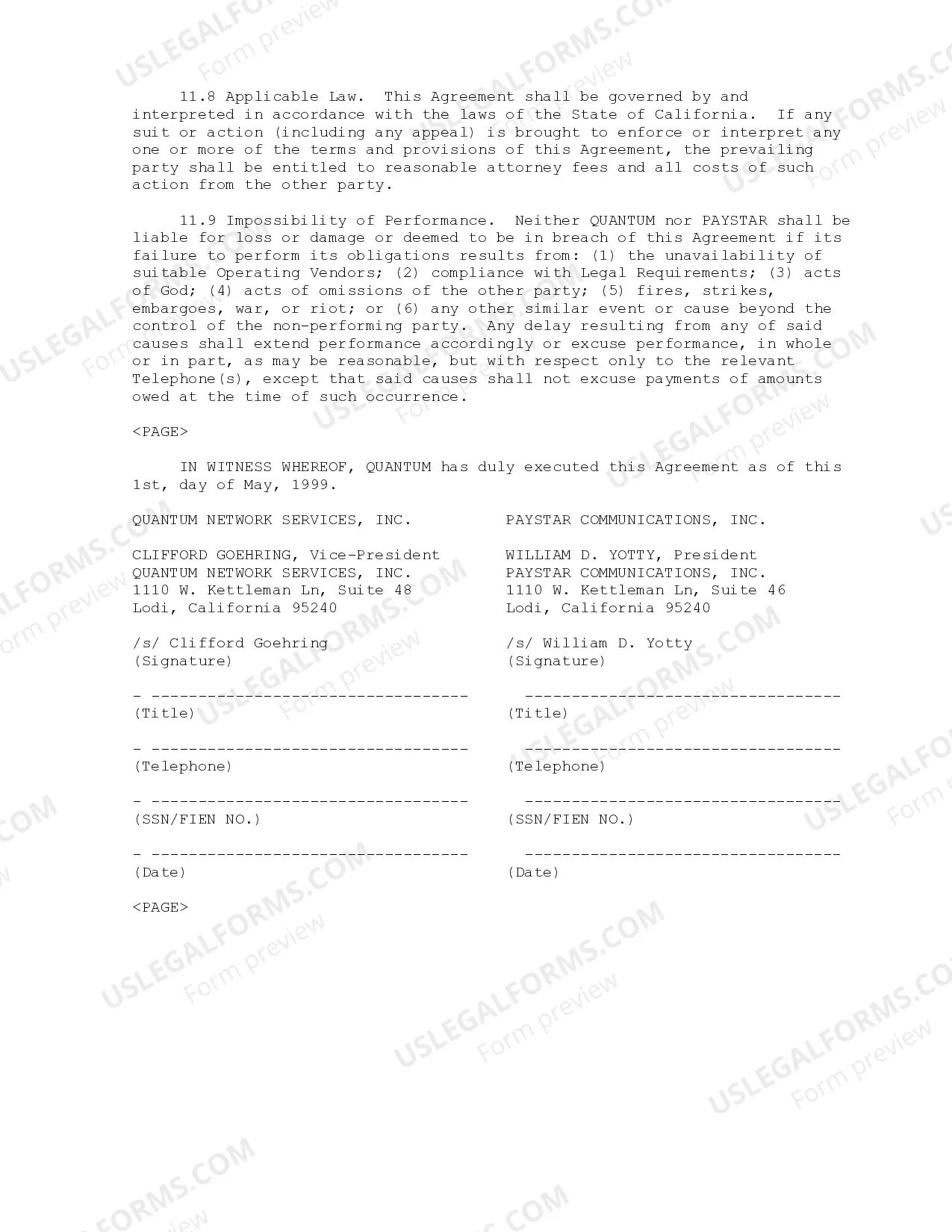

The South Dakota Pay Telephone Services Agreement is a contractual agreement between a pay phone service provider and the State of South Dakota, outlining the terms and conditions for the provision of pay telephone services within the state. This agreement governs the relationships between the service provider and the state to ensure efficient, reliable, and accessible pay telephone services throughout South Dakota. Pay telephone services in South Dakota are crucial for residents, tourists, and businesses alike. These services allow individuals to make local, long-distance, or international calls conveniently from pay phone stations spread across various locations within the state. Pay telephone services are particularly important in areas where cell phone coverage may be limited or unreliable, ensuring that individuals have access to telecommunication services at all times. The South Dakota Pay Telephone Services Agreement includes various key provisions. Firstly, it outlines the responsibilities of the service provider in terms of maintaining, installing, and repairing pay phone stations promptly and efficiently. This ensures that pay phone stations are in proper working order and accessible to the public. The agreement also establishes guidelines for the billing and tariff structure of pay telephone services. It details the rates charged for different types of calls, such as local, long-distance, and international, as well as any additional fees or charges applicable to these services. The service provider must adhere to these rates and transparently bill customers for the services provided. Additionally, the agreement may address the privacy and security aspects of pay telephone services. It may include provisions on the protection of customer information, call recording and monitoring practices, and guidelines for reporting and addressing any security breaches or incidents related to pay telephone services. While there may not be different types of South Dakota Pay Telephone Services Agreements, the agreement can vary slightly depending on the specific service provider and the terms negotiated with the state. These variations may include clauses related to the duration of the agreement, termination procedures, revenue sharing arrangements between the service provider and the state, and any additional services or features offered by the provider. In conclusion, the South Dakota Pay Telephone Services Agreement is a vital document that governs the provision of pay telephone services in the state. It ensures the availability, functionality, and affordability of pay phone stations throughout South Dakota. By establishing a mutually beneficial partnership between the service provider and the state, this agreement guarantees that residents and visitors can access reliable communication services regardless of cell phone coverage or other limitations.

South Dakota Pay Telephone Services Agreement

Description

How to fill out South Dakota Pay Telephone Services Agreement?

If you have to total, download, or printing authorized document web templates, use US Legal Forms, the largest collection of authorized types, that can be found on-line. Utilize the site`s easy and handy search to find the papers you will need. Numerous web templates for enterprise and specific reasons are categorized by groups and states, or keywords. Use US Legal Forms to find the South Dakota Pay Telephone Services Agreement in just a few mouse clicks.

