Title: South Dakota Letter of Transmittal to Accompany Certificates of Common Stock Introduction: The South Dakota Letter of Transmittal to Accompany Certificates of Common Stock is a legal document used to facilitate the transfer of ownership of common stock in the state of South Dakota. This detailed description aims to provide a comprehensive overview of this document, its purpose, and any additional types or variations of this letter that exist. Keywords: South Dakota, Letter of Transmittal, Certificates, Common Stock, Ownership, Legal Document, Transfer 1. Purpose and Importance of the South Dakota Letter of Transmittal: The South Dakota Letter of Transmittal to Accompany Certificates of Common Stock is a crucial legal document that allows stockholders to transfer ownership of their common stock to another party. It serves as a formal notification to the corporation or transfer agent about the intent to transfer the shares and includes essential details required to document the transaction. 2. Key Components of the South Dakota Letter of Transmittal: — Stockholder Information: The letter typically includes the name, address, and contact details of the stockholder initiating the transfer. — Certificate Details: The letter must mention the number and identification details of the certificates being submitted for transfer. — Transferee Information: Essential information about the intended recipient of the stock, including their name, address, and contact details, should be provided. — Signatures: The letter must be signed by the stockholder(s) and may require additional signatures of witnesses or notaries, depending on the specific requirements detailed by South Dakota law. 3. Additional Types of South Dakota Letters of Transmittal: a. South Dakota Letter of Transmittal for Inherited Stock: This version of the letter is used when stockholders wish to transfer or update ownership of inherited stock. It typically requires additional documents, such as a copy of the deceased shareholder's death certificate and a legal document proving the inheritance. b. South Dakota Letter of Transmittal for Corporate Mergers or Acquisitions: In cases of corporate mergers or acquisitions, where existing stockholders may be required to exchange their shares for new ones, a specific type of Letter of Transmittal may be used to facilitate the process. This letter includes instructions to submit the old certificates and receive the new ones post-merger/acquisition. c. South Dakota Letter of Transmittal for Dividend Payments: This variation of the letter is used when stockholders wish to receive dividend payments electronically instead of through traditional paper checks. It typically requires the stockholder to provide their bank account information for direct deposit purposes. Conclusion: The South Dakota Letter of Transmittal to Accompany Certificates of Common Stock serves as a critical legal document when transferring common stock ownership in South Dakota. Through this letter, stockholders provide all necessary information to facilitate the smooth transfer of ownership. Additionally, South Dakota offers specific variations of this letter for different scenarios, such as inherited stock, corporate mergers/acquisitions, and dividend payment preferences. It is essential to consult legal experts or refer to official guidelines to ensure compliance with South Dakota laws and regulations when drafting and submitting a Letter of Transmittal.

