dakota Amendment to Trust Agreement Agreement between Polaris Industries, Inc. and Fidelity Management Trust Company with US Legal Forms, probably the most considerable catalogue of authorized record web templates. Use a huge number of specialist and condition-distinct web templates that meet your organization or individual demands and needs.