South Dakota Bill of Sale Issued Shares

Description

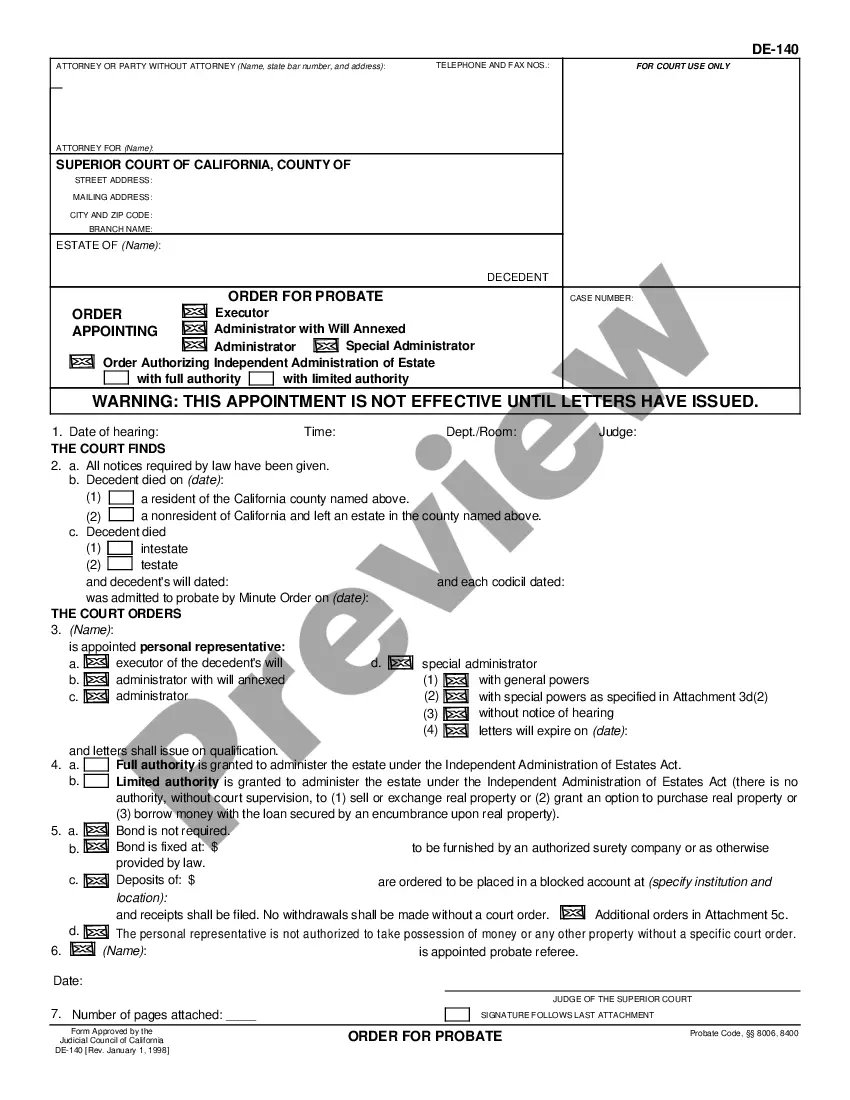

How to fill out Bill Of Sale Issued Shares?

It is possible to commit hours on-line attempting to find the authorized file format that suits the state and federal demands you require. US Legal Forms gives thousands of authorized kinds that happen to be analyzed by experts. It is simple to down load or produce the South Dakota Bill of Sale Issued Shares from our services.

If you already have a US Legal Forms account, you can log in and then click the Obtain button. Afterward, you can comprehensive, revise, produce, or sign the South Dakota Bill of Sale Issued Shares. Every authorized file format you get is yours forever. To get another backup for any obtained type, go to the My Forms tab and then click the corresponding button.

If you are using the US Legal Forms web site the first time, adhere to the basic recommendations under:

- Very first, ensure that you have selected the correct file format for that state/metropolis of your liking. Browse the type outline to make sure you have picked out the proper type. If accessible, take advantage of the Review button to appear throughout the file format too.

- If you want to discover another model from the type, take advantage of the Search industry to discover the format that meets your needs and demands.

- After you have located the format you need, simply click Buy now to continue.

- Find the costs prepare you need, type your qualifications, and register for your account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal account to cover the authorized type.

- Find the file format from the file and down load it in your system.

- Make modifications in your file if required. It is possible to comprehensive, revise and sign and produce South Dakota Bill of Sale Issued Shares.

Obtain and produce thousands of file layouts utilizing the US Legal Forms site, that provides the largest selection of authorized kinds. Use expert and express-specific layouts to deal with your business or individual needs.

Form popularity

FAQ

The information required for general bills of sale in South Dakota is often the bare minimum needed: Purchase price. Date. Contact information. Signatures.

You will need your original out of state titles, a copy of your state driver license, social security number, and a Motor Vehicle and Boat Title & Registration Application. Take this paperwork to your local county treasurer's office to complete registration process.

REQUIRED DOCUMENTS FOR TITLE TRANSFERS: Original Title. Driver's License or State Issued ID. Proof of social security number (Copy of Social Security card or W-2) South Dakota Application for Motor Vehicle/Boat Title & Registration (MV-1001)

A seller's permit may be printed by the seller using the online Vehicle Registration & Plates portal or may also be obtained at a county treasurer's office. The seller's permit is valid for 45 days.

Sale without delivering certificate of title--Purchase without obtaining certificate of title--Temporary use--Time limit--Violation as misdemeanor.

South Dakota charges a 4% excise sales tax rate on the purchase of all vehicles. In addition, for a car purchased in South Dakota, there are other applicable fees, including registration, title, and plate fees.

At that time a paper title will be printed and mailed to the location indicated by the lienholder in the release. South Dakota has been an ELT state since October 2012.

If you want to transfer ownership of a boat, car, or horse in South Dakota, you need a bill of sale. The document provides legal protection whenever you buy or sell any high-value items. Learn more about what a bill of sale is and how to draft one that will work.