South Dakota Letter of Transmittal to Accompany Certificates of Common Stock

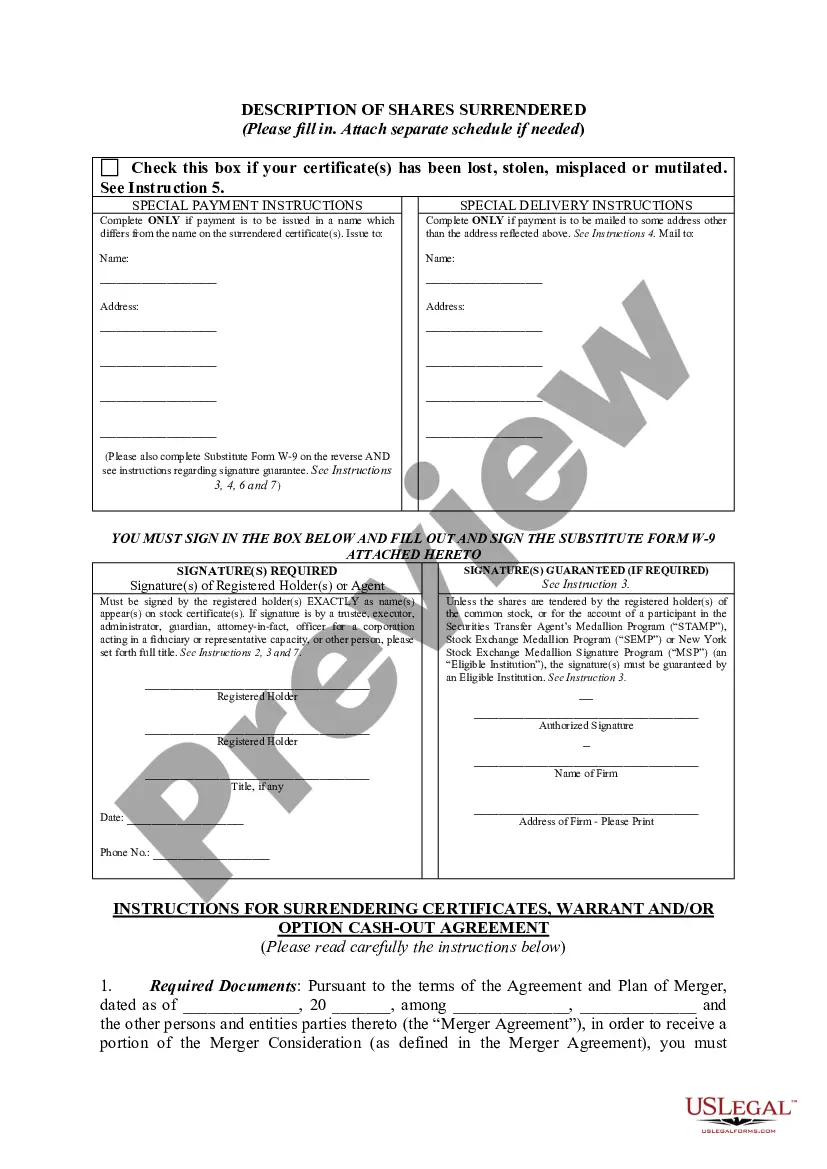

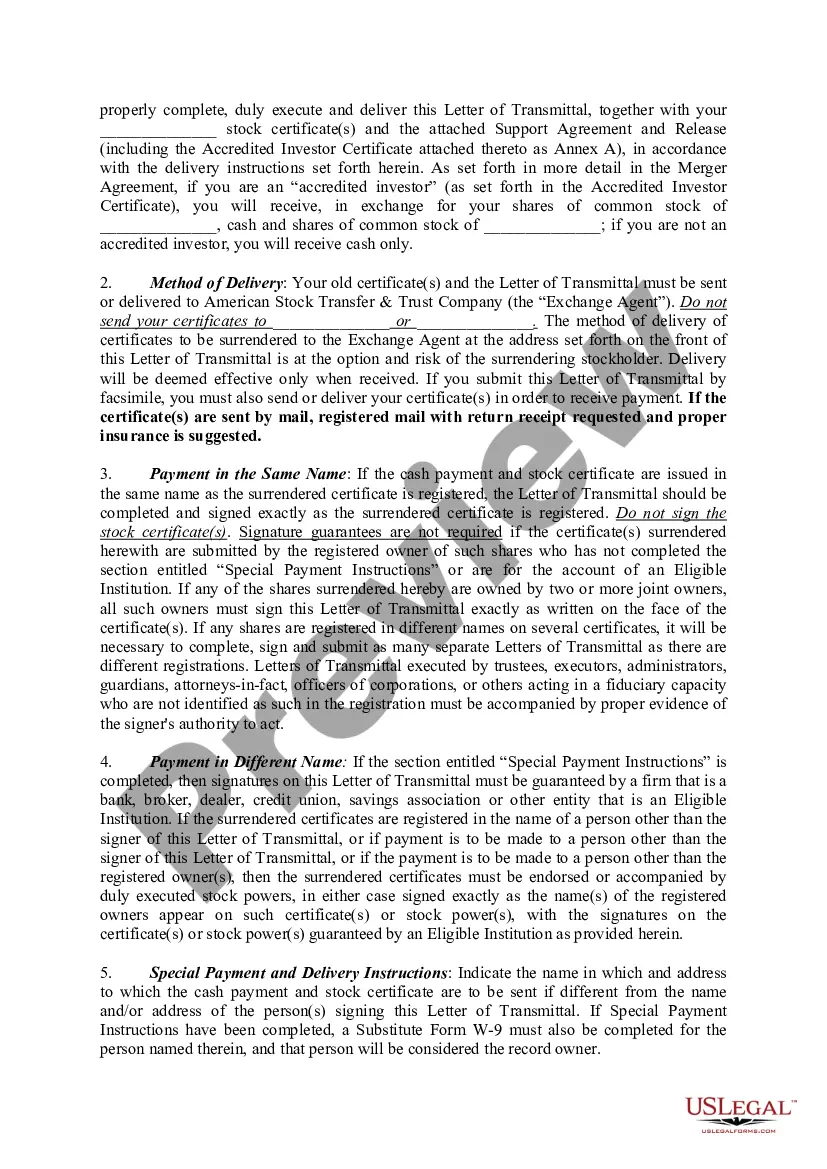

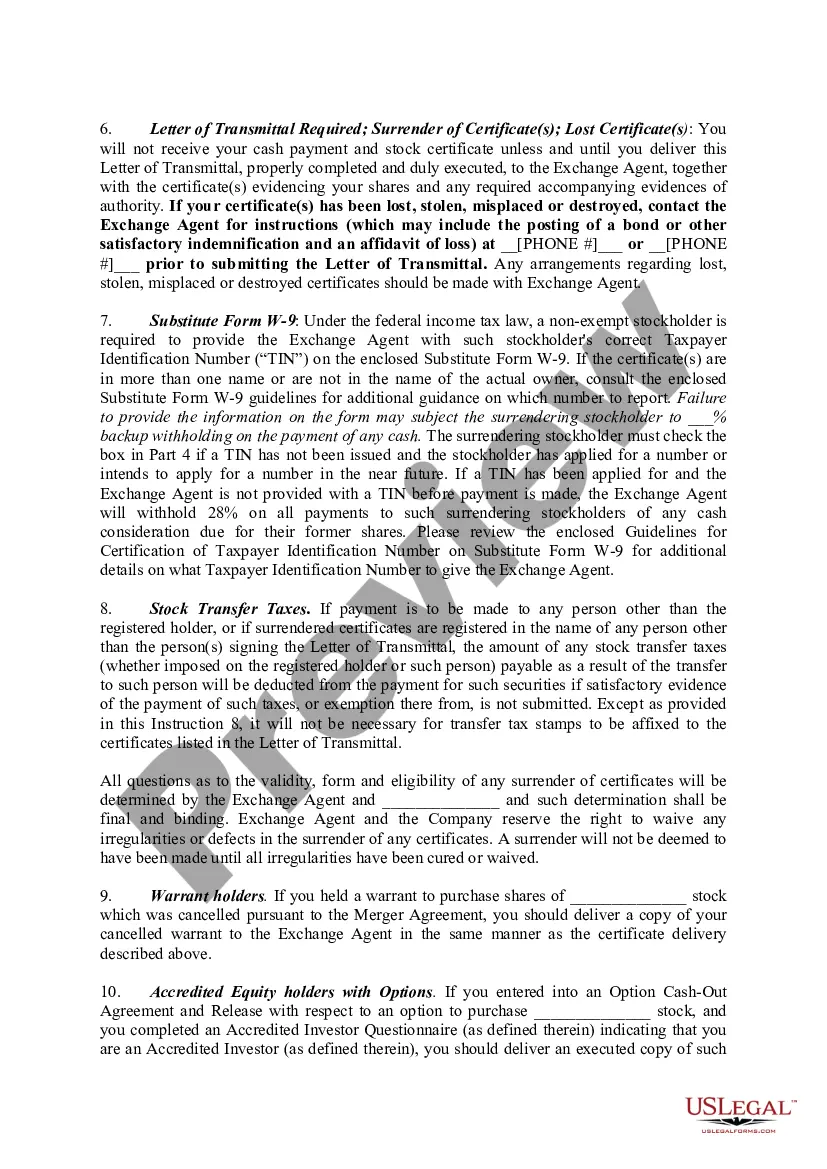

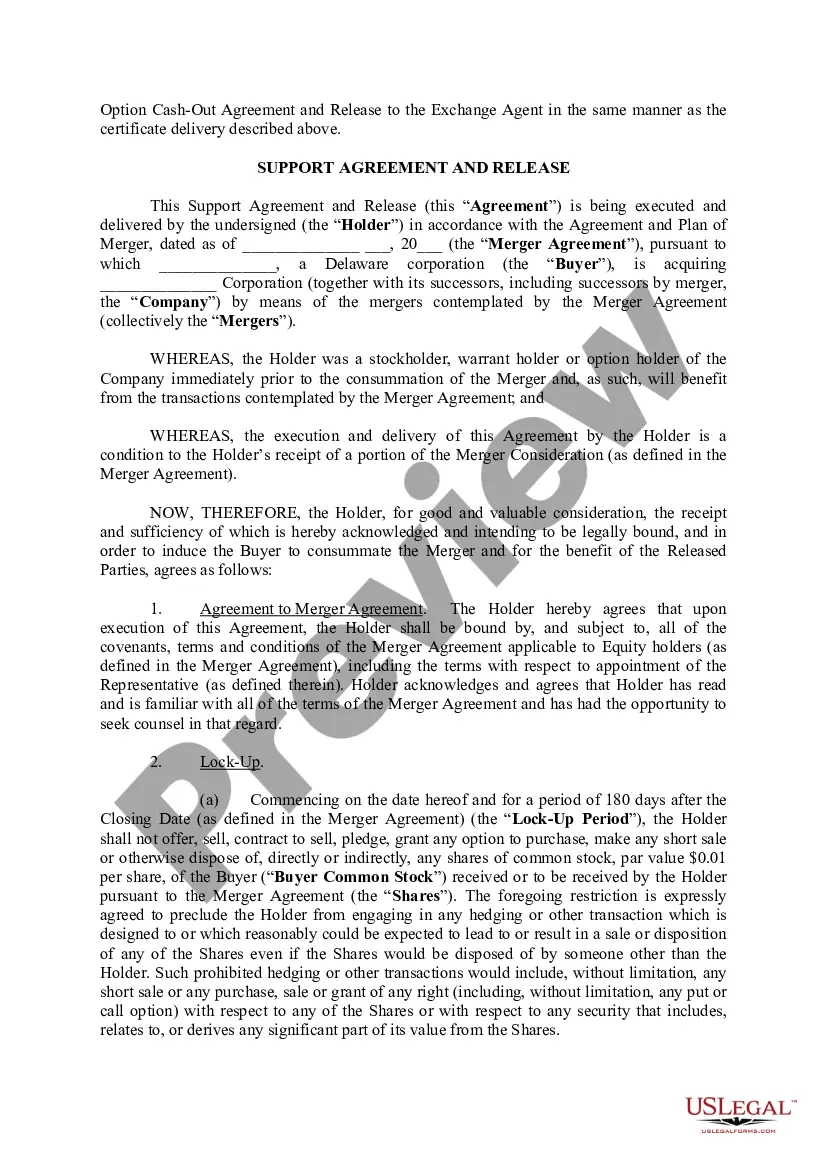

Description

How to fill out South Dakota Letter Of Transmittal To Accompany Certificates Of Common Stock?

If you wish to comprehensive, download, or printing legal papers layouts, use US Legal Forms, the biggest selection of legal kinds, that can be found online. Use the site`s basic and handy look for to discover the documents you require. Various layouts for organization and personal uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the South Dakota Letter of Transmittal to Accompany Certificates of Common Stock with a handful of click throughs.

Should you be previously a US Legal Forms consumer, log in to your profile and then click the Obtain option to obtain the South Dakota Letter of Transmittal to Accompany Certificates of Common Stock. You may also entry kinds you formerly downloaded within the My Forms tab of the profile.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Make sure you have selected the shape for your correct town/land.

- Step 2. Use the Preview option to look over the form`s articles. Never neglect to learn the description.

- Step 3. Should you be not happy together with the kind, take advantage of the Research discipline near the top of the display screen to locate other types of your legal kind web template.

