South Dakota Employee Shareholder Escrow Agreement

Description

How to fill out Employee Shareholder Escrow Agreement?

Choosing the best legitimate file template can be quite a have a problem. Of course, there are tons of web templates available online, but how will you obtain the legitimate develop you require? Take advantage of the US Legal Forms internet site. The assistance offers a large number of web templates, including the South Dakota Employee Shareholder Escrow Agreement, which you can use for organization and private needs. Every one of the kinds are examined by pros and satisfy state and federal needs.

When you are already registered, log in to your accounts and then click the Download button to find the South Dakota Employee Shareholder Escrow Agreement. Make use of accounts to look with the legitimate kinds you have acquired earlier. Visit the My Forms tab of the accounts and get another duplicate in the file you require.

When you are a brand new customer of US Legal Forms, listed here are simple instructions that you should follow:

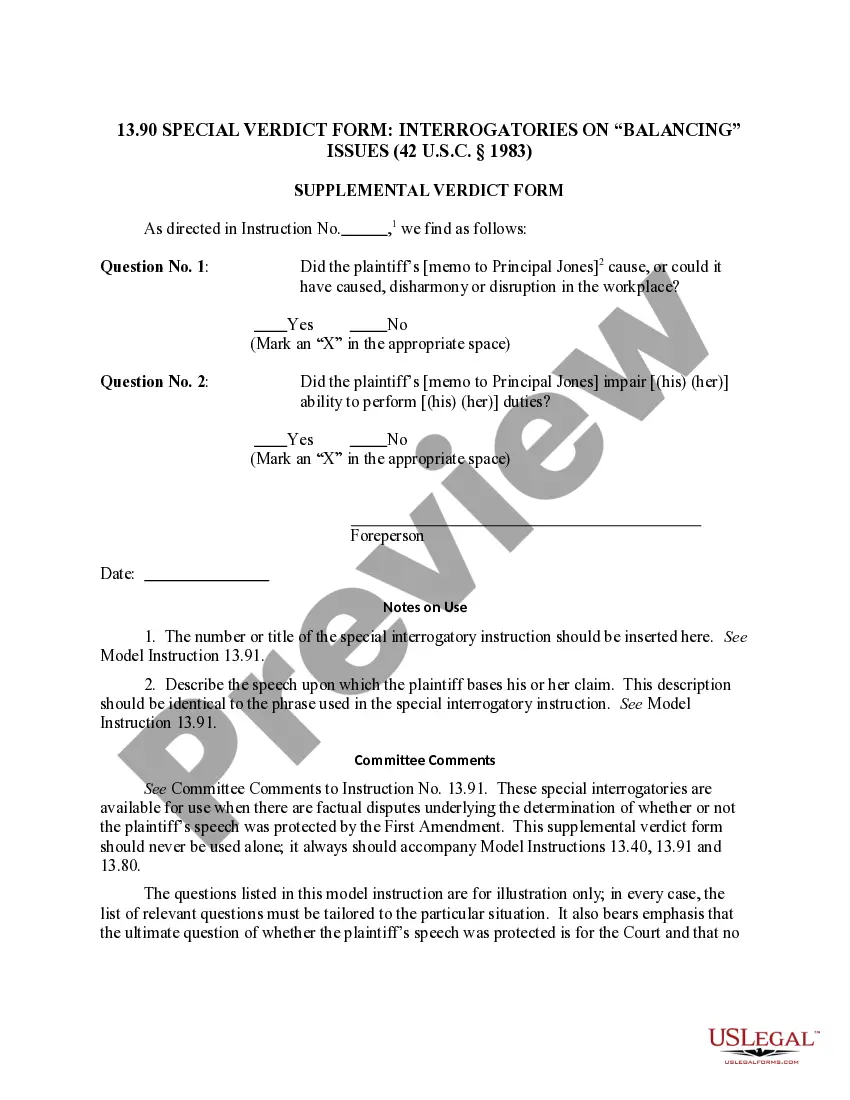

- First, make sure you have chosen the correct develop to your city/region. You are able to check out the form using the Review button and read the form outline to ensure this is basically the right one for you.

- In the event the develop will not satisfy your preferences, take advantage of the Seach discipline to find the appropriate develop.

- When you are sure that the form is suitable, click on the Purchase now button to find the develop.

- Opt for the prices program you want and enter in the required info. Create your accounts and pay for the order with your PayPal accounts or Visa or Mastercard.

- Pick the submit formatting and download the legitimate file template to your system.

- Full, revise and produce and indicator the attained South Dakota Employee Shareholder Escrow Agreement.

US Legal Forms is definitely the most significant library of legitimate kinds for which you can find a variety of file web templates. Take advantage of the service to download skillfully-manufactured papers that follow state needs.

Form popularity

FAQ

In California, there are two forms of escrow instructions generally employed: bilateral (i.e., executed by and binding on both buyer and seller) and unilateral (i.e., separate instructions executed by the buyer and seller, binding on each).

Escrow agreements provide security by delegating an asset to an escrow agent for safekeeping until each party meets his or her contractual obligations.

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

Who owns the money in an escrow account? The buyer in a transaction owns the money held in escrow. This is because the escrow agent only has the money in trust. The ownership of the money is transferred to the seller once the transaction's obligations are met.

Understanding Escrowed Shares Escrow is a process whereby money or a financial asset is held by a third party on behalf of two other parties. The assets or funds that are held in escrow remain there and are not released until all of the obligations outlined in the agreement are fulfilled.

Joint Written Instructions means written instructions from Sellers and Buyer, a form of which is attached to the Escrow Agreement as an exhibit thereto, directing the Escrow Agent to deliver the Escrowed Funds as provided for under this Agreement.