When you are already a US Legal Forms customer, log in to your profile and click the Download button to have the South Dakota Pay Telephone Services Agreement. Also you can entry types you previously delivered electronically within the My Forms tab of the profile.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your appropriate city/region.

- Step 2. Take advantage of the Review option to look over the form`s content. Do not overlook to learn the outline.

- Step 3. When you are unsatisfied using the form, use the Look for field on top of the display screen to discover other types from the authorized form web template.

- Step 4. Upon having discovered the shape you will need, click the Purchase now button. Select the costs program you choose and include your references to register on an profile.

- Step 5. Procedure the purchase. You can use your credit card or PayPal profile to finish the purchase.

- Step 6. Find the structure from the authorized form and download it on your own product.

- Step 7. Comprehensive, modify and printing or sign the South Dakota Pay Telephone Services Agreement.

Each and every authorized document web template you get is your own property eternally. You have acces to every form you delivered electronically in your acccount. Select the My Forms section and pick a form to printing or download once again.

Compete and download, and printing the South Dakota Pay Telephone Services Agreement with US Legal Forms. There are thousands of specialist and status-certain types you can utilize for your personal enterprise or specific needs.

Form popularity

FAQ

Fuel used for agricultural purposes is exempt from sales tax. This includes motor fuel, kerosene, tractor fuel, liquefied petroleum gas, natural and artificial gas, diesel fuels and distillate. Dyed fuel should be used in unlicensed agricultural equipment used to provide agricultural services on agricultural land.

The economic nexus threshold will now be gross revenue of $100,000 in the previous or current calendar year, effective July 1, 2023. This is potentially good news for smaller remote sellers making sales into South Dakota whose sales don't exceed $100,000 in a calendar year but whose transaction count exceeds 200.

South Dakota does not have an individual income tax. South Dakota also does not have a corporate income tax. South Dakota has a 4.50 percent state sales tax rate, a max local sales tax rate of 4.50 percent, and an average combined state and local sales tax rate of 6.40 percent.

You must be 65 years of age or older OR disabled (as defined by the Social Security Act). You must own the home or retain a life estate in the property. Un-remarried widow/widowers of persons previously qualified may still qualify in some circumstances. Income and property value limits apply.

The state's tax system is among the most retiree-friendly in the country. It has no income tax, relatively low sales taxes, high property taxes and no estate or inheritance taxes.

Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered electronically) into South Dakota.

South Dakota is one of a few states that tax groceries at the same rate as general sales. Democrats had long supported the grocery tax cut.

Some goods are exempt from sales tax under South Dakota law. Examples include gasoline, purchases made with food stamps, and prescription drugs.