- Step 4. After you have discovered the shape you require, click on the Acquire now option. Opt for the rates strategy you choose and put your references to register for an profile.

- Step 5. Method the deal. You may use your charge card or PayPal profile to accomplish the deal.

- Step 6. Choose the structure of your legal kind and download it in your product.

- Step 7. Complete, revise and printing or sign the South Dakota Letter of Transmittal to Accompany Certificates of Common Stock.

Each and every legal papers web template you acquire is yours forever. You have acces to each and every kind you downloaded in your acccount. Click on the My Forms segment and select a kind to printing or download once more.

Remain competitive and download, and printing the South Dakota Letter of Transmittal to Accompany Certificates of Common Stock with US Legal Forms. There are thousands of professional and express-distinct kinds you can utilize for your personal organization or personal demands.

Form popularity

FAQ

How to write a letter of transmittal Include a heading with the date and recipient's address. Include a heading with your full name and company address, located in the top left corner of the page. ... Greet the recipient appropriately. ... Write the letter body. ... Include a short closing paragraph.

Transmittal letters (sometimes referred to as cover letters) are sent as an accompaniment to enclosed material. Transmittal letters should be brief and clearly written. If you are sending the transmittal letter with a report, the transmittal letter should be the first element of the front matter.

What is a Letter of Transmittal? A Letter of Transmittal is a form generally used for an exchange of stock and/or cash payment.

As you draft your letter of transmittal, adhere to these guidelines: Follow proper business letter. Maintain a professional tone. Clarify the purpose of the letter (to notify the recipient that the report is enclosed) Offer any specific details necessary for the reader to understand why the report was written.

Letters of transmittal are usually brief, often with three paragraphs, each one devoted to a specific purpose: review the purpose of the report, offer a brief overview of main ideas in the report, and offer to provide fuller information as needed, along with a ?thank you? and contact information.

At a minimum, those elements should include the following information: The Recipients Information (Company, Name, Contact Info) The Sender's Information (Company Branding, Name, Title, Contact Info, Address) Transmittal Information (Transmittal Number, Date, Purpose)

A letter or memo of transmittal conveys the report to the person requesting it, or the primary audience for the report. It provides a context for reading the report. Unlike the report proper, a letter of transmittal may use ?I? and be less formal in tone than the rest of the report.

Letters of transmittal are usually brief, often with three paragraphs, each one devoted to a specific purpose: review the purpose of the report, offer a brief overview of main ideas in the report, and offer to provide fuller information as needed, along with a ?thank you? and contact information.