Title: South Dakota Qualified Investor Certification Application — Comprehensive Overview and Types Introduction: The South Dakota Qualified Investor Certification Application is a crucial document for individuals seeking to qualify as an investor under South Dakota state laws. This application is designed to assess an investor's financial acumen and suitability for participating in certain investment opportunities that may be restricted to qualified investors. In this article, we will delve into the South Dakota Qualified Investor Certification Application, its purpose, the information required, and potential types of certifications available. 1. Purpose of the South Dakota Qualified Investor Certification Application: The South Dakota Qualified Investor Certification Application aims to ensure that individuals meet specific criteria, enabling them to access and invest in opportunities typically reserved for qualified investors. By evaluating an applicant's financial experience and understanding, this application assists in safeguarding investors' interests while promoting fair market participation. 2. Information Required in the Application: a. Personal Details: Applicants are required to provide their full name, contact information, residential address, and social security number. b. Employment and Financial Information: Applicants must disclose details about their employment status, professional background, annual income, net worth, and other pertinent financial information. c. Investment Experience: As part of the application, individuals need to outline their investment knowledge, experience, previous investment performance, and any relevant licenses or certifications. d. Risk Tolerance: The application may include questions related to an applicant's risk profile, determining their comfort level with various investment strategies. 3. Types of South Dakota Qualified Investor Certifications: a. Individual Investor Certification: This certification is intended for individual investors who meet specific financial thresholds and possess the requisite investment experience. b. Entity Investor Certification: This certification applies to legal entities such as corporations or partnerships that meet the qualifications outlined by South Dakota state laws. c. Professional Certification: This type of certification is geared towards licensed professionals, including attorneys, certified public accountants (CPA's), and financial advisors, who meet additional qualifying criteria. Conclusion: Obtaining the South Dakota Qualified Investor Certification is a vital step for individuals and entities looking to engage in investment opportunities offered exclusively to qualified investors. By accurately completing the application and meeting the prescribed criteria, prospective investors can unlock a wider spectrum of investment options available in South Dakota's financial landscape.

South Dakota Qualified Investor Certification Application

Description

How to fill out South Dakota Qualified Investor Certification Application?

Are you inside a place where you need to have files for possibly company or specific uses nearly every time? There are plenty of lawful document web templates accessible on the Internet, but getting versions you can depend on isn`t simple. US Legal Forms offers a huge number of form web templates, like the South Dakota Qualified Investor Certification Application, which can be published to meet state and federal specifications.

When you are presently informed about US Legal Forms web site and get a free account, basically log in. Afterward, you are able to obtain the South Dakota Qualified Investor Certification Application web template.

If you do not offer an bank account and would like to begin using US Legal Forms, follow these steps:

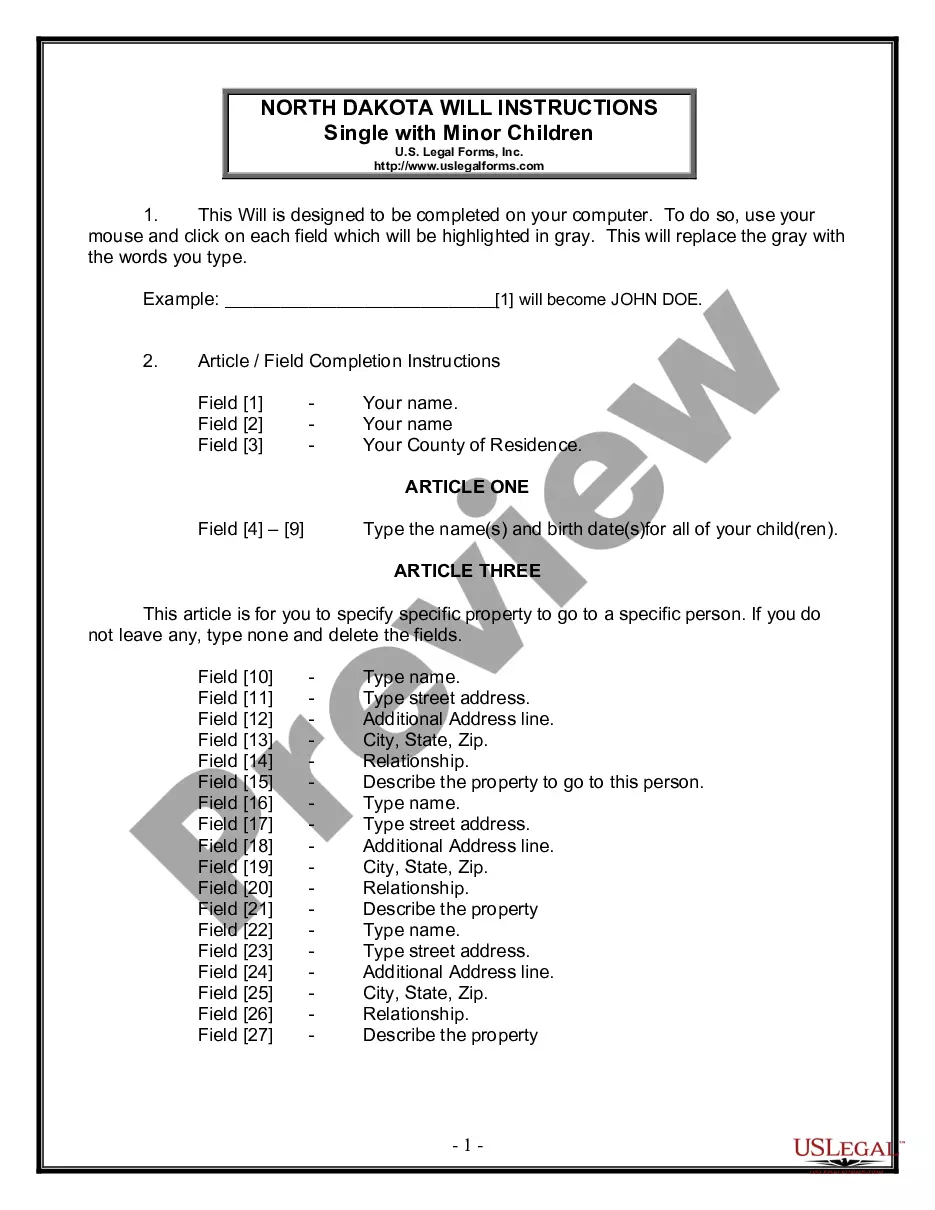

- Discover the form you require and ensure it is for your correct metropolis/area.

- Utilize the Review button to examine the form.

- See the outline to actually have selected the appropriate form.

- When the form isn`t what you`re trying to find, make use of the Look for area to obtain the form that suits you and specifications.

- Whenever you find the correct form, simply click Purchase now.

- Choose the prices plan you desire, fill out the necessary information to make your account, and pay for the order using your PayPal or charge card.

- Choose a practical data file file format and obtain your duplicate.

Locate every one of the document web templates you might have bought in the My Forms food list. You can get a additional duplicate of South Dakota Qualified Investor Certification Application any time, if required. Just go through the needed form to obtain or print the document web template.

Use US Legal Forms, probably the most comprehensive variety of lawful kinds, to save time as well as steer clear of blunders. The assistance offers expertly produced lawful document web templates that you can use for a range of uses. Produce a free account on US Legal Forms and commence creating your daily life a little easier.